KRX Gold Market Surpasses 80,000 Won for the Second Time Since Establishment

Flight to Safe Assets Intensifies Amid Financial Uncertainty

Since the establishment of the KRX gold market, the gold price (price per gram of 1kg gold spot) has surpassed 80,000 won for the second time. This is attributed to the strengthening preference for safe-haven assets as financial instability spread to major global banks following the collapse of Silicon Valley Bank (SVB).

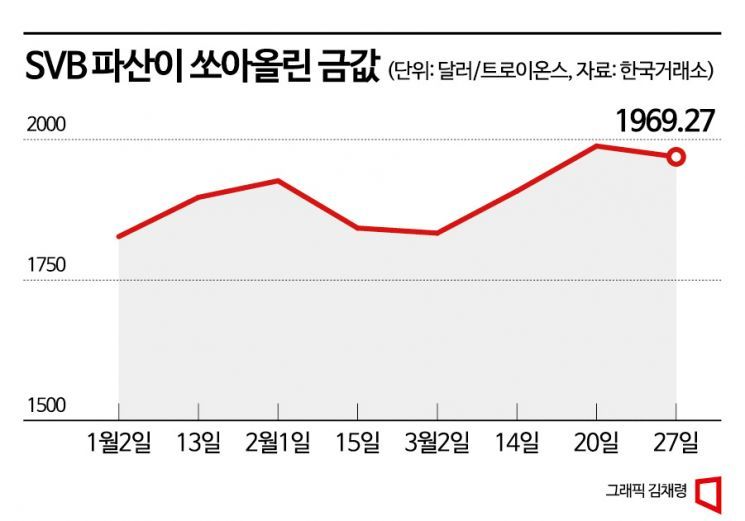

According to the Korea Exchange on the 28th, the international gold price closed at $1,969.27 per troy ounce, down 0.93% from the previous trading day. After reaching a yearly high of $1,988.53 on the 20th, it slightly declined but is again approaching the $2,000 mark.

The international gold price had stalled after recording $1,903.44 on April 26 last year, then dropped to $1,622.81 on September 28, 2022, due to the impact of the 'King Dollar.' The gold price, which had hovered around the $1,800 level, began to rise after the SVB collapse on the 10th. It recorded $1,908.36 again on the 14th and has been on an upward trend since.

Domestic gold prices also hit a yearly high. Since the establishment of the KRX gold market on March 24, 2014, the gold price has reached 80,000 won for the second time. Subsequently, on the 21st, it recorded an all-time high of 83,490 won.

The rise in gold prices is attributed to financial instability triggered by SVB. Sim Soo-bin, a researcher at Kiwoom Securities, explained, "Despite Federal Reserve Chairman Jerome Powell dismissing the possibility of a rate cut within the year, the perception that we are in the late phase of the rate hike cycle has strengthened, driving gold prices up," adding, "Concerns over the soundness of individual banks not being fully resolved also contributed to the price increase."

Gold prices generally move inversely to real interest rates. They tend to move opposite to the 10-year U.S. Treasury yield, a representative real interest rate indicator. Although the Fed has ruled out rate cuts this year, the perception of being in the late stage of the rate hike cycle has led to a decline in U.S. Treasury yields, increasing gold's investment appeal.

In fact, funds are flowing into gold. According to Daishin Securities, the gold holdings in exchange-traded funds (ETFs), which had been declining since April last year, have turned upward. ETF gold holdings increased to 92.894 million ounces, returning to levels seen in February. Notably, since COVID-19, the proportion of demand for financial gold such as ETFs has been relatively smaller compared to demand for gold bars and central bank gold purchases.

However, some argue that while the support level for gold prices has risen, there are insufficient factors to drive a sustained increase. Unlike the COVID-19 period (August 2020), when gold prices hit historical highs, the SVB collapse has increased uncertainty over Fed's financial policies and concerns about bank failures, which have also heightened uncertainty over the dollar's value.

Kim So-hyun, a researcher at Daishin Securities, predicted that it would be difficult for gold prices to surpass historical highs this year. The record high during COVID-19 was due to four major factors acting simultaneously: increased safe-haven demand due to COVID-19, a weak dollar, falling real interest rates, and historic levels of ETF fund inflows. Kim said, "It will be difficult for gold prices to exceed the all-time high of $2,063 per ounce this year," adding, "Contrary to previous expectations, stronger dollar pressure is likely to limit gold price increases." Another securities firm official also said, "Due to the dilemma between central banks' inflation stabilization and financial stability, the real interest rate decline effect seen in 2020 is unlikely to be expected," and maintained the gold price range for this year at $1,750 to $2,070.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)