Net Buying Continued Until May This Year, Turned to Net Selling in June

Short-Term Peak, Temporary Selling Due to Won Depreciation Prevails

Concerns That Selling Will Continue Until Fundamentals Improve Are Also Strong

This year, a withdrawal of foreign investors, who had been leading the rally in the domestic stock market, is being observed. While foreign investors had maintained strong net buying positions despite the "Sell in May" adage, their net selling dominance in June has led to opinions that the market has entered a correction phase, alongside claims that this is a temporary adjustment due to recognition of a short-term peak.

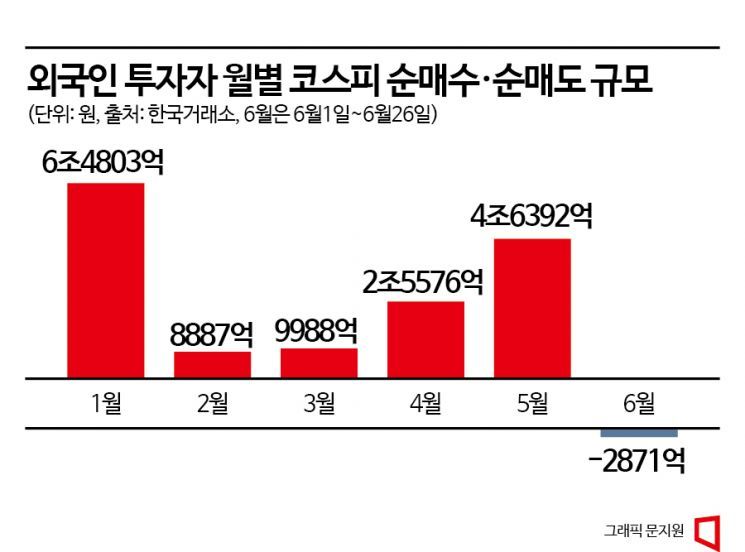

According to the Korea Exchange, foreign investors have net sold a total of 287.1 billion KRW in the KOSPI market from the beginning of this month through the 26th. During the same period, they net sold 209.4 billion KRW worth of stocks in the KOSDAQ market. From the 19th to the 23rd, foreign investors maintained a net selling position for five consecutive trading days in the KOSPI, selling over 1 trillion KRW in total during the past week. This contrasts sharply with their net buying of 2.5576 trillion KRW in April and 4.6392 trillion KRW in May in the KOSPI.

With the withdrawal of foreign investors, the KOSPI eventually fell below the 2600 level. On the 2nd, the KOSPI closed above 2600 for the first time in over a year, finishing at 2601.36. However, on the 20th, it dipped intraday to 2596.82, falling below 2600, and closed at 2582.63 on the 21st, breaking the 2600 level. The KOSPI, which had risen to a high of 2650.45 on the 12th, dropped to 2582.20 by the close on the 26th amid foreign selling pressure.

However, some in the securities industry analyze that the shift to net selling by foreign investors is temporary. This is because net buying by foreign investors continues in certain sectors such as semiconductors and automobiles. The top stocks for foreign net buying in April and May were Samsung Electronics, SK Hynix, and Hyundai Motor, in that order. Up to the 26th of this month, the top stocks for foreign net buying were Samsung Electronics (1.2479 trillion KRW), Doosan Enerbility (293.8 billion KRW), POSCO Future M (151 billion KRW), Hanwha Aerospace (148.3 billion KRW), SK Hynix (141.3 billion KRW), Cosmo Advanced Materials (133.2 billion KRW), and Hyundai Motor (132.5 billion KRW), showing that net buying centered on semiconductors and automobiles continues.

Kim Dae-jun, a researcher at Korea Investment & Securities, said, "Last week, foreign investors net sold 1.1 trillion KRW worth of stocks in the KOSPI market, marking a change in foreign investors' supply and demand direction after 11 weeks, leading to divided opinions on whether the selling trend is temporary or structural." He added, "Since there is no clear reason for foreign investors to significantly reduce their allocation to Korean stocks, it appears to be a temporary selling trend."

There is also analysis that exchange rates influenced foreign investors' net selling. Following the June Federal Open Market Committee (FOMC) meeting, concerns over further interest rate hikes increased, weakening the Korean won against the US dollar, creating an environment where foreign investors sensitive to foreign exchange losses might sell some stocks. Choi Yoo-jun, a researcher at Shinhan Investment Corp., diagnosed, "Recognition of a short-term peak around the KOSPI 2600 level has slowed foreign investors' buying in June, but preference for semiconductor stocks centered on Samsung Electronics remains."

On the other hand, the possibility of a structural selling trend by foreign investors is also being raised. Cho Byung-hyun, a researcher at Daol Investment & Securities, said, "The economic surprise index, which fluctuated around zero, has now clearly entered negative territory," adding, "Due to lowered macroeconomic expectations, the market is more sensitive to issues that could tilt the stock market downward rather than upward." He further noted, "Inflation pressures growing mainly in Europe and additional tightening by the US Federal Reserve are factors that could burden our stock market."

Kim Young-hwan, a researcher at NH Investment & Securities, expressed a similar view. He said, "It appears that foreign investors are realizing profits due to concerns over further Fed rate hikes," and analyzed, "Until valuation pressures ease and improvements in our stock market fundamentals are confirmed, additional selling pressure may emerge."

With the psychological support level of 2600 in the KOSPI broken, concerns are also raised that a strong rally like that in the first half of the year may be difficult to expect. Park Sang-hyun, a researcher at Hi Investment & Securities, explained, "An additional rally in the domestic stock market will be possible only if the semiconductor industry conditions and trade balance improve," adding, "If a sharp decline in semiconductor inventory and an improvement in export growth rate are confirmed, expectations for economic recovery in the second half of the year will increase further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)