Future Strategies Seen Through SK, LG, Lotte, and Hanwha M&A

Boldly Selling Past Cash Cows and Focusing on Growing New Growth Engines

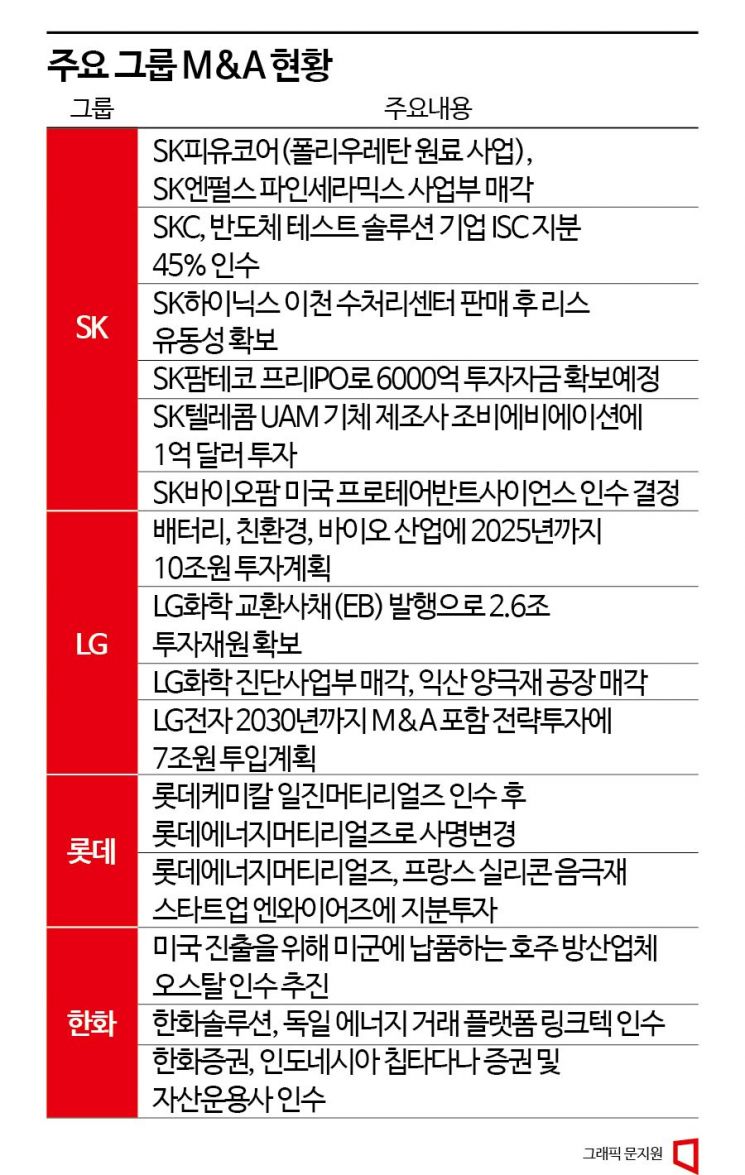

Overcome the 'Innovator's dilemma.' Major groups such as SK, LG, Lotte, and Hanwha are boldly restructuring their business portfolios by divesting past 'cash cow' businesses and focusing on future growth engines and core portfolios. This is an attempt to surpass the 'Innovator's dilemma,' where being tied to past successes leads to being overtaken by latecomers. According to the investment banking (IB) industry, SK, LG, Lotte, and Hanwha have recently been actively conducting mergers and acquisitions (M&A) and new investments for business restructuring.

SK Group actively liquidates assets... Innovation attempts in future materials, artificial intelligence, and semiconductor businesses

Among SK Group affiliates, SKC is currently the most active company undergoing business restructuring. The company is attempting aggressive asset liquidation to focus on secondary battery materials business.

First, it is selling non-core businesses such as SK PU Core and SK Enpulse's fine ceramics division. SK PU Core is a subsidiary of SKC engaged in polyurethane raw materials. The main product of SK PU Core, polyurethane made from polyol, is used in a wide range of downstream industries including automobiles, fashion, electronic devices, medical devices, and building materials. However, SK PU Core's recent performance has been on a downward trend. Sales were about 734 billion KRW in 2021 but decreased to the 720 billion KRW range in 2022. Operating profit also declined from 46 billion KRW to 32 billion KRW during the same period. Although still generating significant sales, the company is boldly selling to concentrate on high value-added industries such as battery materials.

