Highball Popularity Drives 'Jinro Tonic Water' Sales Up 74% Last Year

Office worker Yoon Seok-min (34) has recently been drinking whiskey highballs with his wife more frequently after work. His wife, who used to have an aversion to strong whiskey, changed her attitude toward whiskey after trying highballs diluted with carbonated water to lower the alcohol content. Yoon said, “My wife still finds high-proof whiskey a bit overwhelming, but she enjoys highballs because they are refreshing and easy to drink, so we often have them with meals.” He added, “She prefers bourbon mixed with cola and Scotch blended whiskey with ginger ale or tonic water.”

The practice of mixing various liquors and beverages, known as 'Mixology,' is becoming a popular drinking trend, especially among younger generations. As various highball recipes gain attention, sales of tonic water and similar mixers have surged.

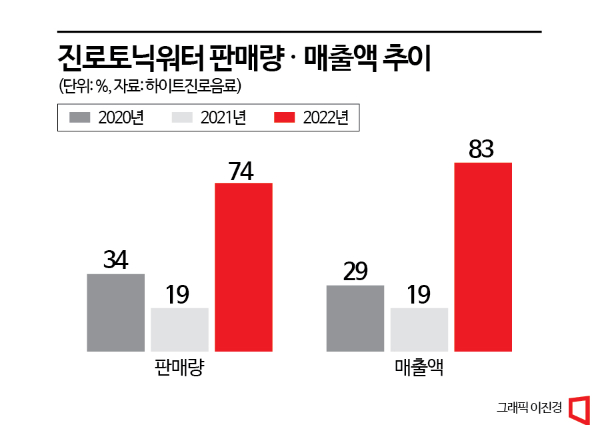

According to industry sources on the 7th, Hite Jinro Beverage’s ‘Jinro Tonic Water’ sales increased by 74% compared to the previous year. The annual sales last year reached 78 million bottles, with 10 million bottles sold in December alone, significantly surpassing the sales growth rates of 34% in 2020 and 19% in 2021.

Along with increased sales volume, revenue is also rising rapidly. Jinro Tonic Water’s revenue, which grew by 34% in 2020 and 19% in 2021, is expected to achieve its highest performance in brand history with an 83% increase last year compared to the previous year. Quarterly sales rose by 51% in Q1, 65% in Q2, 100% in Q3, and 103% in Q4 compared to the same periods last year, showing strong momentum in the second half of the year.

The recent rapid growth of the tonic water market is due to the emergence of a new drinking culture where high-proof liquors are mixed with carbonated water or tonic water. In particular, consumers who were previously hesitant about high-proof alcohol find highballs with lowered alcohol content more approachable, which is driving the expansion of this drinking culture. Liquor companies are actively attracting consumers through highball promotions that include selling liquor along with dedicated highball glasses.

The industry plans to continue market growth by expanding product lines and sales channels. A Hite Jinro Beverage representative stated, “We plan to broaden our target audience from the existing MZ generation to middle-aged and older consumers to boost sales.” They added, “We will strengthen the home channel by increasing store presence mainly in online platforms, large supermarkets, and convenience stores, and actively target 500,000 dining establishments nationwide that sell soju.”

Meanwhile, as highballs gain popularity, ready-to-drink (RTD) highball products that can be conveniently enjoyed like canned beer are being actively launched, especially in convenience stores. In November last year, CU became the first convenience store in the industry to collaborate with lifestyle brand Up Up to release Lemon Tonic and Earl Grey Highball. GS25 partnered with Japanese restaurant Kushimasa to introduce two cocktails: Kushimasa One More Highball and Yuzu Soda. Seven Eleven is also scheduled to launch Jeju Black Pork specialty Sukseongdo and Sukseongdo Highball on the 15th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)