After Price Limit Expansion, IPO Overheating... Effect of Finding Appropriate Price Falls Short

Initial Surge After Listing... 20% of Listed Companies Fall Below IPO Price

SPAC Stock Price Soars Abnormally Before Merger, Merely a 'Deposit Account'

Although funds are pouring into the initial public offering (IPO) market, many newly listed companies are being neglected after one to two months of listing. Speculative trading, which expects high short-term returns by taking advantage of high volatility on the first day of listing, is rampant. While newly listed companies raise investment funds through IPOs and public offering investors also make profits, there are cases where early investors suffer losses.

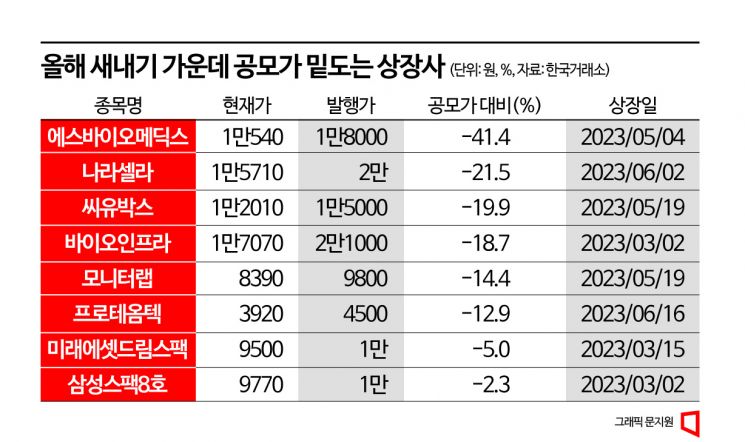

According to the financial investment industry, among the 33 companies listed on the KOSDAQ market this year after demand forecasting, the stock prices of six companies including SBioMedics, Naracella, CU Box, BioInfra, MonitorLab, and ProteomeTech are trading below their offering prices.

SBioMedics Drops More Than 40% Compared to Offering Price

The company with the largest decline compared to the offering price is SBioMedics. SBioMedics, a cell therapy developer, was listed on May 4th at an offering price of 18,000 KRW. The current stock price is 10,540 KRW, down more than 40% in just over two months. Considering that the offering price was set at the upper end of the expected range after a demand forecast competition rate of 854 to 1, the stock price trend after listing is below expectations. Subscription deposits from retail investors reached 1.7 trillion KRW with a competition rate of 995 to 1. Although the stock price rose to 24,000 KRW on the first day of listing, it has been steadily declining since then. On the 10th, it fell to 9,420 KRW, marking the lowest price since listing.

Wine import and distribution company Naracella is also trading below its offering price of 20,000 KRW. There were controversies about overvaluation since the demand forecast. The offering price was finalized at the lower end of the expected range, 20,000 KRW. On the day of listing, it closed at 17,500 KRW, falling below the offering price. Although it rose to 24,750 KRW on the 12th of last month, a weak trend has continued since then. Han Yoo-jung, a researcher at Hanwha Investment & Securities, explained, "Naracella is discovering new wineries to strengthen its product portfolio," adding, "They plan to introduce new directly operated stores and expand through franchise business." Although growth plans were made with funds raised through the IPO, the company has yet to shine in the domestic stock market.

Contract research organization (CRO) BioInfra's stock price rose to 54,600 KRW on the first day of listing but has since dropped to 17,070 KRW. The demand forecast competition rate was 1,595 to 1, and the final offering price was set at the top of the expected range at 21,000 KRW. The IPO was successful, attracting subscription deposits of 1.77 trillion KRW. On March 2nd, the first day of listing, trading started at 42,000 KRW, double the offering price. The stock price surged early in the session, hitting the upper limit, but soon gave back the gains, closing at 29,400 KRW on the first day. While public offering investors recorded high returns, most investors who traded intraday suffered losses.