SK Enpulse's fine ceramics division manufactures fine ceramic products, which are consumable parts used in semiconductor etching processes. This division has been considered a core business accounting for 70% of the company's total sales but was somewhat distant from new businesses.

SKC plans to expand its business area by entering the semiconductor back-end materials and components business, which is expected to grow rapidly. To this end, it recently acquired a 45% stake in semiconductor test solution company ISC for 522.5 billion KRW. Established in 2001, ISC's main product, test sockets, are used to inspect the electrical characteristics of packaged semiconductor chipsets. They are considered essential consumables in semiconductor back-end processes. ISC is the industry leader, holding 424 original patents. It operates a factory in Vietnam, which is evaluated to have high cost competitiveness.

The semiconductor sector, which has been experiencing a prolonged downturn, faces liquidity securing for reinvestment as a key issue. SK Hynix is preparing to secure liquidity by selling the Icheon water treatment center to SK REITs in a leaseback format. An IB industry official analyzed, "As semiconductor industry facility investments expand, the intention is to improve asset efficiency and financial soundness not only through borrowing but also through asset liquidation."

New businesses are also being explored through new investments in IT and bio-pharmaceutical sectors. The IT sector is expected to focus more on artificial intelligence, while the bio sector will concentrate on anticancer drugs.

SK Telecom recently invested 100 million USD (about 130 billion KRW) in Joby Aviation, a global urban air mobility (UAM) aircraft manufacturer. This investment secured about a 2% stake in Joby Aviation. The company is recognized as a leader in developing electric vertical takeoff and landing (eVTOL) aircraft, a core component of UAM. SK Telecom has secured exclusive rights to use Joby aircraft domestically.

UAM is a business actively promoted by SK Telecom, which is transitioning into an AI company. SK Telecom plans to utilize its internalized AI technology to popularize UAM services and build an ecosystem.

SK Biopharmaceuticals plans to acquire ProteoVant Sciences, a U.S. joint venture (JV) established by Roivant Sciences and SK. This is to secure targeted protein degradation (TPD) technology. Moving beyond its existing focus on central nervous system drug development, the company is expected to actively pursue anticancer drug development.

LG Group focuses on battery, eco-friendly, and anticancer treatment sectors

LG Group plans to invest 10 trillion KRW by 2025 in batteries, eco-friendly, and bio sectors. LG Chem recently secured funds by issuing 2.6 trillion KRW worth of exchangeable bonds (EB), which can be converted into LG Energy Solution shares.

LG Chem recently sold its diagnostics division and the cathode material plant in Iksan, Jeonbuk, securing an additional 200 billion KRW. An IB industry official said, "There is ongoing speculation about the possible sale of parts of the petrochemical division, which recently started restructuring, as well as Palmhanong, vaccine business, and filler business units." All business units outside the three pillars of battery, eco-friendly, and bio are considered potential sale candidates. Except for specialty pharma areas such as anticancer, all are expected to be divested.

LG Chem plans to invest more than 10 trillion KRW in cathode material facilities and technology development by 2028. Considering the European Critical Raw Materials Act (CRMA), it plans to establish cathode material plants locally in Poland, Germany, Hungary, and other European countries. It will also increase investment in R&D for new materials such as pure silicon anode materials and solid-state battery electrolytes. Regarding eco-friendly materials, it is focusing on biodegradable bioplastics (PLA). LG Chem is establishing a joint venture with U.S. AMD to build a PLA plant with an annual capacity of 75,000 tons in the U.S. by 2025. In the bio sector, it is strengthening new drug development. In January, it acquired U.S. anticancer drug developer Aveo Oncology for 571 million USD (about 700 billion KRW).

LG Electronics has also announced bold investments. It plans to invest 7 trillion KRW in strategic investments including M&A by 2030. LG Electronics is preparing aggressive M&A by hiring M&A experts for each business unit. LG Electronics acquired Austrian automotive lighting company ZKW in 2018, which was the largest acquisition in LG Electronics history at 1.5 trillion KRW. In 2021, it established a joint venture called Aluto with Swiss software company Luxoft. In the same year, it established 'LG Magna e-Powertrain' with Canadian electric vehicle parts company Magna and acquired Israeli automotive cybersecurity company Cybellum. Last year, it secured a 60% stake in electric vehicle charging company Apple Mango, actively expanding its automotive electronics business. Currently, LG has ample cash reserves. As of the end of Q1 this year, LG Corporation holds about 2 trillion KRW in cash and cash equivalents, and LG Electronics holds about 7 trillion KRW.

