September Monetary and Credit Policy Report

Recent analysis by the Bank of Korea revealed that the worsening financial imbalance, caused by the recent rebound in housing prices and the surge in bank household loans, stems from the ineffective coordination between macroprudential policies and monetary policy. In particular, the Bank of Korea pointed out that since the current housing prices are still considered overvalued and the real estate sector has been the core mechanism behind the accumulation of domestic financial imbalances, macroprudential and monetary policies must be consistently formulated and implemented over the long term.

In its Monetary and Credit Policy Report released on the 14th, the Bank of Korea stated this in the report titled “Review of Recent Financial Imbalance Conditions and Policy Implications.” This report is significant as it represents the Bank of Korea’s direct assessment while formulating monetary policy amid a market perception that housing prices have bottomed out and household loans from banks continue to rise.

According to the report, discussions on monetary policy’s response to financial imbalances are divided into views favoring a macroprudential policy (MPP)-centered approach and those advocating coordinated responses with monetary policy (MP). The MPP-centered approach argues that MPP allows for micro-level and selective responses to overheated sectors, making it more efficient, while MP affects the entire economy indiscriminately, potentially causing greater negative impacts on the real economy. Conversely, the MP coordination approach emphasizes that MP significantly influences credit and asset prices, whereas the policy effects of an MPP-centered approach may be limited depending on conditions.

Since the global financial crisis, calls for expanding MP’s role in controlling financial imbalances have gained traction, with studies showing that preemptive coordination of MP alongside MPP to regulate financial cycles is effective and enhances welfare.

In major countries, coordinated MP responses to financial imbalances are generally evaluated as more effective than MPP-centered approaches. When MP and MPP policies align, their effects on housing prices and household loans are pronounced, whereas opposing policy directions reduce effectiveness or increase uncertainty.

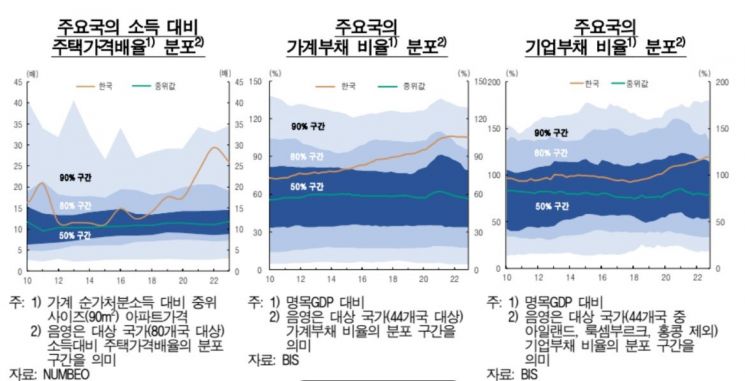

Currently, the accumulation of financial imbalances in South Korea is centered on the real estate sector, causing side effects such as reduced efficiency in resource allocation and increased economic vulnerability to real estate market fluctuations. Notably, unlike major countries, household debt has continued to rise without deleveraging (repayment or reduction), reaching levels that threaten macroeconomic and financial stability.

During Financial Imbalance Periods, Effectiveness of Macroprudential and Monetary Policy Combinations Is Low

The report assessed that the combination of MPP and MP policies in South Korea’s past responses to financial imbalances had low effectiveness. In 2014, simultaneous real estate deregulation and interest rate cuts triggered a reinforcing interaction between housing prices and household debt, deepening the imbalance. Since 2020, monetary easing in response to the pandemic has constrained the tightening effects of MPP, expanding imbalances with a time lag.

As a result, housing prices rose rapidly from March 2020 but shifted to a downward trend after August last year due to the impact of interest rate hikes and a cooling real estate market, before rebounding again this year. As of July this year, the rate of change in housing prices and transaction volumes remain below long-term averages; however, apartment prices are rising in the order of Gangnam 3 districts → Seoul → metropolitan area, while price declines in non-metropolitan areas are slowing. Unsold housing inventory is also gradually shrinking in both the metropolitan area and provinces.

Bank household loans have turned to an increase since April, influenced by relaxed lending attitudes, falling loan interest rates, and the supply of special home mortgage loans (Bogeumjari Loan), while the repayment flow of unsecured loans is decreasing. Consequently, the household debt-to-nominal GDP ratio remains at a high level, significantly exceeding the critical threshold where debt’s negative impact on growth expands.

However, the report judged that housing prices remain overvalued compared to fundamental economic conditions, as they are detached from income levels.

The Bank of Korea emphasized, “Signs of renewed accumulation of financial imbalances have recently appeared, so to promote stable growth in the medium to long term, financial imbalances must be managed below a certain level, requiring continuous adjustment efforts. Given past cases where the real estate sector has been the core mechanism behind the accumulation of domestic financial imbalances, related policies should be consistently formulated and implemented over a long-term horizon.”

At a press briefing that day, Lee Sang-hyung, Deputy Governor of the Bank of Korea, responded to a question suggesting that the recent surge in household loans and rebound in real estate prices might be the result of a mismatch between monetary policy and macroprudential policy by saying, “Macroprudential policy has primarily responded to financial market instability and a hard landing in the housing market since the end of last year, during which household loans increased more than expected. While macroprudential policy has positive effects, unexpected side effects may occur, and since the policy combination has only recently been implemented, it is too early to judge.” He added, “With financial market instability easing and the possibility of a soft landing in real estate increasing, but household loans expanding, how to manage macroprudential policy going forward is important.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)