ProteomeTech, which transferred its listing from KONEX to the KOSDAQ market, is also struggling. It started trading at 6,500 KRW, about 44% higher than the offering price of 4,500 KRW, but closed at 5,210 KRW. The decline from the opening price was about 20%. The current stock price is below 4,000 KRW.

An IPO industry insider said, "A formula for undefeated public offering investors is being created," but expressed concern, saying, "If investors who invest after listing continue to suffer losses, it will be far from improving the soundness of the IPO market." He added, "In most cases, the stock price surges sharply in the early days of listing and then follows a downward curve. After investors seeking high short-term returns in the early days leave, trading volume decreases and stock prices tend to fall."

Short-term Funds Flood IPO Subscriptions, Day Trading on First Day of Listing Rampant

The IPO market is hot, but most of the funds are speculative short-term money. There are criticisms that expanding price fluctuations on the first day of listing encourages the inflow of speculative funds.

Webtoon production company YLAB and ultra-high frequency telecommunications cable company SensorView received public offering subscriptions from retail investors over two days from the 10th to the 11th. Subscription deposits of about 6.5 trillion KRW and 3.4 trillion KRW were gathered respectively. Nearly 10 trillion KRW flowed into the IPO market in just two days.

One reason for the high competition rate in public offering subscriptions is the high rate of increase compared to the offering price on the first day of listing. Since the 26th of last month, the price fluctuation range on the first day of listing for newly listed companies has been expanded to 60-400% compared to the offering price. Companies listed afterward, such as InnoSimulation, Almek, OpenAll, and SecuSen, saw their stock prices rise more than 100% compared to the offering price on the first day.

The recent stock price trends of SPACs confirm the speculative trading tendency even more clearly. After expanding the price limit on the first day of listing, Hana 29th SPAC, Kyobo 14th SPAC, and DB Financial SPAC 11th were listed. Hana 29th SPAC, listed on the 28th of last month, started trading at 2,115 KRW and closed at 2,110 KRW on the day of listing.

Then, after investors saw SecuSen's sharp rise, they flocked to SPACs as well. Kyobo 14th SPAC, listed on the 6th, started at 2,170 KRW on the day of listing and soared to 7,980 KRW during the session. The next day, the stock price rose to 8,190 KRW before falling to 5,590 KRW. After repeated sharp fluctuations, it dropped to 4,325 KRW. DB Financial SPAC 11th, listed on the 12th, rose to 6,860 KRW but closed at 4,435 KRW amid continued sell orders.

An investment banking (IB) industry official pointed out, "SPACs listed on the stock market are just deposit accounts without a merger target," adding, "The phenomenon of investors flocking to buy at a premium on cash is problematic."

A SPAC (Special Purpose Acquisition Company) is a company formed solely for the purpose of merging with another corporation. If it fails to register a merger within three years from the public offering subscription payment date, it undergoes dissolution procedures. Upon dissolution, the public offering deposit is distributed to shareholders. According to the Enforcement Decree of the Capital Markets Act, a SPAC must deposit or entrust at least 90% of the amount raised from issuing shares to a securities finance company or trustee. It cannot withdraw or use it as collateral until the merger registration is completed. This is why it is impossible for a SPAC's value to surge immediately upon listing. Nevertheless, recent SPAC stock prices have surged upon listing, raising concerns.

As SPAC stock prices surged on the first day of listing, the competition rate for SPAC public offering subscriptions also increased. SK 9th SPAC, which held public offering subscriptions for retail investors over two days from the 11th to the 12th, recorded a final competition rate of 592 to 1. Interest in SPACs was not high enough for some to withdraw their listings at the end of last year. Since the expansion of price fluctuations on the first day of listing this year, SPAC popularity has increased.

A securities firm IPO staff member explained, "The influx of funds into public offering subscriptions is positive in terms of market activation," but added, "It is still too early to expect an effect of quickly finding the appropriate price."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)