LG Chem has officially embarked on its journey to become one of the 'Top 30 Global Pharmaceutical Companies.' The company plans to commercialize new drugs by focusing resources on the oncology and metabolic disease sectors. While expanding the diabetes drug Gemigliptin business, LG Chem is also nurturing Aveo Pharmaceuticals (Aveo), acquired this year, as a forward base to target the U.S. oncology market.

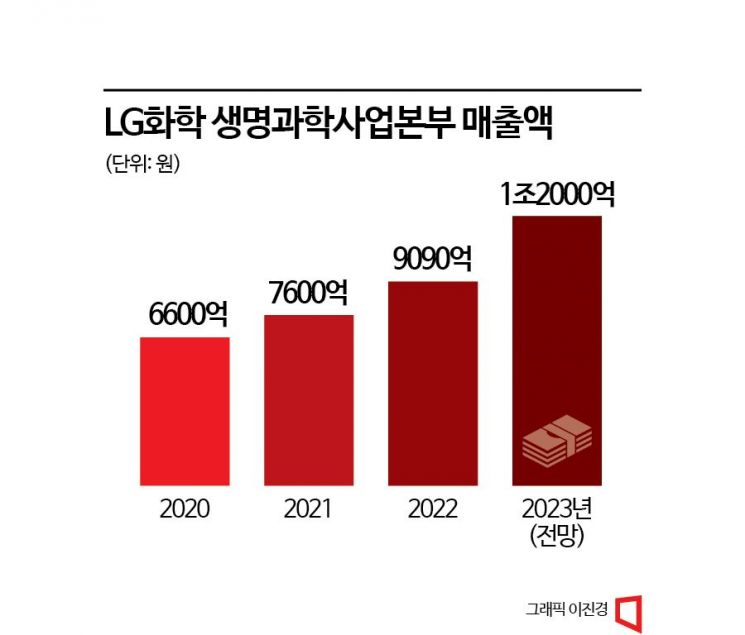

Joining the '1 Trillion KRW Club' in Sales This Year

LG Chem's Life Sciences Division is expected to surpass annual sales of 1 trillion KRW this year. Among domestic pharmaceutical companies, only five have annual sales exceeding 1 trillion KRW: Yuhan Corporation, GC Green Cross, Chong Kun Dang, Hanmi Pharmaceutical, and Daewoong Pharmaceutical. LG Chem will become the sixth domestic pharmaceutical company to join the 1 trillion KRW club.

LG Chem has set the Life Sciences Division's annual sales target at 1.2 trillion KRW for this year. Last year's sales were 909 billion KRW. In the first half of this year alone, sales reached 595 billion KRW. The diabetes drug Gemigliptin product line is a key contributor. Launched in 2012, Gemigliptin is Korea's first diabetes drug containing DPP-4 inhibitors and SGLT-2 inhibitors. DPP-4 inhibitors are drugs that inhibit DPP4, which interferes with the activity of incretin hormones that promote insulin secretion from the pancreas. SGLT-2 inhibitors regulate sodium-glucose co-transporters located in nephrons, the functional units of the kidney. Since the launch of Gemigliptin, LG Chem has diversified its portfolio with combination drugs based on Gemigliptin, such as Gemimet and Gemerow. According to last year's UBIST statistics, sales of the Gemigliptin product line reached 133 billion KRW, capturing a 22% market share in the DPP-4 inhibitor market. The Gemigliptin product line recorded prescription sales exceeding 70 billion KRW in the first half of the year. In April, LG Chem launched a new diabetes combination drug, Gemidapa. Gemidapa is a new drug combining Gemigliptin and dapagliflozin. Dapagliflozin, an oral diabetes treatment, inhibits glucose reabsorption in the kidneys, promoting glucose excretion through urine and thereby suppressing blood sugar elevation.

Aveo, acquired earlier this year, is also expected to play a strong supportive role. LG Chem invested 707.2 billion KRW to acquire Aveo, which holds the FDA-approved kidney cancer treatment 'Fotivda.' Aveo recorded sales of 130 billion KRW last year. This year, sales are projected to grow by more than 60% compared to the previous year, reaching 210 billion KRW. Sales in the first half of this year were 83 billion KRW.

