Kim Jeong-ju's Two Children Pay Inheritance Tax with 29.3% NXC Shares

Management Control Difficult and Dividends Low, Reducing Appeal

Big Tech in Game Content, Chinese Game Companies, Strategic Investors, and Private Equity Funds as Candidates

The family of the late Kim Jung-ju, founder of Nexon, is expected to publicly sell approximately 30% of the shares of NXC, the holding company of the Nexon Group, which were paid as inheritance tax in kind. This is a large-scale deal valued at about 4.7 trillion KRW. However, since these are unlisted shares without management rights, the sale is expected to take a considerable amount of time.

According to the Financial Supervisory Service's electronic disclosure, in February, Kim's two children paid 852,190 shares (29.3%) of NXC, inherited from the founder, as inheritance tax in kind. Payment in kind is a method of paying inheritance tax with assets other than cash, such as real estate or securities, if certain conditions are met. These shares are currently owned by the Ministry of Economy and Finance.

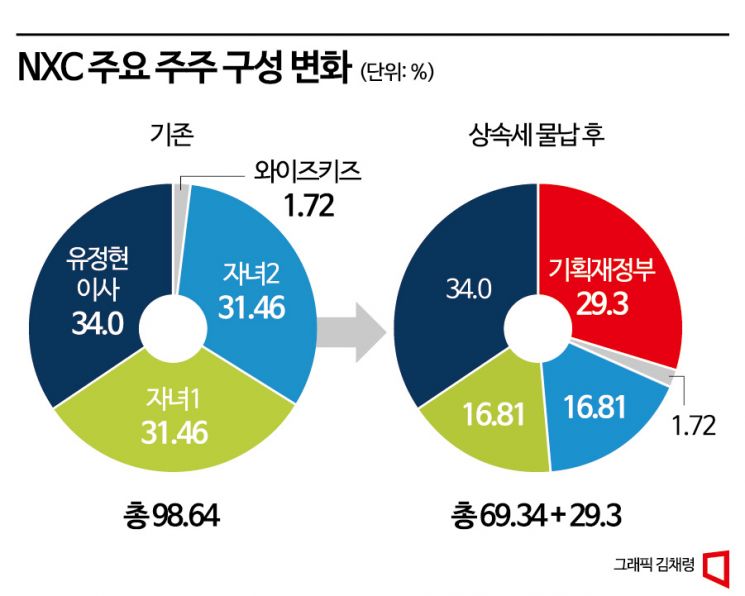

After Payment in Kind of Inheritance Tax, Kim Jung-ju Family's NXC Shareholding Ratio is 69.34%

Earlier, after the founder's passing, in September last year, 1,960,300 shares (67.49%) of the founder's stock were inherited by his spouse, Yoo Jung-hyun, an NXC director, and their two children. Director Yoo received 4.57% of the shares, becoming the largest shareholder with a total of 34%, while the two children each inherited 30.78%, holding 31.46% each.

About five months later, Kim's two children paid a total of 29.3% as inheritance tax in kind. Currently, the shareholder composition of NXC is Director Yoo Jung-hyun with 34.0%, the two children with 33.62%, Wise Kids with 1.72%, and the Ministry of Economy and Finance including others with 33.62%. Wise Kids is a limited liability company owned 50% each by Kim's children. The Kim family’s total NXC shareholding ratio is 69.34%. Even excluding the shares paid as inheritance tax in kind, this is a sufficient stake to maintain management control.

The NXC shares paid as inheritance tax in kind, amounting to 29.3%, were valued at 4.7 trillion KRW. According to industry sources, Kim left assets worth about 10 trillion KRW as inheritance, and the family reportedly declared about 6 trillion KRW as inheritance tax.

