SM's Stock Plummets and Stabilizes After Disappearance of Management Dispute Catalyst

Hybe Reports Record Q1 Earnings, Kakao and SM Underperform

On the 31st, Hive employees were handed over to the prosecution on suspicion of avoiding losses of about 230 million KRW by selling company stocks after learning in advance about BTS's suspension of group activities. BTS officially announced the temporary suspension of group activities on June 14 last year, and it was investigated that these employees sold Hive stocks before this bad news was publicly disclosed, having learned the information in the course of their duties.

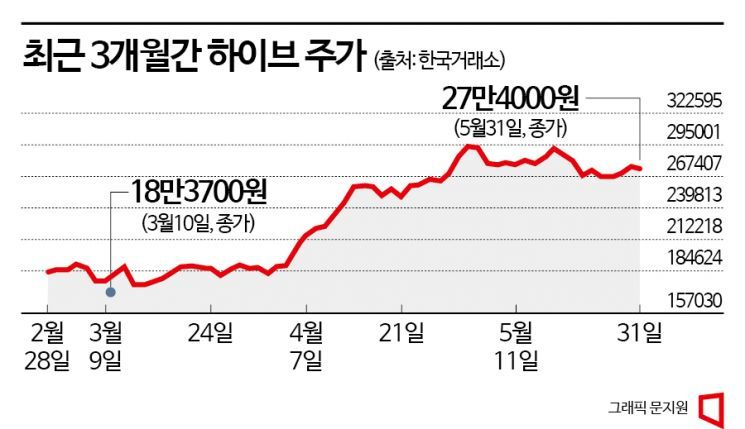

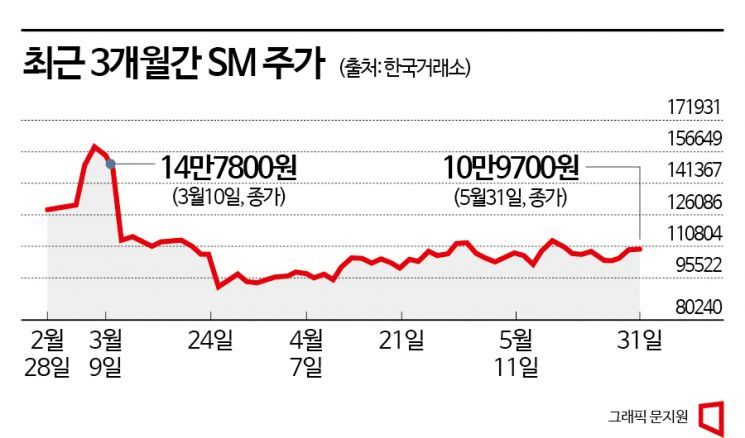

Meanwhile, following the heated SM Entertainment (SM) management rights dispute during this year's shareholder meeting season, the stock prices of Hive and Kakao have diverged significantly, attracting attention. Hive, which withdrew midway from the competition to secure shares against Kakao, is showing an upward trend with its stock price nearly doubling in three months amid the 'golden age of entertainment stocks,' whereas Kakao, which secured SM's management rights, continues to experience sluggish stock performance. SM's stock price remains flat.

According to the Korea Exchange, on the 31st of last month, Hive's stock closed at 274,000 KRW, down 0.72% from the previous trading day. Based on the closing price that day, Hive's stock price rose 49.15% since the SM management rights dispute ended on March 12 (closing price on March 10 was 183,700 KRW).

On the same day, Kakao's stock closed at 56,200 KRW, down 1.06%. Kakao's stock price has fallen 3.27% since the management rights dispute. After the positive effect of the management rights dispute disappeared, SM's stock price also plunged 25.77% and has since remained flat.

The difference in stock performance among the three companies was determined by their first-quarter earnings. Despite the gap caused by BTS's military service, Hive exceeded market expectations in both first-quarter sales and operating profit, recording the highest first-quarter results ever. Hive's consolidated first-quarter sales increased 44.1% year-on-year to 410.6 billion KRW, and operating profit rose 41.8% to 52.5 billion KRW. Following the earnings announcement, 12 domestic securities firms raised their target prices for Hive. Do-young Ahn, a researcher at Korea Investment & Securities, analyzed, “Hive monetizes intellectual property (IP) through its platform, benefiting not only its own artists but also artists from other companies. It is also the most active in integrating other fields such as gaming and blockchain into the entertainment business. There is abundant growth potential not yet reflected in market earnings estimates.”

Kakao recorded poor first-quarter results, leading to investor neglect. Kakao's first-quarter sales were 1.7403 trillion KRW, up 5.4% year-on-year, but operating profit was 71.1 billion KRW, down 55.2% over the same period. Operating profit was 42.05% below market expectations (122.7 billion KRW). Jung-yeon Seo, a researcher at Shin Young Securities, said, “The slowdown in the advertising market significantly affected the underperformance of display advertising revenue, including Kakao's main advertising product, Bizboard. Growth in high-margin businesses is slowing, and investments and losses in key affiliates such as healthcare and brain-related new businesses must be endured in the short term.”

Although entertainment stocks are in the spotlight, SM experienced negative growth in the first quarter due to expenses related to responding to the management rights dispute. SM's consolidated sales increased 20.3% year-on-year to 203.9 billion KRW, while operating profit decreased 5% to 18.3 billion KRW. The securities industry gave mixed evaluations of SM. Some upgraded their investment opinions to 'buy,' citing the entertainment industry's structural growth phase and the potential for improved performance due to favorable market conditions, while others downgraded from 'buy' to 'hold.' Soo-young Park, a researcher at Hanwha Investment & Securities who downgraded the investment opinion and lowered the target price to 100,000 KRW, diagnosed, “SM's first-quarter operating profit fell short of market expectations. More than SM's poor first-quarter performance, the delay in artist activities is a bigger problem.”

Meanwhile, the Financial Supervisory Service's Capital Market Special Judicial Police (Special Judicial Police) forwarded three Hive employees to the prosecution with a 'prosecution opinion' for selling stocks after obtaining insider information about BTS's suspension of group activities, drawing attention to Hive's stock price trend. In fact, Hive's stock price fell 24.87% to close at 145,000 KRW on June 15 last year, the day after BTS announced the temporary suspension of group activities on YouTube on June 14. However, Hive's stock price began to decline from June 10, three trading days before BTS's announcement, raising suspicions that insider trading may have occurred. The three employees responsible for idol group-related work used insider information to sell their stocks before BTS's activity suspension was publicly announced, avoiding losses of about 230 million KRW. However, if they had not sold their Hive stocks at that time and held them until now, the current return would be about 23%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)