Large Retailers, Duty-Free Shops, Cosmetics, and Food & Beverage Companies

Profitability Declines as Domestic Market Conditions Worsen

High Interest Rates and Inflation Lead Consumers to Cut Spending, Sales Drop

Labor Cost Reductions... Vicious Cycle of Employment Instability and Reduced Consumption

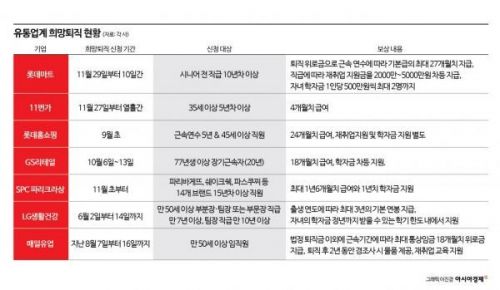

A cold wave of employment has swept across the entire distribution industry, including large supermarkets, duty-free shops, cosmetics, and food and beverage companies. As consumers tightly close their wallets amid the economic downturn, distribution companies experiencing poor performance have started workforce reductions. This is interpreted as a desperate measure to improve financial structure by cutting labor costs.

According to the distribution industry on the 5th, Lotte Mart is conducting its third voluntary retirement since its establishment. After conducting voluntary retirements twice in the first and second halves of 2021, it is now conducting another one after two years. The target employees are those who have worked for more than 10 years at all levels. Since November last year, after integrating with supermarkets, it earned 80 billion KRW in profits until the third quarter of this year, showing about 90% growth compared to the same period last year, but this decision was made to further improve profitability. Furthermore, since the supermarket and mart staff remained in the same teams without personnel adjustments after the integration, it is presumed that restructuring was carried out for more efficient organizational management.

11st has also been accepting voluntary retirement applications since last month. The eligibility criteria are the lowest among distribution companies. This indicates that they are accepting voluntary retirements even from younger employees, analyzed as a move to restructure due to accumulated fatigue from continuous deficits. 11st, which recorded an operating loss of 150 billion KRW last year alone, has been expanding its deficit over the past three years. Although it confidently announced plans to reduce the deficit starting this year and return to profitability in two years, the pace of performance improvement has been slow.

The biggest reason why major distribution companies had no choice but to choose intense restructuring through workforce reduction is the decline in consumer sentiment caused by the economic recession. Due to high inflation and high interest rates, consumers have become burdened by everything they eat and buy, tightly closing their wallets and reducing consumption. As a result, distribution companies facing difficulties have started cutting labor costs, which are the largest expense.

In fact, some convenience stores are opening unmanned (hybrid) stores using artificial intelligence (AI) technology, devising long-term methods to minimize labor costs, and E-Mart has completed installing self-checkout counters in most of its stores nationwide. Major cafes and fast-food outlets are also actively introducing kiosks.

With the shift of consumption focus to some e-commerce companies, the spread of recession-type consumption is making distribution companies more difficult. As Coupang solidifies its dominance by turning profitable, the positions of other e-commerce companies have narrowed, and consumers who used to purchase products through TV home shopping are refraining from unnecessary consumption or shifting their main purchasing channels to e-commerce. A distribution industry official said, “As Coupang’s influence grows, workforce adjustments are necessary to quickly respond to changes in the distribution industry. However, the difficult situation due to the economic recession may continue into next year.”

The workforce reduction trend is spreading not only to distribution channels but also across domestic companies in cosmetics, food, and beverage sectors.

LG Household & Health Care, which started efficiency improvements after continued sluggish performance due to lack of consumer sentiment recovery in China even after the endemic phase, accepted voluntary retirement applications for the first time since its founding in June. LG Household & Health Care’s operating profit this year is expected to be less than half of that in 2020 (1.2209 trillion KRW). Amorepacific also conducted voluntary retirements for employees in the direct sales division (New Commerce) in the same month.

SPC Paris Croissant also accepted voluntary retirements from employees with more than 15 years of service belonging to 14 brands, including Paris Baguette and Shake Shack, starting early last month. This is to reduce the burden caused by rising costs such as raw materials and labor, but broadly, the direct cause is identified as Paris Croissant’s poor performance. Paris Croissant’s sales last year were 1.9847 trillion KRW, a 7% increase from the previous year, but operating profit during the same period decreased by 4% to 18.8 billion KRW. The operating profit margin, a profitability indicator, fell to the 0% range last year. Paris Croissant’s operating profit margin was 4% in 2013, recovered to 4.1% in 2019, but dropped to the 1% range the following year and continued to decline to 0.9% last year.

The bigger problem lies ahead. The vicious cycle of employment insecurity and reduced consumption may prolong the economic recession. The Korea Chamber of Commerce and Industry expects next year’s retail sales growth rate to be only 1.6%, half of this year’s 2.9%.

Professor Seo Yong-gu of the Department of Business Administration at Sookmyung Women’s University analyzed, “With the recession, full-scale restructuring is beginning, and this may not be a temporary phenomenon but a structural one. In traditional retail, the most important people were the so-called ‘shuttermen’ who opened and closed store doors, but now, just as Coupang no longer needs to open store doors, algorithms do it instead, so people are no longer needed. This is the same phenomenon as bank tellers disappearing from banks.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)