LG Chem is focusing on the oncology market because it is a disease area driving growth in the global pharmaceutical market. The oncology market is expected to grow from 250 trillion KRW in 2021 at an average annual rate of 10.4%, reaching 410 trillion KRW by 2026. Currently, the U.S. market accounts for more than 40% of this.

"From a Small Seed to a Future Giant"

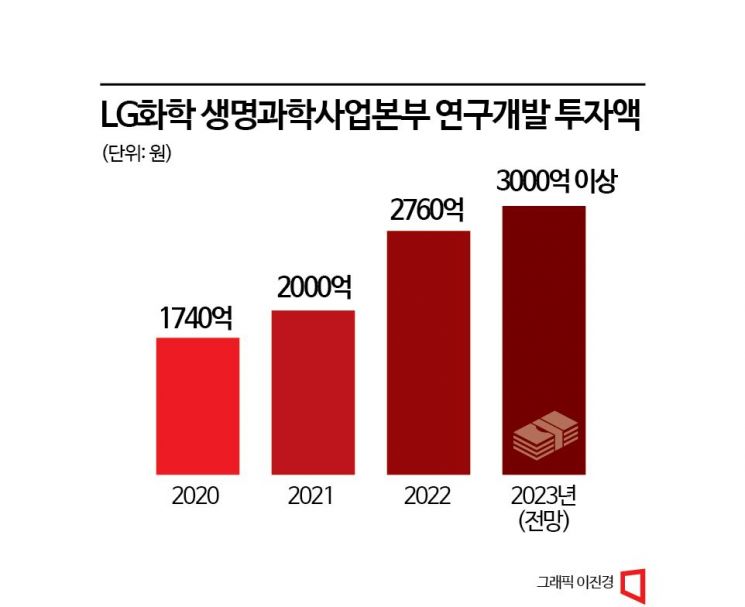

LG Chem identifies the bio business as one of its three major new growth engines and is focusing investments accordingly. The company plans to invest a total of 2 trillion KRW in bio business research and development (R&D) by 2027. Through this, LG Chem aims to launch more than four new drugs globally in the oncology and metabolic disease fields by 2030. First, LG Chem will invest over 300 billion KRW in R&D this year. The new gout treatment drug 'Tigulixostat' has entered Phase 3 clinical trials in the U.S. The plan is to obtain FDA approval as a first-line treatment by 2027 and begin global sales from 2028. LG Chem has also started developing a 6-valent combination vaccine for infants, which currently relies entirely on imports. Recently, LG Chem registered the first subject for Phase 1 clinical trials of the 6-valent combination vaccine 'APV006,' based on purified pertussis. 'APV006' is a vaccine that prevents six infectious diseases: diphtheria, tetanus, pertussis, poliomyelitis, meningitis, and hepatitis B. Compared to the commonly used 5-valent vaccine (diphtheria, tetanus, pertussis, poliomyelitis, meningitis) in Korea, it reduces the number of doses by two. LG Chem plans to invest more than 200 billion KRW in the clinical development and facility construction of 'APV006,' aiming for domestic commercialization by 2030.

LG Chem believes that securing talent is a top priority to become a global company and is actively seeking skilled professionals. Earlier this month, Shin Hak-cheol, Vice Chairman of LG Chem, visited the U.S. and met with about 40 master's and doctoral candidates from over 20 major North American universities, including Massachusetts Institute of Technology (MIT), Harvard University, Stanford University, and California Institute of Technology. Vice Chairman Shin shared LG Chem's current research and development status and future directions, engaging in direct conversations with attendees during a roundtable to introduce LG.

The LG Group also views the bio industry as a key next-generation business. Last month, Koo Kwang-mo, Chairman of LG Group, visited the U.S. to review the bio business status. He visited LG Chem's Boston office and Aveo. He also toured the Dana-Farber Cancer Institute, the world's leading oncology research facility in Boston, and LabCentral, a startup incubator facility in the biopharmaceutical field. Boston, known as the 'Mecca of the Bio Industry,' is home to over 2,000 global bio-related companies and research institutions. Chairman Koo said, "LG's bio business is a small seed now, but with effort and continuous challenge, it will grow into a future giant representing LG."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)