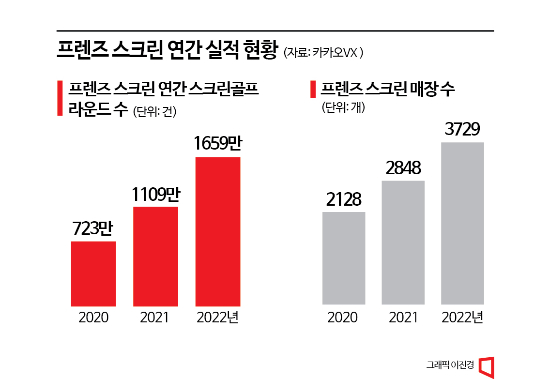

Increase in Friends Screen Rounds Due to Green Fee Burden and Screen Golf

16.6 Million Rounds Last Year, Doubled in One Year

Number of Stores Also Increased to 3,729 Last Year

Despite industry predictions that the golf boom, which surged after COVID-19, may subside, screen golf continues to thrive. Experts analyze that golfers, burdened by skyrocketing green fees, are flocking to screen golf venues, which offer relatively easy access at a lower cost than field golf. In the United States, the world's largest golf market, the screen golf population has grown to a size comparable to field golf enthusiasts, leading to forecasts that the related market could exceed 4 trillion won in the future.

Screen Golf Craze Growing 50% Annually

According to the industry on the 24th, the number of screen golf rounds at ‘Friends Screen,’ a screen golf brand operated by Kakao VX, reached 16,597,001 last year. This is an increase of more than 50% compared to 11,098,955 rounds in 2021. The annual rounds in 2020 were 7,235,319, showing about a 50% increase each year since the full onset of COVID-19.

Friends Screen has been steadily expanding its number of stores domestically and internationally, fueled by the popularity of screen golf. The company’s total number of stores, including for-profit, non-profit, and overseas locations, increased from 2,128 in 2020 to 2,848 in 2021, and then to 3,729 last year, adding nearly 1,000 stores in just one year. Overseas expansion is also active, with about 400 stores currently secured in China and plans to expand globally starting next year.

Experts cite high green fees and worsening economic conditions as reasons why the screen golf market continues to thrive alone. They analyze that golfers, burdened by expensive golf course fees, have massively shifted to screen golf venues. In fact, a survey conducted by the Korea Golf Association (KGA) from August to November last year targeting 4,512 golfers nationwide found that the average monthly expenditure on golf courses was 575,000 won, more than three times higher than the 189,000 won for indoor screen golf usage fees. Perhaps due to this, 45.5% of respondents identified indoor screen golf venues as their primary place to enjoy golf, more than three times higher than the 13.1% who chose golf courses.

Recently, advances in science and technology have enabled screen golf venues to provide practice environments comparable to those on the field. Indoor golf facilities equipped with state-of-the-art golf simulators are emerging one after another. Golfers can experience famous courses from around the world in virtual reality at nearby screen golf venues without having to go out to the field.

With new technology development and increasing participation, the golf simulator sector is expected to open a market worth around 4 trillion won. Market research firm Straits Research recently reported that the global golf simulator market value is expected to grow from $1.3155 billion (about 1.69 trillion won) in 2021 at an average annual rate of 10.1%, reaching $3.38 billion (about 4.3 trillion won) by 2030. According to the National Golf Foundation (NGF), as of 2021, about 12.4 million American golfers prefer ‘off-course’ play, including indoor golf simulators, while 12.6 million enjoy ‘on-course’ field golf, narrowing the gap between the two groups.

Screen Golf Companies Compete to Attract Golfers

Competition among companies to attract golfers to screen golf venues is fierce both domestically and internationally. Golfzon, which holds a 60% share of the domestic screen golf market, opened its first ‘Golfzon Social’ complex golf culture facility at the Palisades Center in New York, USA, on the 21st of last month. It is a sports pub where users can enjoy food and beverages alongside screen golf. Additional stores are planned to open in New York State this year. Domestically, the Busan X1 Park branch, which adds a kids’ cafe facility to the existing Golfzon Park screen venue, is scheduled to open around mid-next month.

Kakao VX is leveraging the familiar Kakao Friends characters in its marketing. The Friends Academy Hannam branch has opened a Kakao Store inside the screen golf venue targeting young customers who want to purchase Kakao goods. The Friends Academy Icheon Daewol branch is differentiating itself from other stores by strengthening facility investments with a ‘premium golf course’ concept and luxurious interior design.

Recently, Shinsegae Group has challenged the domestic screen golf market, which had been dominated by Golfzon and Kakao VX. Shinsegae Construction opened the first TGX Golf store in COEX Mall, Gangnam-gu, Seoul, earlier this year. This venue simulates the feel of walking on real grass from the teeing ground to the rough, and the store’s wall interiors feature panoramic views of Trinity Country Club (CC), creating the sensation of playing on a high-end golf course. TGX Golf’s motto is to “allow golfers to experience everything about golf at screen golf venues without paying expensive fees or going out to the field.”

Professor Ok Kwang of the Department of Physical Education at Chungbuk National University said, “Screen golf venues allow play all year round without weather restrictions and are easily accessible even for beginners, so related indicators have continued to grow after COVID-19. With advances in virtual technology and information and communication technology, screen golf venues are expected to provide playing environments comparable to field golf courses and the related market will steadily expand.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)