Lotte and Hanwha continue relentless M&A despite recession... Generous investment in new businesses

Lotte Group is suffering liquidity risks due to sluggish large-scale investments and real estate project financing (PF) failures. However, its heavy chemical affiliates are actively expanding the battery business.

Lotte Chemical acquired Iljin Materials, which produces copper foil, a core secondary battery material, and renamed it Lotte Energy Materials. Recently, the company invested in French silicon anode startup Enwires. Silicon anode materials are next-generation battery materials that can significantly increase energy density compared to conventional graphite anodes. Lotte Energy Materials and Lotte Ventures formed the Lotte Energy Materials Fund and contributed 7.9 billion KRW as investment and operating funds for Enwires' demo plant.

Non-core overseas businesses are being divested. Earlier this year, Lotte Chemical sold its entire stake in LCPL (Lotte Chemical Pakistan Limited), a high-purity terephthalic acid (PTA) production and sales subsidiary in Pakistan, to Pakistani chemical company Lucky Core Industries for 192.4 billion KRW. LCPL was acquired by Lotte Chemical in 2009 for about 14.7 billion KRW. After suspending the PTA plant operation at its Ulsan factory in the second half of 2020, Lotte Chemical has completely withdrawn from the PTA business.

Lotte Chemical, aiming for 50 trillion KRW in sales by 2030, plans to generate 60% of total sales from high value-added specialty and eco-friendly materials businesses. To this end, it plans to issue corporate bonds worth up to 500 billion KRW next month. In February, it received purchase orders worth 620 billion KRW in a 350 billion KRW corporate bond demand forecast and ultimately issued 500 billion KRW.

Hanwha Group is also restructuring its core businesses through M&A. Its main focuses are renewable energy, aerospace, and defense industries. Hanwha Group is considering acquiring Australian defense company Austal. Austal's largest shareholder is HSBC Bank, holding 15.99% of shares. By acquiring Austal, which produces and supplies U.S. Navy warships, Hanwha plans to elevate its status as a global defense industry company. It also plans to enhance synergy with Hanwha Ocean (formerly Daewoo Shipbuilding & Marine Engineering), which has a special shipbuilding division including warship construction. Although the acquisition entity is not yet confirmed, Hanwha Future Proof, a joint venture established in March by Hanwha Solutions and Hanwha Aerospace, is a strong candidate. Hanwha Future Proof previously secured funds by receiving about 1.3 trillion KRW in capital contributions from Hanwha Solutions and Hanwha Aerospace.

Hanwha Solutions acquired a 66% stake in German energy trading platform company Linktek. This is an attempt to leap beyond manufacturing solar cells and modules to become an integrated energy solution company utilizing IT technology.

Hanwha Group has grown its solar business using profits from chemicals. Hanwha Solutions, launched by merging Hanwha Chemical and Hanwha Q CELLS & Advanced Materials, is a core affiliate at the top of the group along with Hanwha Corporation. It has been conducting business restructuring to secure investment funds for the solar business. Last year, it sold 49% of HCC Holdings (China Ningbo subsidiary) and also sold part of Hanwha Advanced Materials' shares to private equity funds. It also liquidated Galleria Gwanggyo branch. The investment industry expects that once the solar business is on track, Hanwha Solutions will sequentially divest chemical businesses such as polyethylene and polyvinyl chloride, which have declining profitability.

Yoo Jeong-ju, head of the corporate research team at the Korea Economic Research Institute, said, "Due to high interest rates, economic nationalism, and climate change, companies face a more uncertain management environment than ever before. The active pursuit of M&A even in a poor economic situation can be seen as a struggle for survival." Park Seok-jung, a researcher at Shinhan Investment Corp., predicted, "The acceleration of global supply chain restructuring is leading to strategic changes in Korea's semiconductor, secondary battery, and major advanced industries. It will strengthen the establishment of production bases centered on semiconductors, secondary batteries, future vehicles, bio, displays, and robots."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)