Chong Kun Dang exports rare disease treatments to Novartis

Total amount $1.3 billion... Completed Phase 1 clinical trial

Orom Therapeutics exports leukemia treatment to BMS

Signing bonus $100 million... 'Largest ever deal'

Although it is already November, when winter begins to arrive, an unexpected wave of optimism has started blowing through the domestic pharmaceutical and bio industries as a series of the largest technology export contracts have been announced. The main players are Chong Kun Dang, which exported a rare disease treatment to Novartis, and Orum Therapeutics, which exported a leukemia treatment to Bristol-Myers Squibb (BMS).

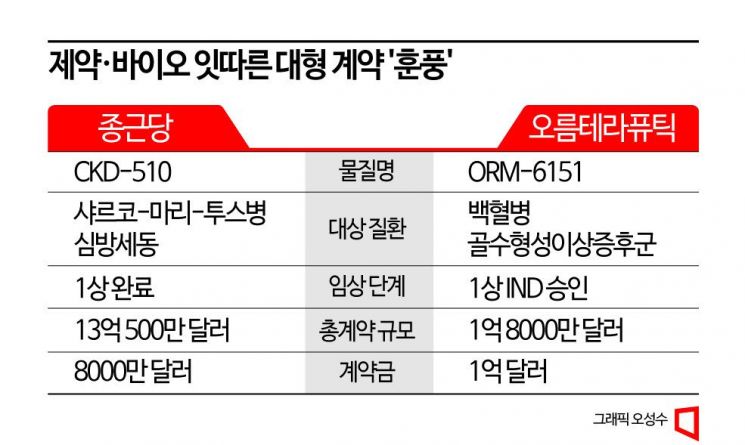

On the morning of the 6th, Chong Kun Dang announced that it had signed a technology export contract with Novartis worth up to $1.305 billion (approximately 1.73 trillion KRW), including an upfront payment of $80 million (approximately 106.1 billion KRW), for the histone deacetylase 6 (HDAC6) inhibitor 'CKD-510.' Later that same evening, Orum Therapeutics announced a technology export deal worth a total of $180 million (approximately 233.6 billion KRW), with an upfront payment of $100 million (approximately 129.8 billion KRW), for 'ORM-6151,' a treatment for acute myeloid leukemia (AML) and high-risk myelodysplastic syndrome patients.

CKD-510 is an HDAC6 inhibitor that Chong Kun Dang is developing as a treatment for the rare disease Charcot-Marie-Tooth disease (CMT) and atrial fibrillation. Preclinical studies have confirmed its efficacy in various HDAC6-related diseases, including cardiovascular diseases, and clinical phase 1 trials conducted in France and the United States have verified its safety, tolerability, and formulation change potential. In March 2020, it was designated as an orphan drug (ODD) by the U.S. Food and Drug Administration (FDA) for the treatment of CMT.

According to data compiled by the Korea Pharmaceutical and Bio-Pharma Manufacturers Association, Chong Kun Dang’s technology export deal worth up to $1.3 billion is the largest pharmaceutical and bio technology transaction this year and also represents the largest technology export in the company’s history. Hyemin Heo, a researcher at Kiwoom Securities, analyzed, "Despite being the first big pharma contract, it was a high-quality deal with a high upfront payment ratio and a well-chosen partner. This is likely because the clinical stage is advanced, it is first-in-class within its category, and having completed phase 1, it can proceed to phase 2."

Kim Young-joo, CEO of Chong Kun Dang, expressed, "This contract is the largest ever, and we feel rewarded to have exported one of our innovative new drug candidates, developed through consistent investment of over 12% of annual sales in research and development, to a multinational company. I am grateful to our researchers."

Orum Therapeutics Achieves 'Largest Upfront Payment Ever' Big Deal

Orum Therapeutics’ ORM-6151 is an anti-CD33 antibody-based GSPT1 protein degrader drug being developed with the goal of being first-in-class. It is structured as a degrader-antibody conjugate (DAC), which is similar to but distinct from the antibody-drug conjugate (ADC) that has recently attracted industry attention. In ADCs, the payload (toxic drug) kills cancer cells, whereas in ORM-6151, the payload is a degrader that removes proteins from cancer cells. ORM-6151 has received FDA approval to initiate a phase 1 clinical trial for the treatment of acute myeloid leukemia (AML) or high-risk myelodysplastic syndrome patients.

Although the total contract amount for Orum Therapeutics is smaller than Chong Kun Dang’s, the upfront payment is actually larger. This upfront payment is evaluated as the largest ever in technology exports by domestic pharmaceutical and bio companies beyond this year. In 2015, Hanmi Pharmaceutical exported three diabetes drugs to Sanofi for a total of 400 million euros (approximately 558.7 billion KRW, later reduced to 204 million euros), and in the same year, Hanmi Pharmaceutical exported the long-acting obesity and diabetes treatment 'Epinogpegdutide' to Janssen for $105 million. In 2019, SK Biopharm exported the European rights for the epilepsy treatment 'Cenobamate' to Avel Therapeutics (now Angelini Pharma) for $100 million, ranking these deals jointly in third place. Considering that Hanmi Pharmaceutical’s exported drugs were all returned, this deal ranks joint first among currently valid contracts.

Another point of note is the proportion of the upfront payment relative to the total contract amount. Since upfront payments in technology transfer contracts are generally non-refundable even if the development of the drug fails, the proportion of the upfront payment can be seen as an indicator of how confident the acquiring company is in the success probability of the drug and how highly it values its future potential. Therefore, the more advanced the development stage of the candidate drug, the higher the proportion of the upfront payment tends to be. For a candidate drug at the preclinical to phase 1 level like ORM-6151, an upfront payment ratio exceeding 30% is considered a bold bet, and even at phase 3, it is rare for the upfront payment to exceed half of the total contract amount. In fact, most of the major domestic technology exports mentioned earlier had upfront payments around 10% of the total amount. However, BMS raising the upfront payment ratio to as high as 55.6% in this contract suggests strong confidence in the success of ORM-6151.

Technology Transfer Tailored to Big Pharma’s Demand for Synergy with Existing Research

These moves by Novartis and BMS are interpreted as efforts to strengthen their own research and development (R&D) pipelines. CMT has various types, with type 1 patients accounting for about 60% of all cases, followed by type 2, which accounts for 12-36%. It is a relatively well-known rare disease due to family history within large corporate owner families.

Novartis, recognized as a leader in rare disease treatment, acquired DTx Pharma for $1 billion in July and secured 'DTx-1252,' a type 1 treatment with FDA orphan drug designation. Given that CKD-510 is an HDAC6 inhibitor, it is expected to be effective for type 2 treatment, indicating efforts to cover most patients with CMT.

Although ORM-6151’s degrader-antibody conjugate mechanism is somewhat unfamiliar, BMS has already been researching related platforms. However, in September, BMS halted the phase 1 clinical trial of 'CC-90009,' a GSPT1 degrader drug they had been developing, and appears to have shown interest in ORM-6151 as a new pipeline candidate with stronger efficacy and tolerability in preclinical studies compared to CC-90009.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)