June KOSDAQ Individual Trading Volume Decreases, KOSPI Increases

Concerns Over Market Weakness Due to Intensified Concentration During Economic Vulnerability

While the KOSPI is showing relatively stronger bullish characteristics compared to the KOSDAQ, the polarization phenomenon is accelerating due to deteriorating investor sentiment following a series of stock price manipulation scandals. Individual investors are flocking to large-cap KOSPI stocks, which are less likely to become targets of stock price manipulation. In the KOSDAQ as well, only large-cap stocks such as semiconductors and secondary batteries are popular.

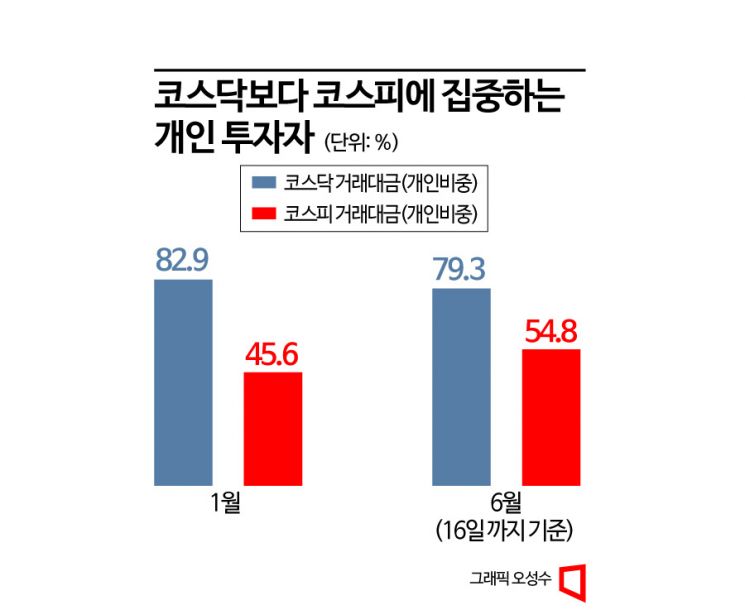

According to the financial investment industry, individual investors have been concentrating more on the KOSPI than the KOSDAQ since the beginning of this month. In particular, for the first time since the Korea Exchange began compiling related statistics in November 1999, the proportion of individual investors' trading value in the KOSDAQ has fallen below 80%. As of the 13th, the proportion of individual investors' trading value was only 79.4%, and it further decreased to 79.3% as of the 16th this month. In January of this year, the proportion was 82.9%.

The decline in the proportion of individual investors' trading value in the KOSDAQ is due to the ongoing bullish market in the KOSPI centered on large semiconductor stocks such as Samsung Electronics and SK Hynix, which has shifted buying interest. Currently, the proportion of individual investors' trading value in the KOSPI is 54.8%. Compared to January (45.6%) and February (48.3%) of this year, this is nearly 10 percentage points higher. Kim Jisan, head of the Kiwoom Securities Research Center, analyzed, "As a large-cap semiconductor-led market emerges, individual investors have moved to the KOSPI, which offers relatively higher investment attractiveness."

The deterioration of investor sentiment due to a series of stock price manipulation incidents is also causing individuals to withdraw from the KOSDAQ market, especially from small- and mid-cap stocks. In the case of large-cap stocks, the likelihood of becoming a target of stock price manipulation is relatively low. Most of the stocks targeted by manipulation groups are either scarce stocks with a small number of circulating shares or small- and mid-cap stocks. Scarce stocks are characterized by low market capitalization and a high shareholding ratio by the largest shareholder, resulting in a small amount of shares circulating in the market. In fact, the five stocks at the center of recent stock price manipulation controversies during the lower limit price incidents were all scarce stocks.

As of the 16th of this month, the stocks most purchased by individuals in the KOSPI are Kia, NCSoft, Kakao, Hotel Shilla, POSCO Holdings, SK Telecom, KT&G, and Celltrion. In the KOSDAQ, they are L&F, EcoPro BM, Lunit, Alteogen, HLB, and Celltrion Healthcare.

The preference for large-cap stocks is the same among foreigners and institutions. Especially in the KOSDAQ, their preference for large-cap stocks is prominent. Foreign investors have concentrated on EcoPro, EOFlow, and JYP Entertainment in the KOSDAQ market this month. Institutions have also purchased Rootronic, EcoPro, and TMC. Jung Yong-taek, chief economist at IBK Investment & Securities, explained, "In the past, except for Celltrion among the top market capitalization stocks in the KOSDAQ, the market caps were not large enough for foreigners and institutions to invest, which is why the proportion of individual trading was overwhelmingly high. However, recently, large-cap stocks have appeared evenly in the KOSDAQ as well, increasing the trading proportion of foreigners and institutions." Five years ago, in June 2018, the trading value proportions of foreigners and institutions in the KOSDAQ were only 10.6% and 5.0%, respectively. Now, they exceed 14% and 5.5%, respectively.

Looking ahead, the domestic stock market is expected to continue being led by large-cap stocks such as semiconductors and secondary batteries. However, there are concerns that if market funds continue to concentrate on some large-cap stocks including semiconductors, volatility could increase. The fact that only some large-cap stocks are rising is considered a risk factor for the overall market. Over the past month, the KOSPI large-cap index rose by 7.22%, while the mid-cap and small-cap indices only increased by about 3% each. Park So-yeon, a researcher at Shin Young Securities, pointed out, "When the economy is strong, concentration leads to rotation among neglected stocks, but when the economy is weak, concentration often results in a general market downturn."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)