11%P Lower Than OECD Average

Need for Personal and Retirement Pension Activation System

Out-of-Pocket Medical Expenses Also Exceed OECD Average

A study found that Korea's pension replaces less than half of post-retirement income. This is nearly 30% lower than the recommendation by the Organisation for Economic Co-operation and Development (OECD). It is analyzed that the scale of post-retirement coverage from private pensions such as retirement pensions and personal pensions is significantly lower than that of advanced countries.

On the 11th, according to the Korea Life Insurance Association, the Global Federation of Insurance Associations (GFIA), composed of 40 insurance associations worldwide, commissioned the global consulting firm McKinsey to conduct and release the "Global Protection Gap Study Report."

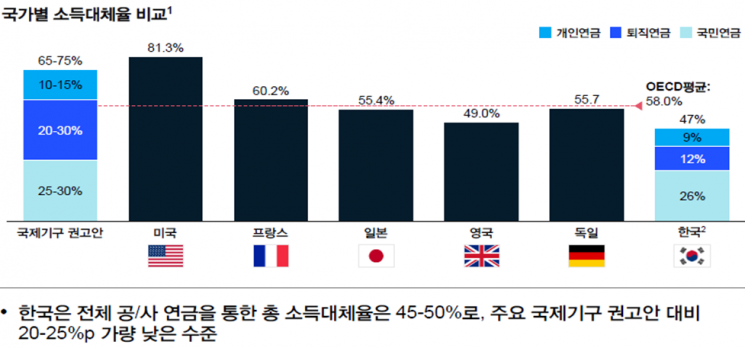

Based on this, McKinsey Korea Office analyzed the pension income replacement rate (the ratio of pension amount received to the average income during the pension subscription period) by country, combining public and private pensions. Korea's income replacement rate was estimated at about 47%, which is 20-25 percentage points lower than the OECD recommendation of 65-75%. It was also 11 percentage points lower compared to the OECD average of 58%. The pension income replacement rates of major countries were recorded as the United States (81.3%), France (60.2%), Japan (55.4%), the United Kingdom (49.0%), and Germany (55.7%).

Regarding the detailed income replacement rates by pension system, the National Pension accounted for the largest share at 26%, followed by retirement pensions (12%) and personal pensions (9%). The National Pension's income replacement rate met the OECD recommendation (25?30%), but retirement pensions (20?30%) and personal pensions (10?15%) fell short of the recommended levels.

To increase the income replacement rate, it was pointed out that tax benefits should be expanded to further activate retirement pensions and personal pensions. The Korea Life Insurance Association proposed expanding the income tax reduction rate on retirement benefits for long-term pension receipts such as lifetime pension payments to encourage long-term pension receipt of retirement pensions. They also suggested expanding the separate taxation limit on pension account contributions and increasing the tax credit limit for protection insurance premiums.

Meanwhile, McKinsey evaluated that Korea's out-of-pocket ratio for medical expenses is 34.3%, which is very high compared to the OECD average of 20%. To address this, they proposed reducing individual medical expenses by expanding subscription to protection insurance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)