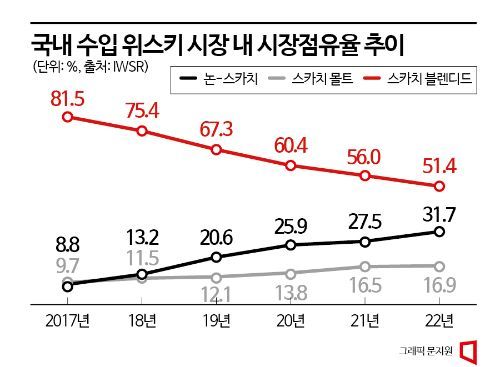

Domestic Scotch Whisky Share Drops from 91.2% to 68.3% in 5 Years

Consumption Experience Grows, Expanding to Various Regions

Increase in Single Malt Whisky Consumption Drives Premiumization

In the domestic market, the market share of Scotch whisky, which has long been synonymous with whisky, is declining, dismantling the formula of 'whisky = Scotch.' This is interpreted as a result of the whisky market's rapid growth and the increase in consumers' drinking experiences, leading to a rising demand for whiskies from various countries.

At a media briefing held on the 13th at Maison Le Cercle in Gangnam-gu, Seoul, Billy Layton, Redbreast Master Blender, is introducing the product to commemorate the launch of Redbreast 15 Years.

At a media briefing held on the 13th at Maison Le Cercle in Gangnam-gu, Seoul, Billy Layton, Redbreast Master Blender, is introducing the product to commemorate the launch of Redbreast 15 Years. [Photo by Pernod Ricard Korea]

According to the International Wine and Spirit Research (IWSR) on the 14th, the proportion of non-Scotch whisky in the imported whisky market in Korea last year was 31.7%, an increase of 4.2 percentage points compared to the previous year. The share of non-Scotch whisky, which was around 8.8% in 2017, rose to double digits the following year and grew to about one-third of the total import value during the pandemic period.

As the share of non-Scotch whisky increased, the decrease in Scotch whisky mostly occurred in blended whisky. In 2017, Scotch blended whisky accounted for an overwhelming 81.5%, but it rapidly declined each year to 51.4% last year, about half the previous level. On the other hand, Scotch malt whisky steadily increased its share from 9.7% to 16.9% during the same period.

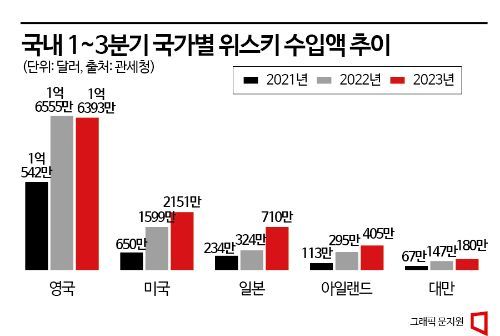

Looking at whisky import values by country, this trend becomes even more pronounced. According to customs export-import trade statistics, the cumulative import value of American whisky, represented by bourbon whisky, reached $21.51 million (approximately 28.5 billion KRW) in the third quarter of this year, up 34.5% from $15.99 million in the same period last year. During the same period, Japanese whisky increased from $3.24 million to $7.10 million (approximately 940 million KRW), and Irish whisky rose from $2.95 million to $4.05 million (approximately 540 million KRW), marking increases of 119.1% and 37.3%, respectively.

In contrast, the import value of British whisky, including Scotch from Scotland, was $163.93 million (approximately 217 billion KRW), down 1.0% from $165.55 million in the same period last year. Although Scotch whisky still overwhelmingly dominates the market in absolute terms, this indicates that domestic consumers are gradually turning their attention to whiskies from various countries.

This easing of the concentration on Scotland also demonstrates that the domestic whisky market is experiencing both quantitative growth and qualitative maturation. Whereas Scotch whisky was previously simply recognized as imported distilled liquor commonly referred to as "yangju," the increasing experience of whisky consumption has led consumers to distinguish and enjoy differences in taste and quality based on production methods such as distillation and aging by region and distillery.

Moreover, the growth of the domestic whisky market is driven by the younger generation who value their personal preferences, which further promotes diversification in consumption. However, the reduction in Scotch whisky's market share is mainly due to a decline in the consumption of relatively low-priced blended whisky, while the market for high-priced single malt whisky is actually growing. This suggests that overall interest in Scotch whisky has not diminished but rather that consumption is becoming more premium.

In line with these market trends, importers are diversifying their portfolios. Pernod Ricard Korea is the most proactive. Pernod Ricard Korea, which previously focused on blended whiskies such as 'Ballantine's,' 'Chivas Regal,' and 'Royal Salute,' has expanded into single malts like 'Aberlour' and 'Glenlivet,' and recently broadened its portfolio to include Irish whiskies with 'Redbreast' following 'Jameson.'

On the 13th, Pernod Ricard Korea launched the Irish whisky 'Redbreast 15 Year.' Redbreast is a brand that adheres to the traditional single pot still production method dating back to the 1800s. Single pot still whisky is made by mixing unmalted raw barley and malted barley and distilling it three times in a copper pot still, characterized by its smoothness and complex flavors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)