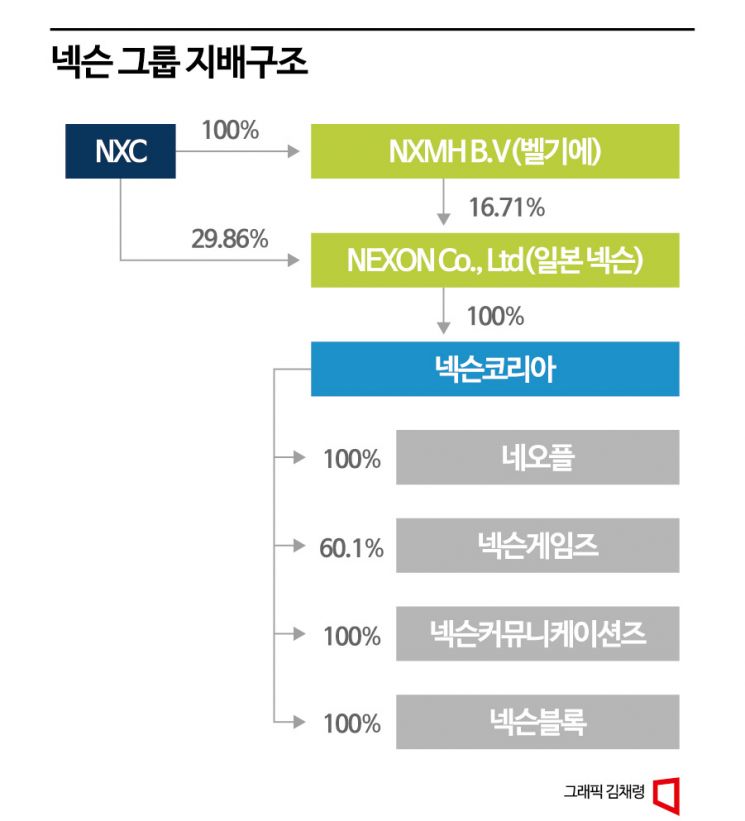

NXC → Japan Nexon → Nexon Korea → Nexon Games, etc. Control Structure

NXC is the holding company of the Nexon Group. The Nexon Group is a corporate group with 18 domestic and 104 overseas affiliates. Major affiliates include Nexon Korea, Neople, Nexon Games, and Japan Nexon (NEXON Co., Ltd.). NXC holds 46.57% of Japan Nexon, the headquarters of the Nexon Group, and Japan Nexon fully controls Nexon Korea. Nexon Korea, in turn, owns Neople (100%) and Nexon Games (60.1%).

The Ministry of Economy and Finance, which became the second-largest shareholder of NXC through the inheritance tax payment in kind, plans to dispose of the shares based on the share value of 4.7 trillion KRW as assessed by the National Tax Service. The disposal is expected to be entrusted to the Korea Asset Management Corporation (KAMCO) and conducted through public auctions or similar methods.

However, the market expects the share sale to proceed slowly. Since these are unlisted shares, it is difficult to realize profits after purchasing the shares, and the visible benefits may be small compared to the share value. From a dividend perspective, NXC has paid dividends of about 11.6 billion KRW annually since 2020. Holding 29.3% of shares would yield about 3.4 billion KRW in dividends.

Ministry of Economy and Finance's NXC Share Dividend Yield Only 0.1%... IPO Requires Family Consent

Currently, with the 29.3% stake valued at 4.7 trillion KRW, acquiring the shares at this price results in a dividend yield of less than 0.1%. The investment banking (IB) industry considers that an annual return of over 10% is necessary to profit given the current interest rate environment and financing costs. From an investor's perspective, depositing 4.7 trillion KRW in a bank would be more advantageous.

It is also difficult to demand higher dividends through shareholder proposals. The Kim family holds enough shares to pass special resolutions at shareholders' meetings, so a 29.3% stake alone cannot influence management. An exit via an initial public offering (IPO) also requires the family's consent, so it is not guaranteed.

Due to these practical issues, disposing of unlisted shares paid as inheritance tax in kind has been difficult in the past. According to KAMCO, from the introduction of the inheritance tax payment in kind system in 1997 until August 2021, the actual recovery rate of unlisted shares received as payment in kind was about 67.7%. Although the payment in kind amount was 1.4983 trillion KRW, the actual proceeds from sales were 1.0142 trillion KRW.

Taekwang Industrial Shares Paid by the Late Park Yeon-cha's Family Still Owned by Government

In particular, disposing of large-scale unlisted shares has been even more difficult. In 2021, the family of the late Park Yeon-cha, chairman of Taekwang Industrial, paid about 300 billion KRW of the approximately 600 billion KRW inheritance tax in unlisted shares of Taekwang Industrial (now TKG Taekwang). At the time, this was the largest amount of unlisted shares paid in kind. These shares remained government-owned until the first quarter of this year. Currently, the Ministry of Economy and Finance holds 18.31%, making it the second-largest shareholder of TKG Taekwang.

The case of DAS, an auto parts company revealed to be owned by former President Lee Myung-bak, is similar. After the death of Kim Jae-jung, Lee's brother-in-law, his wife Kwon Young-mi became the owner of DAS and paid 41.6 billion KRW in inheritance tax with DAS shares. KAMCO conducted public auctions of DAS shares annually from 2011 to 2017, but after 42 failed auctions, the sale is currently on hold.

Accordingly, the market expects that potential buyers of NXC shares will be global IT companies or private equity funds. An IB industry insider said, "Microsoft acquired Blizzard, and Meta is also interested in game content, so global IT companies may be interested in NXC," adding, "If private equity funds participate, it will likely be in the form of a consortium with strategic investors (SIs) who can create business synergies with the Nexon Group."

The gaming industry also sees a possibility of Chinese capital entering. The Chinese government has not been issuing new game licenses (panho) to Chinese game companies to prevent minors' game addiction. Notably, Tencent joined forces with Netmarble and MBK Partners to bid for NXC shares in 2019 when the entire NXC stake was up for sale (the sale was canceled due to price differences at the time).

Another industry insider said, "Since the shares paid in kind do not confer management rights, only buyers who can maintain amicable relations with existing shareholders and devise an exit strategy will consider purchasing the shares."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)