Poor Performance Expected Last Year and This Year

Diversifying Demand for Vaccine Products

Plan to Introduce mRNA Technology

Establishment of Songdo Global R&PD Center

[Asia Economy Reporter Myunghwan Lee] SK Bioscience has established a management strategy based on the endemic (periodic outbreak of infectious diseases). Although poor performance is expected last year and this year as well, the company plans to create growth momentum through demand diversification and aggressive investment.

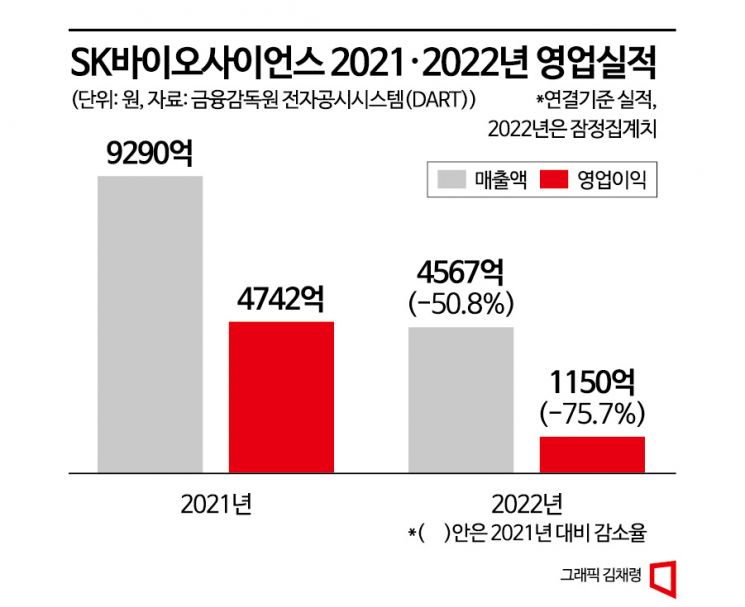

According to SK Bioscience on the 9th, last year's (provisional) sales recorded 456.7 billion KRW, down 50.8% from the previous year, and operating profit was 115 billion KRW, down 75.7%. The significant decline was due to decreased contract manufacturing (CMO) and contract development and manufacturing (CDMO) sales of COVID-19 vaccines. As the endemic phase began, the CMO and CDMO sectors of COVID-19 vaccines, which SK Bioscience had focused its capabilities on, showed sluggish performance, resulting in a base effect. The company achieved its highest performance since its establishment in 2021 by undertaking contract manufacturing of AstraZeneca and Novavax COVID-19 vaccines during the early domestic COVID vaccination period.

The recombinant gene COVID-19 vaccine ‘Skycovione (GBP510)’, co-developed by the company, is also experiencing weak demand. This is due to the waning COVID-19 outbreak and the successive release of bivalent improved vaccines by global major companies. Additionally, the absence of the influenza vaccine ‘Skycellflu’, whose domestic supply was halted to produce COVID-19 vaccines, has also had an impact. This product held the number one domestic influenza vaccine market share until 2020. According to IMS data from a global market research firm, Skycellflu recorded a 29% share of the domestic influenza vaccine market in 2020, ranking first in Korea. The vaccine contract manufacturing agreement with Novavax is scheduled to end in April. It is currently difficult to generate additional demand for Skycovione.

SK Bioscience plans to diversify demand through other vaccine products besides COVID-19. The domestic production of the influenza vaccine Skycellflu, which temporarily stopped production lines to supply COVID-19 vaccines, is expected to resume around March. Skycellflu recently received product approval from Chilean authorities, opening the door to the Latin American market. The shingles vaccine ‘Skyzoster’ also received product approval in Malaysia at the end of January.

In the mid to long term, the company also plans to introduce messenger RNA (mRNA) technology and enter the CDMO sector for cell and gene therapies. Songyi Park, a researcher at Meritz Securities, said, "(SK Bioscience) presented the introduction of mRNA platform technology and entry into cell and gene therapy CDMO as mid- to long-term momentum," adding, "Since a decrease in sales related to COVID-19 vaccines is inevitable, mid- to long-term plans are expected to materialize quickly."

The company has also embarked on aggressive investment to increase research and development (R&D) and production capacity. SK Bioscience resolved yesterday to establish a ‘Global R&PD (Research & Process Development) Center’ in Songdo, Incheon. The R&PD center will be built on a 34,138㎡ (9,200 pyeong) site in Songdo. A total of 325.7 billion KRW will be invested in establishing the center, which is the largest investment since the company’s launch. Once the R&PD center is completed in the first half of 2025, the headquarters and research institute currently located in Pangyo, Gyeonggi Province, are expected to move to Songdo.

There are forecasts that this investment will have a positive impact on the company’s future value. Jisoo Lee, a researcher at Daol Investment & Securities, said, "As a center covering the entire process from research to commercial production, it is expected to positively affect production and R&D," and added, "In the future, when entering new businesses through mergers and acquisitions (M&A), a revaluation of corporate value will be possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)