OPEC Production Cuts Continue Driving Price Increases

Additional Listing of Saudi State-Owned Aramco Shares Also a Factor

Iran's Return to Oil Market and Economic Slowdowns in China and US Weigh on Prices

International oil prices have risen for seven consecutive trading days recently, breaking through $86 intraday and setting a new yearly high. This is largely due to the extended production cut policy by major oil-producing country Saudi Arabia. As the stock prices of domestic listed oil refining companies also soared, the securities industry has warned that the instability of oil prices could have adverse effects on the market.

According to Bloomberg and others on the 5th, the price of West Texas Intermediate (WTI) crude oil futures on the New York Mercantile Exchange (NYMEX) surged to $86.06 per barrel intraday the previous day, marking the highest level this year. This is the highest level since mid-November last year. The supply factor is fueling the rise in oil prices as OPEC+, consisting of OPEC including Saudi Arabia and major non-OPEC oil producers such as Russia, is increasingly likely to decide to extend production cuts. Recently, the Wall Street Journal (WSJ) reported that Saudi state-owned Aramco, the world's largest oil company, is planning an additional share listing worth up to $50 billion (about 60 trillion won), which adds weight to the possibility that Saudi Arabia's production cuts will continue until the end of this year or next year. It is expected that international oil prices will be pushed up as much as possible until the year-end, the anticipated timing of the additional listing, to ensure a successful sale. Jae-young Oh, a researcher at KB Securities, said, "If Saudi Arabia's voluntary production cuts are extended until the end of the year, international oil prices are expected to rise above the $90 range."

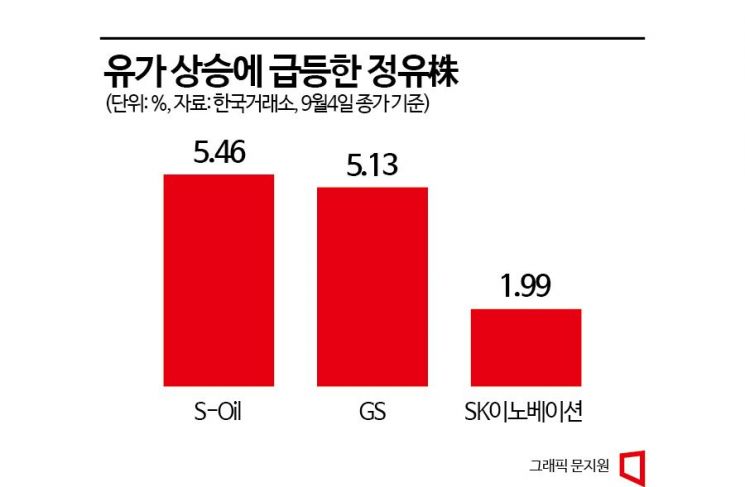

As international oil prices rose, the stock prices of domestic listed oil refining companies also jumped. According to the Korea Exchange, S-Oil's stock price closed at 77,200 won, up 5.46% from the previous trading day. GS's stock price rose 5.13% to 39,950 won, and SK Innovation closed at 179,500 won, up 1.99%. GS's stock price is the highest in about three months since May 22 (40,000 won). Oil-related exchange-traded funds (ETFs) are also on the rise. KODEX WTI Crude Oil Futures (H) has shown an upward trend for four consecutive trading days recently, closing at 15,640 won the previous day. This is the highest level in about 10 months since November 16 last year (15,655 won).

The securities industry is watching closely, concerned about the adverse effects that oil price instability could have on the stock market. A sharp rise in oil prices could dilute inflationary pressures caused by the slowdown in U.S. employment indicators and act as a factor raising government bond yields. The Korea Development Institute revised its economic outlook released on the 10th of last month, raising the average import price of international oil this year from $76 per barrel to $81, and next year's price from $68 to $76. Sang-hyun Park, a researcher at Hi Investment & Securities, said, "The U.S. employment indicators are being interpreted more as 'Goldilocks' (an economic state of high growth without inflation) rather than bad news," adding, "The real bad news is unstable oil prices." He emphasized, "Although the possibility of a slowdown in Chinese demand is increasing, the risk of further oil price increases due to supply-demand and inventory instability in the crude oil market is currently the biggest bad news." Soo-wook Hwang, a researcher at Meritz Securities, also said, "It is necessary to monitor whether the rise in oil prices will lead to inflation expectations, as controlling inflation expectations could provide an excuse for interest rate hikes."

However, there are also forecasts that this trend in international oil prices will not continue until the end of the year. The key variable is Iran. Young-chan Baek, a researcher at Sangsangin Securities, said, "Last month, prisoner exchanges between Iran and the U.S. took place, and the frozen Iranian oil export funds in Korea were also released, indicating close exchanges are ongoing," adding, "If this trend continues, the probability of finding a temporary compromise on the nuclear agreement increases, and the possibility of Iran's return to the oil market cannot be ruled out." He added, "The resumption of Iranian oil supply could offset Saudi production cuts and ease tight supply-demand conditions."

Economic downturns in China and the U.S. could also affect oil prices. If China's economy contracts further amid weak consumption and investment, downward pressure on crude oil demand will increase. Researcher Baek said, "Past phases of inflation control through interest rate hikes have inevitably led to recessions in some form, so this is a time when vigilance cannot be relaxed," and predicted, "U.S. crude oil demand is expected to act as a downward factor for oil prices, reflecting the cumulative effects of tightening."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)