Battery Industry Unveils ESS Market Strategies Early This Year

Collaboration with Car Companies Emphasized Amid Vehicle Electrification

US and EU Provide Hundreds of Trillions in Subsidies for Eco-Friendly Energy

ESS Batteries Expected to Rapidly Grow as Energy Dam Role

[Asia Economy Reporter Jeong Dong-hoon] Battery companies are dreaming of a leap in the energy storage system (ESS) market following electric vehicles. Since the beginning of this year, they have been competing to present strategies targeting the ESS market, including market entry, collaboration models, and new product launch schedules related to the ESS market.

So far, battery companies have focused on batteries for electric vehicles in line with the trend of vehicle electrification. They are building local factories in North America with American automakers such as GM, Ford, and Stellantis. They have also signed contracts for joint ventures and exclusive battery supply with Hyundai Motor, Honda, Toyota, BMW, and others. The three major domestic battery companies are constructing battery factories worldwide with an annual production capacity for more than 4 million electric vehicles by 2025. As many alliances in the electric vehicle market are expected to be settled by 2025, battery companies are turning their attention to the ESS market. Although there are differences among battery companies, ESS battery sales currently account for about 10% of the total.

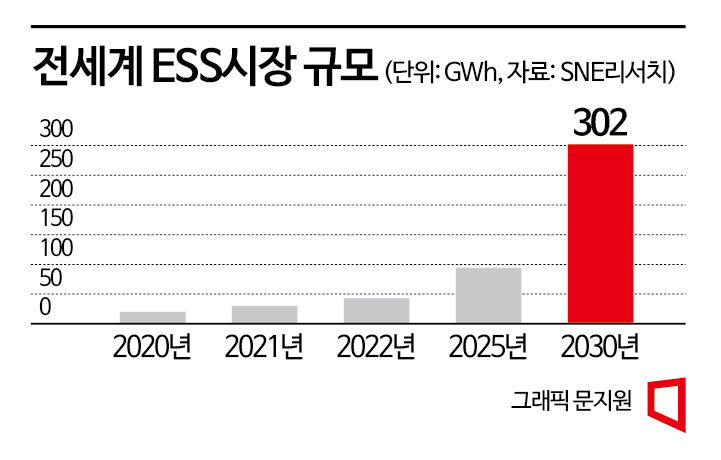

ESS refers to power devices composed of batteries and power control equipment. It stores generated electricity and supplies it when needed, playing a role similar to a 'dam' in water resources. ESS can reduce investment costs such as power plant construction and transmission line installation through power storage and can respond to the variability of renewable energy. For this reason, its importance in power systems is increasing. The global ESS market is expected to grow from $11 billion (approximately 13.4695 trillion KRW) in 2021 to $262 billion (approximately 320 trillion KRW) by 2030. Advanced countries such as the United States are expanding ESS applications in power systems as they face difficulties due to extreme weather conditions like heatwaves and cold waves.

LG Energy Solution started the new year by announcing an ‘ESS collaboration’ with Hanwha. They have entered the U.S. market, which provides massive tax credits and subsidies for investments in eco-friendly energy starting this year. The two companies’ plan is to secure a foothold in the energy transition era through a model that offers solar power plants that generate electricity, ESS batteries that store it, and EPC (engineering, procurement, and construction) services.

LG Energy Solution stated in a fourth-quarter conference call last year, "The U.S., which accounts for 60% of global demand, is expected to see continuous demand growth this year due to the recently announced IRA tax benefits." They also said, "Europe is expected to show a growth rate of over 60% compared to the previous year due to concerns about energy supply risks." Additionally, this year, ESS-oriented LFP (lithium iron phosphate) batteries will begin mass production at their Chinese factory. LFP batteries are evaluated as suitable for ESS batteries that require long-term use because they are resistant to fire.

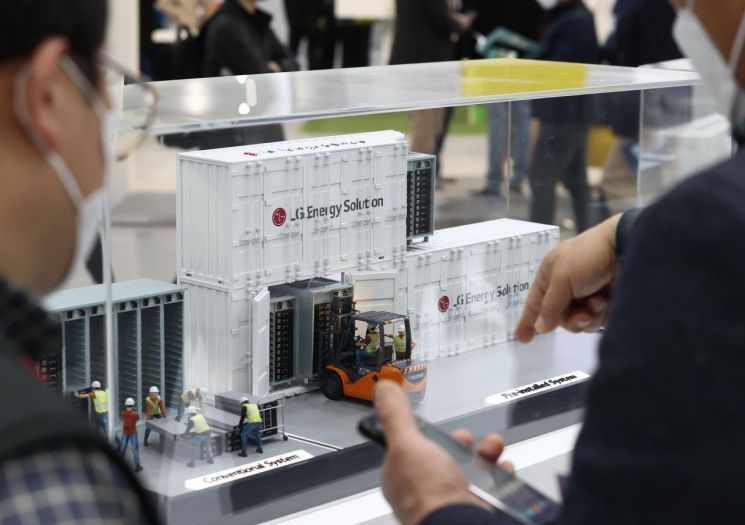

Visitors at 'InterBattery 2022,' a specialized battery exhibition including secondary batteries held last March at COEX in Gangnam-gu, Seoul, are examining a displayed model of a portable energy storage system (ESS). [Image source=Yonhap News]

Visitors at 'InterBattery 2022,' a specialized battery exhibition including secondary batteries held last March at COEX in Gangnam-gu, Seoul, are examining a displayed model of a portable energy storage system (ESS). [Image source=Yonhap News]

Samsung SDI plans to unveil a new product with higher energy density in the second half of this year. Son Mikael, Vice President of Strategy Marketing for Medium and Large Batteries, said in a conference call on the 30th of last month, "We will respond to the market by unveiling a new power ESS product in the second half of the year that improves battery materials, manufacturing methods, and systems," adding, "It is a product that applies high-nickel NCA cathode materials and new manufacturing methods to increase energy density by about 15% or more." Last year, Samsung SDI targeted the ESS market by expanding its share in the uninterruptible power supply (UPS) market, which can leverage its high energy density advantage. Samsung SDI expects the global ESS market to reach $16 billion (approximately 19.592 trillion KRW), a 44% increase from the previous year. They announced plans to launch new power ESS products that account for 60-70% of the total market to meet market demand.

SK On is targeting the local market through collaboration with local companies. In 2021, it signed a memorandum of understanding (MOU) with the U.S. ESS company 'IHI Terrasun Solutions' to cooperate in the ESS business. SK On is focusing on the North American market, which accounts for 80-90% of the global ESS market. They are also considering signing a specific business contract with IHI Terrasun Solutions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)