Sangui, 'Structural Changes and Challenges in Global Export Trade'

"Losing Competitiveness in Korea from China... China Grows from Korea"

Proposes 'A·R·T' Solution to Resolve Export Slump

As the global trend of de-Chinaization accelerates, there have been suggestions to revise trade strategies to capture new opportunities.

The Korea Chamber of Commerce and Industry (KCCI) argued in its report "Changes in the Global Trade Structure and Response Tasks," released on the 5th, that to overcome export sluggishness caused by changes in the global trade structure, it is necessary to focus on ▲ the de-China trend and opportunity capture (Altasia) ▲ trade structure restructuring (Restructuring) ▲ policy support to strengthen technological competitiveness (Technology).

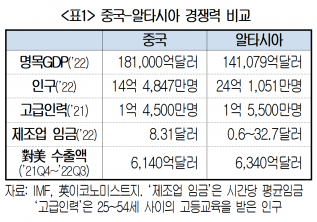

Recently, the British magazine The Economist identified 14 major Asian countries, including Korea, as alternative markets to replace the Chinese supply chain, coining the neologism "Altasia," a combination of Alternative and Asia. While no country can completely replace China's role, when divided by sectors such as technology, logistics services, resources, investment policies, and wages, Asian countries can substitute for China.

Specifically, Korea, Japan, and Taiwan can replace China in technology; Singapore in finance and logistics; Indonesia, Malaysia, and Brunei in resources; Vietnam, Thailand, and India in investment policies. The Philippines, Bangladesh, Laos, and Cambodia are considered China substitute countries in terms of wages, having seen wages more than double over the past decade. Lee Buhyung, Director at Hyundai Research Institute, said, "Among the countries identified as Altasia, only a very few, including Korea, possess outstanding technological capabilities, human capital, stable social infrastructure, and a market environment suitable as a testbed. The government must strive to rebuild trade strategies with China."

"Korea has lost competitiveness in China, but China is growing in Korea... The scope of trading partners must be expanded"

KCCI suggested that trade structures should be reorganized through strengthening economic diplomacy. Korea's export structure is concentrated on certain countries, certain products, and mainly intermediate goods. Among last year's total exports of $683.6 billion, the top three export countries (China, the United States, and Vietnam) accounted for 48% ($326.5 billion).

KCCI advised expanding the trading partner countries, which are concentrated in a few nations, to high-growth-potential Indo-Pacific countries and Middle East and Africa markets, and diversifying export products that are concentrated in some items such as semiconductors. Jiman Soo, a research fellow at the Korea Institute of Finance, said, "Since China has shifted from a period of high growth to medium-to-low growth, it is necessary to engage broadly to capture new business opportunities arising in China."

"Government R&D investment expansion needed... Policies to establish and attract mother factories domestically must be implemented"

The need for policy promotion was also raised. According to research by Hyundai Research Institute, while China has strengthened its competitiveness in the Korean market, Korea has gradually lost competitiveness in the Chinese market. Korea's revealed comparative advantage (RCA) index in high-tech manufacturing for China rose 1.2 times from 1.19 in 1990 to 1.42 in 2020, but China's RCA for Korea in high-tech manufacturing surged 28.8 times from 0.05 to 1.44 during the same period. RCA is an indicator used to assess export competitiveness. An RCA above 1 indicates that the country has export competitiveness in that specific market segment.

KCCI urged the government to share the risks of investing in advanced technology fields that require huge funds and to implement policies to establish and attract mother factories domestically to maintain competitiveness. A mother factory is a plant that performs core functions such as product design, research and development, and design among domestic and overseas production facilities. They also pointed out the need to significantly expand government R&D investment, which is about one-third of private R&D investment, and to move away from a top-down, rigid management system led by the government.

Professor Park Kisoon of Sungkyunkwan University’s Graduate School of China Studies advised, "The US-China technological hegemony competition is an opportunity for Korean companies to accumulate technological assets. To counter China's protectionism, patriotic consumption, and the strengthening competitiveness of Chinese companies, it is necessary to nurture talent who understand the Chinese market well and can comprehend the minds of Chinese consumers."

Woo Taehee, Executive Vice Chairman of KCCI, said, "Trade conditions are unfavorable, with exports declining for nine consecutive months. To enhance domestic production capacity, it is essential to precede with subsidies and tax benefits at the level of global competitors and improve the business environment through labor reforms."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)