South Korea has significantly increased its direct investment in Israel over the past decade, raising concerns that the prolonged war between Israel and the Palestinian armed faction Hamas could lead to substantial investment losses.

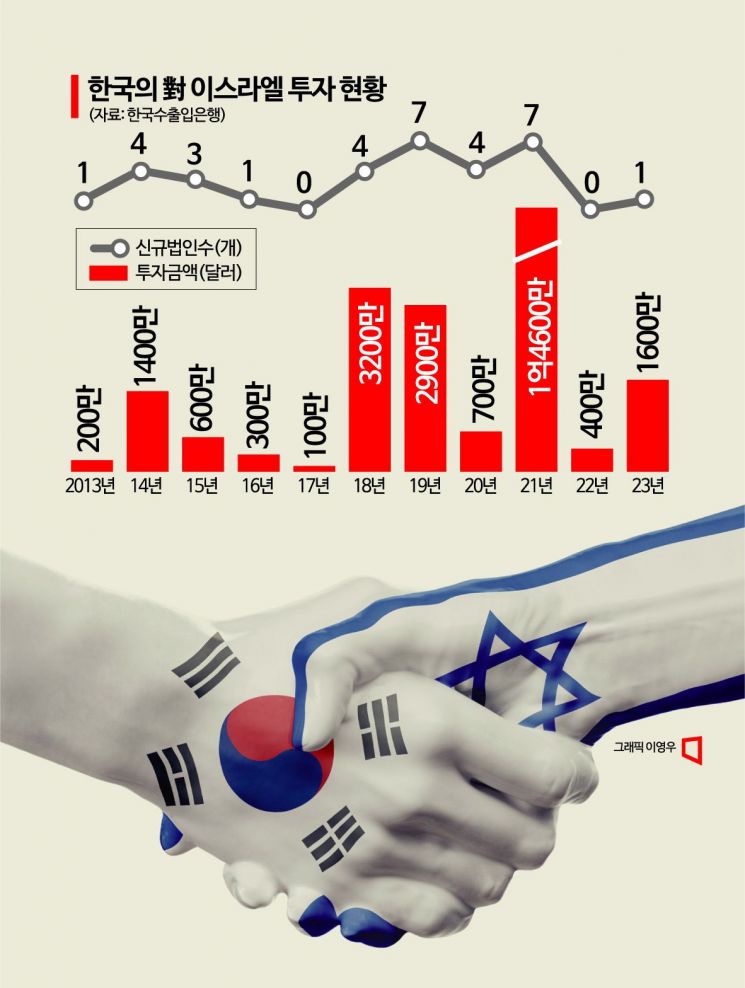

On the 24th, the Export-Import Bank of Korea announced in its overseas direct investment statistics that South Korea's investment in Israel over the past 10 years (2014?2023) has reached $257 million (approximately 347.6 billion KRW). The number of new corporations established by Korean companies in Israel during this period totals 31. While South Korea's investment in Israel was around $10 million (with 9 new corporations) from 2004 to 2013, it rapidly expanded over the last decade as international joint research and development (R&D) efforts?based on Israel's foundational core technologies and South Korea's manufacturing industry technologies?progressed beyond technology development to commercialization and direct investment attraction. Initially limited to manufacturing and information and communication industries, the sectors of investment in Israel have now expanded to diverse fields such as finance and insurance, science and technology, construction, and arts and sports.

Korean companies face potential losses if the ground conflict between Israel and Hamas escalates, as local investment facilities in Israel could be damaged or unable to operate properly. Currently, major groups such as Samsung, Hyundai Motor, and LG have research centers, corporations, and branches established and operating in Israel. Samsung Electronics operates three corporations in Israel through Benelux, in which it holds 100% ownership: Samsung Electronics Israel (marketing business), Samsung Semiconductor Israel R&D Center (R&D business), and Corephotonics (camera business). Samsung Bioepis also operates a local subsidiary, Samsung Bioepis IL, in Israel. Within LG Group, LG Electronics has operated a sales office in Tel Aviv since 2010, and Cybellum, an Israeli automotive cybersecurity company acquired in 2021, is headquartered in Tel Aviv.

The prolonged war could also impact Korean companies’ active investments in Israeli startups. Amid a global economic slowdown, Israeli startup investments shrank from $26 billion in 2021 to $16 billion in 2022, and $5 billion in the first half of 2023, with the outbreak of armed conflict further increasing risks related to investment recovery. So far, Samsung Electronics has invested in 66 companies in Israel, including AI semiconductor startup New Reality, through its overseas startup investment firm Samsung Next.

Hyundai Motor also operates Cradle Tel Aviv, which handles startup acquisitions and equity investments in Israel. Kwangho Yoo, a Middle East researcher at the Korea Institute for International Economic Policy, said, "If the conflict between Israel and Hamas continues, Israel will not be free from airstrike risks. Flight cancellations will make entry and exit to Israel difficult, complicating local cooperation, and companies planning new startup investments will have to reconsider geopolitical risks due to this war."

In addition to direct investment losses in Israel, Korean companies must also bear losses from trade disruptions and supply chain disturbances. A report titled "Domestic Economic Impact of the Israel-Hamas Conflict," published this month by the Korea International Trade Association, pointed out that since advanced industry companies are concentrated in Israel, the prolonged war could lead to a simultaneous decline in semiconductor demand. The report warned, "If Intel’s CPU factory located in the Kiryat Gat area in southern Israel halts operations, the demand for memory semiconductors from our companies, which is linked to CPU demand, may also weaken," expressing concerns about potential negative impacts on Samsung Electronics and SK Hynix.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)