Online Luxury Market Expanded by COVID-19

Diversification of Sales Channels Including Own Malls for Offline Expansion

Threats Include User Decline and Counterfeit Controversies

Luxury platforms that grew in size due to COVID-19 are busy devising measures to maintain their market share. Although luxury consumption continues to increase, the purchase channels have diversified, and traditional fashion companies are simultaneously strengthening their online and offline presence, expanding their influence.

According to market research firms such as Euromonitor on the 3rd, the size of the domestic luxury market, which was 12.21 trillion KRW in 2015, grew about 22% to 14.9964 trillion KRW in 2020. The industry estimates that it surpassed 15 trillion KRW last year. The domestic online luxury market grew 52% from 1.0455 trillion KRW in 2015 to 1.5957 trillion KRW in 2020. It is expected to maintain a similar scale so far, accounting for about 10% of the total luxury market.

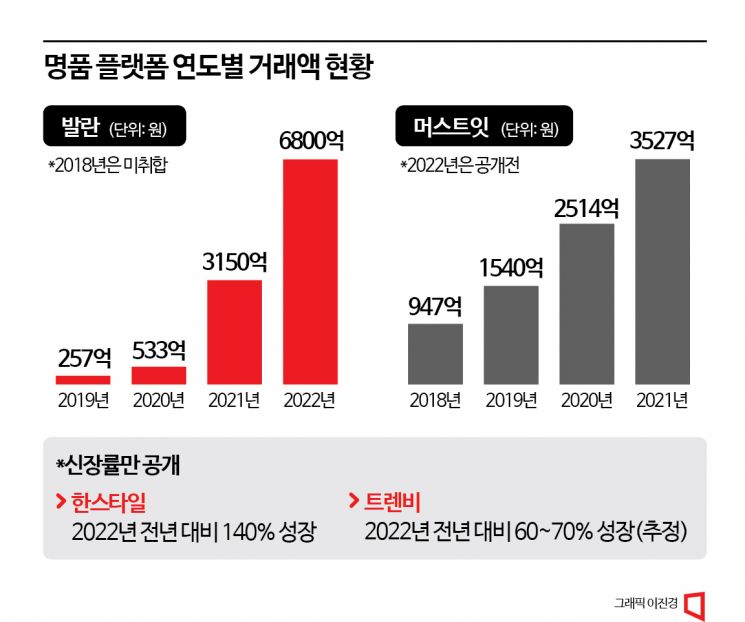

As non-face-to-face consumption was activated due to COVID-19, luxury platforms centered on the so-called 'Big 3'?‘Meo·Teu·Bal (MustIt·Trenbe·Balan)’?expanded their size. Balan's transaction volume rapidly grew from 25.7 billion KRW in 2019 to 680 billion KRW last year, recording an average annual growth rate of 127% over the past four years. The company explained that it holds about 45% of the domestic online luxury market share.

MustIt also grew 272% in four years, from 94.7 billion KRW in 2018 to 352.7 billion KRW in 2021. Last year's transaction volume has not been disclosed. Trenbe did not reveal detailed figures, citing that it is compiling annual transaction volumes. However, internally, it is expected that last year's transaction volume grew about 60-70% compared to the previous year. The cumulative transaction volume reached 1 trillion KRW five years after the service opened. Hanstyle, which promotes dawn delivery service, also saw its transaction volume grow 140% year-on-year last year. However, some critics argue that these transaction volumes are somewhat exaggerated, as most companies are unlisted and use their own accounting standards rather than official accounting criteria.

Although they expanded due to the activation of non-face-to-face consumption caused by COVID-19, there are many challenges ahead. Offline store consumption is being revitalized as social distancing and mask-wearing mandates are lifted, and the number of platforms is gradually increasing. Large fashion companies are also strengthening their own malls one after another, expanding the luxury category.

Contrary to each company's announcement of increased transaction volumes, there is also analysis that the total number of platform users has decreased since this year. App and retail analysis services WiseApp, Retail, and Goods revealed that the combined number of users of domestic luxury commerce platforms such as MustIt, Trenbe, Balan, and OK Mall in January this year was 860,000, down 33% compared to the same period last year. The statistical analysis platform Mobile Index presented similar figures. It is analyzed that overall luxury consumption has decreased due to the general economic downturn.

In addition, there are many factors threatening consumer trust, such as the ongoing genuine vs. counterfeit product controversies throughout last year, prompting platforms to desperately pursue reforms. Balan introduced 'Balan Care Plus' last month, significantly strengthening pre-inspection standards for products. They require partner companies to submit documents proving the import process, tightening the authenticity verification standards compared to before. They also offer a service that guarantees 200% compensation unconditionally if counterfeit product controversies arise. Balan recently completed Series C bridge funding and plans to accelerate new businesses, including global market expansion and category expansion that had been delayed.

Trenbe also released the data-driven luxury authentication system ‘MARS’ last month. MARS, developed in-house by Trenbe, is an integrated authentication system that reduces the time and possible errors when an appraiser authenticates a product, improving accuracy and efficiency. In line with the increase in luxury secondhand transactions such as the Trenbe resale service launched in 2021, Trenbe is focusing on expanding related categories. Trenbe succeeded in turning a profit starting last month, the first time in three years since 2019. In February, they reorganized their organizational structure to establish a business system focused on efficiency and operations. The existing CSO in charge of sales, Choi Ju-hee, moved to CBO, the business general representative, and COO Lee Jong-hyun, who oversaw Trenbe’s growth and operations, took on the role of CRO, overseeing the resale business.

MustIt will significantly strengthen seller policies from this month, imposing sanctions on sellers who disrupt the transaction environment. Along with this, to expand the influx of the MZ generation (Millennials + Generation Z) who prefer new luxury products, MustIt has been conducting the ‘Must Fill & Feel’ project since the second half of last year. As part of this, they introduce brands gaining attention as new luxury products and hold planned events such as their own photo shoots and discounts.

An industry insider said, "With high inflation and high interest rates continuing, many expect the situation in the fashion industry, including luxury, to worsen this year," adding, "As the internal and external environment is undergoing significant changes, competition among platforms to recover demand will become even fiercer."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)