Ant Shareholder Solidarity Pressures Election of External Audit Committee Members at General Meeting

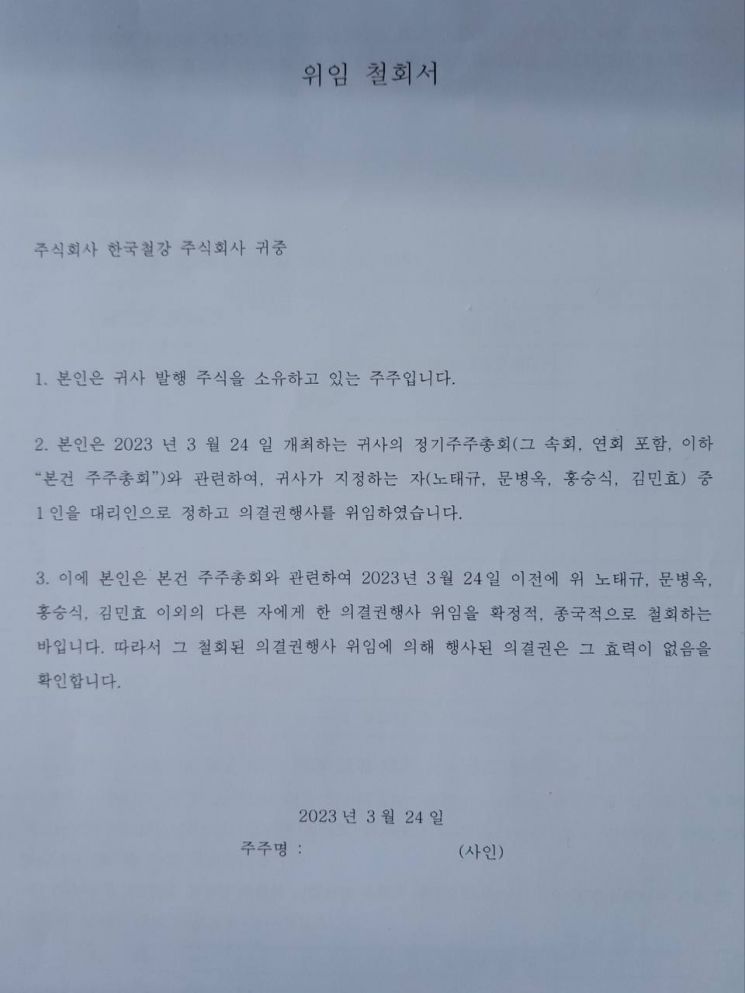

KISCO Holdings and Korea Steel Also Receive Proxy Revocation Letters Ahead of Vote

Capital Market Act Only Regulates Proxy Forms...Legal Validity of Proxy Revocation Letters in Question

KISCO Holdings and Korea Steel have been confirmed to have sent 'proxy revocation forms' with the date pre-filled to individual shareholders to obtain signatures ahead of the vote on appointing external audit committee members at the shareholders' meeting scheduled for the 24th. As the voting results are expected to be close, it is interpreted that they sent the proxy revocation forms with the meeting date pre-filled to nullify the voting rights of individual shareholders opposing them.

According to the securities industry on the 21st, KISCO Holdings and Korea Steel hired a proxy voting agency called 'Korea M&A' and are currently receiving 'proxy revocation forms' with the shareholders' meeting date filled in from individual shareholders.

Both companies recently attracted attention due to 'shareholder proposals' from individual shareholders. The most important agenda item at this shareholders' meeting is the 'appointment of audit committee members.' Previously, Value Partners Asset Management and lawyer Shim Hye-seop filed a provisional injunction lawsuit requesting the court to include the company's stock buyback and cancellation and the nomination of an external audit committee candidate (lawyer Shim Hye-seop) as agenda items for KISCO Holdings' shareholders' meeting. The court ruled in their favor, so these two agenda items will be presented at the meeting. In the case of Korea Steel, the company accepted a shareholder proposal from a shareholder coalition (nominating an external audit committee candidate), and a vote battle is scheduled at the meeting.

The audit committee appointment agenda requires approval by more than half of the shareholders attending the meeting to pass. Since the 'shadow voting' system, which allowed proxy voting for shareholders who did not attend the meeting, was completely abolished in 2018, competition to secure voting rights has intensified when small shareholders disagree with companies like these two.

The controversy arose as the companies simultaneously received 'proxy revocation forms' from individual shareholders. Generally, companies obtain 'proxy forms' to secure voting rights. According to Article 152, Paragraph 4 of the Capital Markets Act (Enforcement Decree Article 163, Item 5), proxy forms must include the date and time of delegation.

If the delegation date is falsely recorded, it is punishable by imprisonment of up to five years or a fine of up to 200 million KRW (Capital Markets Act Article 444). When duplicate proxy forms appear, the most recent date is recognized. The shareholder coalition supporting the appointment of external audit committee members secures voting rights through an application, recording not only the date but also the minute.

As competition to secure proxy forms intensified, the two companies received 'proxy revocation forms' with the shareholders' meeting date filled in to nullify the effectiveness of the opposing side's proxy forms. A lawyer with extensive experience advising on shareholders' meetings said, "Proxy collection agencies sometimes receive such revocation forms, but as far as I know, their effectiveness has never been recognized in practice," adding, "They judge based on the date and time recorded on the proxy form, and if still unclear, they call the shareholder."

The problem is that there is no legal basis to sanction proxy revocation forms with dates filled in. Article 152, Paragraph 2 of the Capital Markets Act only stipulates that proxy revocation can be received. Kim Gyu-sik, chairman of the Korea Corporate Governance Forum, pointed out, "It could be considered obstruction of business by deception," and added, "There is a possibility of criminal charges separately from lawsuits to cancel the shareholders' meeting."

The intense competition between the companies and the individual shareholder coalition is rooted in the '3% rule (amendment to the Commercial Act)' enacted by the National Assembly in December 2000. With the amendment, listed companies must elect at least one audit committee member separately from directors. In this process, no matter how high the largest shareholder's stake is, voting rights are limited to 3%, hence the name '3% rule.'

Among individual shareholders of KISCO Holdings and Korea Steel, investors who want shareholder-friendly policies such as dividend expansion and stock buyback and cancellation have organized a 'shareholder coalition' to actively voice their opinions. The nomination of external audit committee candidates was also led by this shareholder coalition.

Representatives of KISCO Holdings and Korea Steel stated, "After consulting with external lawyers, we received the opinion that obtaining signatures on proxy revocation forms with the shareholders' meeting date (the 24th) pre-filled is not illegal," adding, "We selected a proxy agency and are also receiving proxy delegations within the current law."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)