Shinsegae and Hyundai Department Store Operating Profit Decline

Difficult Improvement Due to Base Effect

Three Companies Invest 1.2 Trillion in Facility Reorganization

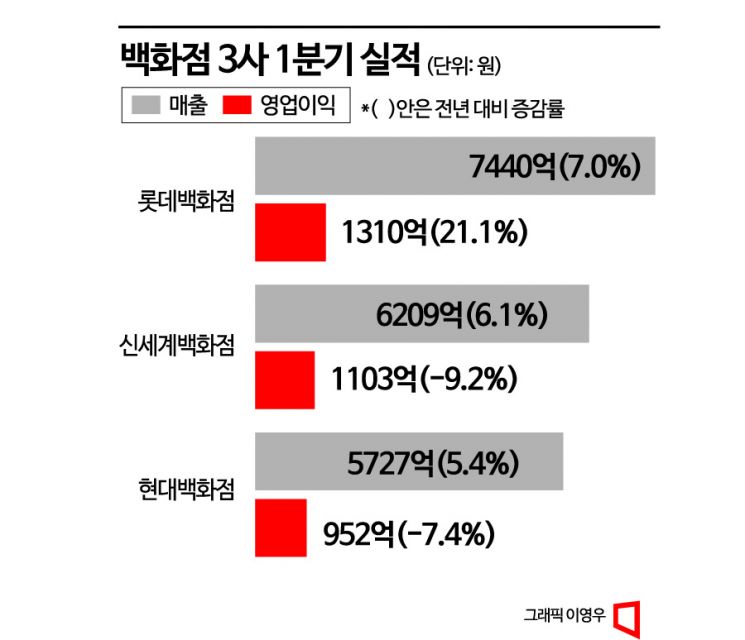

The department store industry struggled in the first quarter of this year amid the consumption downturn caused by high inflation and high interest rates. Both Shinsegae Department Store and Hyundai Department Store recorded operating losses and retreated, while Lotte Department Store was the only one to grow, maintaining its pride. There is a prevailing outlook that performance improvement will not be easy in the future due to the full-scale base effect. Meanwhile, the three department stores plan to respond in the second half of the year with large-scale store renovations.

The 'Big 3' department stores in Korea: Lotte Department Store, Shinsegae Department Store, and Hyundai Department Store (clockwise from top)

The 'Big 3' department stores in Korea: Lotte Department Store, Shinsegae Department Store, and Hyundai Department Store (clockwise from top) [Photo by Lotte, Shinsegae, Hyundai Department Store]

Lotte Grows Alone... Shinsegae and Hyundai Face Setbacks

According to the consolidated earnings disclosures of the three department stores on the 12th, Lotte Department Store's operating profit was 131 billion KRW, a 21.1% increase compared to 108 billion KRW in the same period last year. Sales also recorded 796 billion KRW, about 52 billion KRW (7.0%) higher than 744 billion KRW in the same period last year. Although the sales growth rate slightly decreased compared to last year, the operating profit growth expanded significantly. Last year’s first quarter sales and operating profit growth rates were 9.4% and 2.6%, respectively.

Lotte Department Store's performance is analyzed to have risen alongside sales growth centered on fashion. Lotte Department Store stated, "Offline consumption activation increased fashion product sales, and overseas store sales increased by 10.5% due to the transition to endemic status of COVID-19 in Southeast Asia." Lotte Department Store plans to continue its performance growth by expanding events targeting foreign tourists this year.

On the other hand, Shinsegae Department Store recorded an operating profit of 110.3 billion KRW, down 9.2% compared to the same period last year. The impact of special performance bonuses and increased management costs due to inflation was significant. Considering that Shinsegae Department Store posted record-high performance last year, it paid a special performance bonus of 4 million KRW to all employees, and the resulting one-time cost was reflected in the first quarter. Sales increased by 6.1% to 620.9 billion KRW, marking nine consecutive quarters of growth. However, considering that the sales growth rate in the first quarter of last year was 18.7%, the growth rate clearly slowed down.

Hyundai Department Store also saw sales increase by 5.4% to 572.7 billion KRW in the first quarter, but operating profit fell by 7.4% to 95.2 billion KRW. Although sales of fashion and cosmetics increased due to the transition to endemic status, growth slowed, and operating profit shrank as fixed costs rose due to high inflation. The recovery of offline stores after COVID-19 led to increased labor and marketing costs, and the Daejeon outlet suspended operations after a fire in September last year, which also had an impact.

Concerns for Q2... Facility Renovations and Store Investments

Although Lotte Department Store performed well, the industry outlook is not bright. A base effect is expected starting from the second quarter. The department store industry saw rapid growth in performance from the second quarter last year due to the lifting of COVID-19 social distancing measures. This effect is expected to fully materialize going forward. In fact, Shinsegae Department Store, which discloses monthly operating results, recorded only a 2.8% sales increase in April compared to the previous year.

The luxury consumption that grew explosively during the COVID-19 period is also expected to slow down due to the economic downturn, which is another negative factor. This phenomenon was already evident in the first performance report of this year. Last year’s first quarter luxury growth rates were double digits for Lotte (23.4%), Shinsegae (37.2%), and Hyundai (30.6%), but all fell sharply this year. Shinsegae (7.8%) and Hyundai (9.1%) saw luxury sales growth rates drop to single digits, and Lotte even decreased by 2.4%. Moreover, even the MZ generation (Millennials + Generation Z), which led new luxury consumption, is tightening their belts, and this trend is expected to deepen in the future.

The department store industry is aiming for a rebound by renovating offline stores. According to the industry, the three department stores will invest a huge amount of 1.2357 trillion KRW this year in facility renovations and new store investments. This amount is 32.8% higher than last year’s 930.2 billion KRW. By department store, Shinsegae will invest the largest amount at 586.8 billion KRW. Lotte Department Store and Hyundai Department Store plan to invest 388.9 billion KRW and 260 billion KRW, respectively.

The normalization of the business environment for overseas operations, which were contracted due to the COVID-19 impact, is also considered a positive factor. Nam Sung-hyun, a researcher at IBK Investment & Securities, said, "Since the consumption downturn continues, it is judged that performance improvement will not be easy until the second quarter," but added, "It is positive in that the business environment could turn favorable toward the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)