Revision of Insurance Classification Methods Including Various Contents

"Transition to Digital Non-Life Insurer through Alice"

Lotte Insurance has launched a new platform with the goal of providing unprecedented insurance services and products, and will sell exclusive products.

On the 8th, Lotte Insurance announced that it officially launched this platform, 'Alice,' on the Google Play Store and Apple App Store.

Alice, created with the aim of placing insurance as close as the risks in customers' daily lives, allows users to easily and conveniently subscribe to various lifestyle-oriented insurance services that did not exist before with simple authentication. It also enables detailed insurance contract inquiries and claims. The company explained that customer restrictions on app usage have been minimized.

Through Alice, Lotte Insurance sells 16 types of lifestyle-oriented insurance services. New insurance services that cover various risks in customers' daily lives are exclusively sold through Alice, such as ‘Mini Brain-Heart Insurance,’ which covers brain and heart diseases with high medical costs up to 10 million KRW, ‘Camping Car Insurance,’ which requires only one family member to subscribe on behalf of the family, and ‘Golf Insurance,’ which features joint subscription and gifting functions.

These insurance products are categorized into six categories expanding from the individual to ‘family,’ ‘acquaintances,’ and ‘strangers’ under the worldview called 'Alice Universe.' For example, ‘Baby Insurance,’ which covers growth hormone deficiency treatment for infants and contagious diseases and emergency room treatment, and ‘Kids Insurance,’ which covers fractures, burns, influenza, and emergency room visits, are classified as ‘My Fam’ insurance, meaning ‘protecting my family.’

‘Youth Insurance,’ which covers school violence and school zone traffic accidents, and ‘Office Worker Insurance,’ which covers diseases frequently caused by workplace harassment and stress such as alopecia areata, shingles, and gout, are referred to as ‘Villain’ insurance, meaning ‘protecting myself from villains in daily life.’

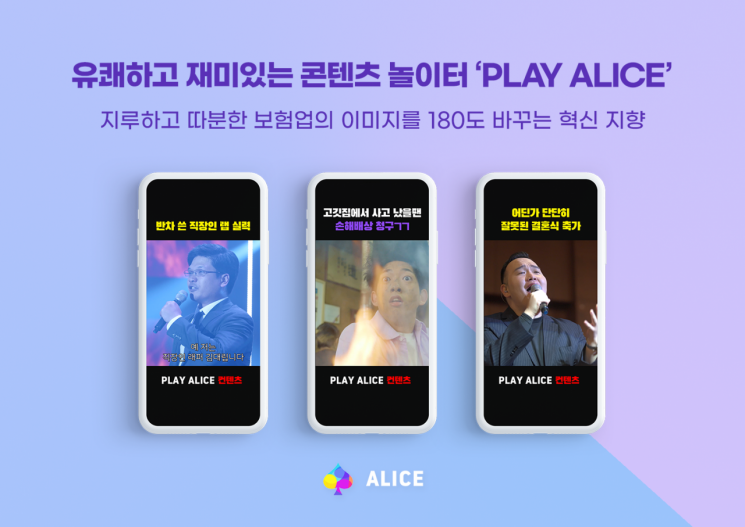

Additionally, an intuitive user interface (UI) and simple user experience (UX) have been prepared. Various content is also available to change the image of insurance. Membership registration or login is not required to use the content.

Moreover, an experimental service offering new features is provided. Representative examples include ‘Risk Radar,’ which allows users to check the risks of people around them and compare them with their own insurance condition, and ‘Golf Calendar,’ which links with the phone calendar to activate golf insurance as an annual pass according to the rounding schedule.

A Lotte Insurance official said, "We aimed to create a fun and pleasant image of insurance by incorporating an intuitive color UI and various content that breaks the stereotypes about the insurance industry," adding, "We plan to complete Lotte Insurance’s digital transformation by launching additional new platforms to support sales in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)