EU and US Move to Block Over Monopoly Concerns... Korean Air May Further Concede Slots and Traffic Rights

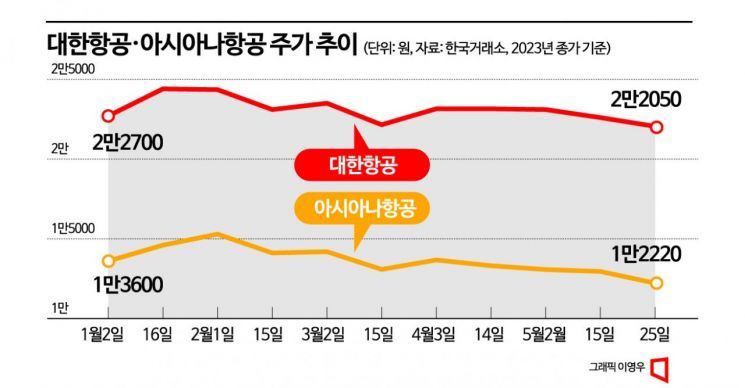

Korean Air Stock Down 2.8% Since Early Year, Asiana Airlines Down 10.1%

Although passenger numbers are increasing due to the COVID-19 endemic (periodic outbreaks of infectious diseases), the stock prices of full-service carriers (FSCs) have not taken off. This is attributed to the delayed merger between Korean Air and Asiana Airlines, raising concerns that more slots than expected may be lost to foreign airlines. They are struggling amid the US and European Union (EU)'s prioritization of their own countries.

According to the Korea Exchange on the 26th, Korean Air's stock price fell 2.8% from 22,700 KRW at the beginning of the year (January 2) to 22,050 KRW as of May 25. Asiana Airlines' stock price dropped 10.1% from 13,600 KRW to 12,220 KRW. This contrasts with the KOSPI, which rose 14.7% from 2,225.67 to 2,554.69 during the same period.

Foreign investors have been selling. During the same period, foreigners alone net sold shares worth 104.7 billion KRW. Monthly figures were 6.137 billion KRW in January, -71.162 billion KRW in February, -31.235 billion KRW in March, 544 million KRW in April, and -8.997 billion KRW in May (up to the 25th).

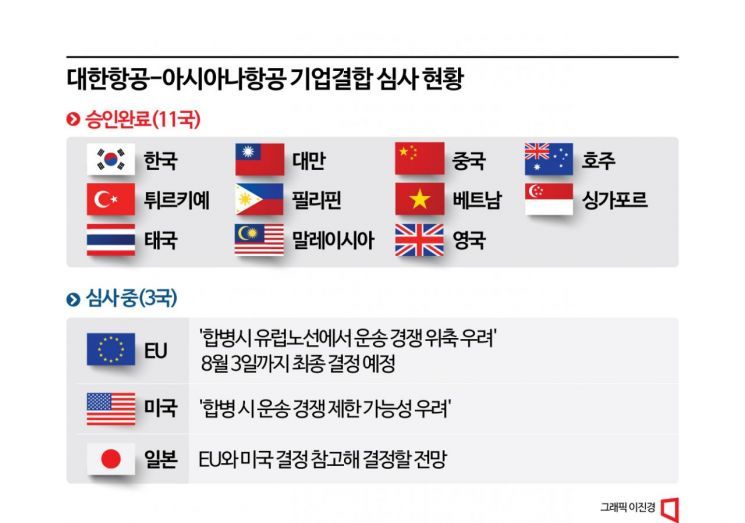

Korean Air's stock price being stuck in a box range is due to turbulence encountered during the merger process with Asiana Airlines. Korean Air expected to receive merger approval from overseas competition authorities this year, but major authorities such as the EU and the US are showing signs of disapproval.

Since February, the EU has been conducting a second-phase in-depth investigation, the final stage of the corporate merger review, and recently notified Korean Air of a Statement of Objections (SO) stating that "competition in passenger and cargo transport on European routes may be reduced due to the merger."

Meanwhile, the US Department of Justice also expressed concerns that the merger could hinder transport competition. The airline industry and securities firms interpret this as a situation where Korean Air must additionally surrender slots at major airports and Incheon International Airport to foreign airlines in both Europe and the US.

Earlier this year, the UK competition authority, as a condition for merger approval, required Korean Air to transfer up to seven weekly slots at London Heathrow Airport to Virgin Atlantic. Currently, Korean Air holds 10 weekly slots, and Asiana Airlines holds 7. The demand was to transfer all of Korean Air's slots to British airlines.

Choi Go-woon, a researcher at Korea Investment & Securities, said, "The strengthening of the home country-first policy due to the COVID-19 pandemic is a variable," adding, "Rather than the merger itself being canceled, it is more concerning that the synergy effect of the merger could be reduced due to the surrender of slots and traffic rights during the overseas approval process."

There is a reason why the home country-first policy has strengthened in the aviation market. During the COVID-19 pandemic, experiencing logistics disruptions made stable supply chain management important. Competition authorities and airlines in each country are sensitive to the integration of cargo operations between Korean Air and Asiana Airlines.

Passenger numbers are on the rise, but the outlook for second-quarter earnings is bleak. Korean Air's passenger numbers increased from 972,103 in January to 1,059,925 in April. Asiana Airlines also rose from 705,568 to 769,829 during the same period.

However, the second-quarter earnings forecast for Korean Air compiled by FnGuide is negative. Operating profit is expected to decrease by 52.3% year-on-year to 352.9 billion KRW. Sales are expected to increase by 3.8% to 3.5512 trillion KRW compared to last year, but net profit is forecast to fall by 38.7% to 275.3 billion KRW.

Nonetheless, securities firms assess that the current uncertainty has a limited impact on Korean Air's stock price. Ryu Je-hyun, a researcher at Mirae Asset Securities, said, "Korean Air's current price-to-book ratio (PBR) is 0.85, which is historically low," adding, "There is a possibility of regression to the five-year average of 1.1, and a long-term re-rating potential when the uncertainty over the Asiana Airlines merger is resolved."

The situation for Asiana Airlines is not good either. Asiana Airlines' cash equivalents (on a separate basis) increased from 626.8 billion KRW in 2021 to 809.2 billion KRW in the first quarter of 2023. However, net financial costs also rose from 71.3 billion KRW in the first quarter of 2022 to 82.0 billion KRW in the first quarter of 2023. Net financial costs refer to aircraft leases, loan interest, and so on.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)