Capital Companies Invest in 9 Firms... Establishing Independent Normalization Plan

The credit finance industry is raising funds worth 400 billion KRW to support the normalization of real estate project financing (PF) sites. They plan to select projects and inject 70 to 100 billion KRW, aiming to facilitate a smooth landing of the PF market.

The Credit Finance Association held a launch ceremony for the 'Credit Finance Sector PF Normalization Support Fund' on the 26th at the association's office in Jung-gu, Seoul. The credit finance industry has been working on extending project maturities, selling and writing off delinquent bonds to ensure a smooth landing of the real estate PF market. However, judging these efforts insufficient, nine major capital companies decided to supply new funds to promote further restructuring of PF projects by establishing and operating the fund.

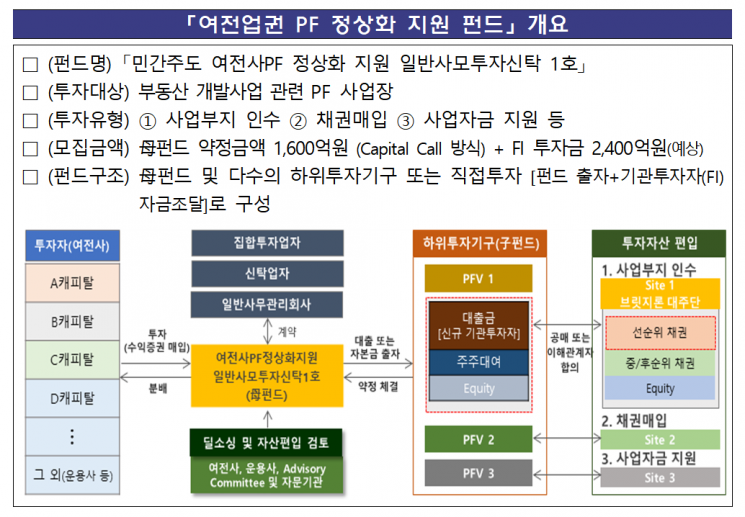

The fund will be raised by nine capital companies including Shinhan, Hana, KB, Woori Financial, IBK, Meritz, BNK, NH Nonghyup, and DGB, who will invest about 160 billion KRW, and by procuring 240 billion KRW from financial investors (FI). The raised funds will be invested in sub-investment entities or directly into projects that can be normalized, categorized by investment types such as ▲land acquisition ▲bond purchase ▲business fund support.

The fund management company, KTB Real Asset Management, will conduct on-site due diligence after receiving accounting and legal reviews from external advisory institutions. They will select 4 to 6 projects by screening PF sites and reviewing investment feasibility, then inject 70 to 100 billion KRW per project.

Following this process, the fund is expected to be launched around late next month. The Financial Supervisory Service (FSS) plans to work with the Credit Finance Association to identify and actively resolve any difficulties that may arise during the fund's operation. Additionally, they intend to spread this credit finance sector case to other financial sectors to encourage expansion throughout the entire financial industry.

Jung Wankyu, chairman of the Credit Finance Association, stated, "It is very unusual that the private sector has independently prepared a normalization plan. We will faithfully serve as a bridge among participants to make this fund formation a successful case."

Lee Junsu, deputy governor of the Financial Supervisory Service, said, "If market participants with long experience and expertise take on project restructuring through new capital supply in addition to government support measures, it will greatly help normalize the PF market and revitalize housing supply. We will listen to various market opinions and support investment activation so that investments for restructuring troubled real estate PF projects can establish themselves as a part of private investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)