Astronomical Inheritance Tax

Chairman Paying in Installments Every Year

Using Funds and Resorting to Loans if Necessary

[Asia Economy Reporter Park Sun-mi] Samsung Group Chairman Lee Jae-yong and LG Group Chairman Koo Kwang-mo share a common concern: the unpaid inheritance tax on the 'great legacy' left by their predecessors.

◆Astronomical inheritance tax paid in installments every year= Samsung Electronics Chairman Lee Jae-yong is preparing for the third installment of inheritance tax payment this April. Lee and the family of the late Chairman Lee Kun-hee have been paying the inheritance tax in six installments over five years since April 2021 through the installment payment system. The installment payment system allows taxpayers to provide securities as collateral and pay the tax in installments if the inheritance tax amount exceeds 20 million KRW. This system is widely used by chairmen who cannot easily sell their shares to maintain control of the company but need to pay inheritance tax. By providing collateral, they can buy several years to secure funds for the tax payment.

The estimated inheritance tax that Lee and his family must pay is about 12 trillion KRW. Of this, the inheritance tax on shares worth about 5 trillion KRW inherited by Lee is known to be approximately 2.9 trillion KRW. LG Group Chairman Koo Kwang-mo is also continuing to take out loans to pay over 700 billion KRW in inheritance tax. Koo paid the fifth installment of about 120 billion KRW at the end of November last year. He will pay the final sixth installment this November. The total inheritance tax he has paid amounts to 716.2 billion KRW.

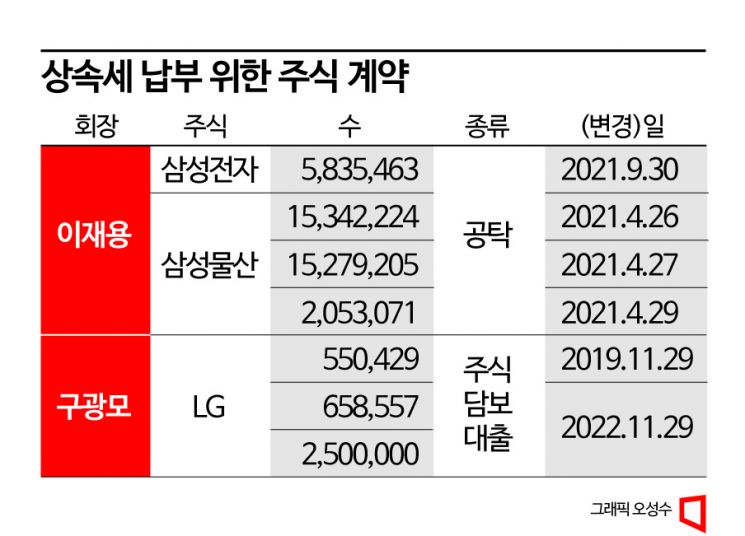

◆Lee Jae-yong without stock-backed loans vs. Koo Kwang-mo utilizing stock-backed loans= The methods Lee and Koo use to raise funds for inheritance tax payments differ. As Samsung Electronics chairman, Lee, who must strengthen Samsung’s governance structure, has paid inheritance tax so far without stock-backed loans or selling shares. Of course, he also pays taxes through the installment payment system. To secure installment payments, on September 30, 2021, he deposited 5,835,463 Samsung Electronics shares with voting rights (0.1%) as collateral at the Seoul Western District Court, worth about 430 billion KRW at the time. Earlier, in April 2021, he also deposited 32,674,500 Samsung C&T shares and 7,116,555 Samsung SDS shares as tax payment collateral.

On the other hand, Koo sold his 7.5% stake in Pantos immediately after the inheritance decision in 2018 to fund the first installment of inheritance tax. Later, in 2021, he sold all shares held in LX Holdings to raise additional funds. Currently, he relies on loans as a last resort. Just before paying the fifth installment in late November last year, Koo borrowed 162 billion KRW from Daishin Securities and Korea Securities Finance, using LG Corp shares as collateral. The interest rates are 5.2% and 5.8% per annum, respectively. About 45% of the LG Corp shares Koo currently holds are pledged as collateral. The bigger problem is this year. In November, Koo must pay about 120 billion KRW for the sixth installment of inheritance tax. Moreover, the loan taken in 2019 will mature. He will need to extend the loan period and borrow more through stock-backed loans than last year. The soaring interest rates are a heavy burden.

◆Stock dividends and compensation also used to pay inheritance tax= Lee, who receives over 300 billion KRW annually in dividends from five listed companies he holds?Samsung C&T, Samsung Electronics, Samsung Life Insurance, Samsung SDS, and Samsung Fire & Marine Insurance?is expected to use dividends to pay inheritance tax again this year. Although Lee is an unregistered executive at Samsung Electronics, he works without compensation. In other words, his annual salary is '0 KRW.' Dividends are his only income from the company. So far, he has paid inheritance tax without major issues using cash on hand and dividends, but in a few years, he may need to take out stock-backed loans to cover shortfalls. Samsung Electronics’ recent performance is not good, so dividends are expected to decrease.

Other family members, excluding Lee, have already taken out stock-backed loans despite high interest rates. Lee’s sister, Lee Boo-jin, CEO of Hotel Shilla, recently announced the extension of stock-backed loan contracts for 9,550,000 Samsung Electronics shares and 4,650,000 Samsung C&T shares. The loan interest rates range from 4.5% to 6% per annum. Their mother, Hong Ra-hee, former director of the Leeum Museum of Art, and second sister Lee Seo-hyun, chairwoman of the Samsung Welfare Foundation, have also taken out loans using Samsung Electronics and Samsung C&T shares as collateral, respectively.

Koo is believed to be using both stock dividends and compensation to pay inheritance tax. Dividends received from 2018 to 2021 totaled 247 billion KRW. If LG Corp’s dividend per share last year rises to around 3,000?3,100 KRW from 2,800 KRW in 2021, Koo could soon receive an additional 70 billion KRW. Of course, about 45% tax applies here, so the net amount received from dividends over five years is about 174.3 billion KRW.

Since becoming LG Corp chairman in June 2018, Koo has received a total of 22.2 billion KRW in salary and bonuses: 5.4 billion KRW in 2019, 8 billion KRW in 2020, and 8.8 billion KRW in 2021. Assuming last year’s salary exceeded 9 billion KRW, he could secure about 31.2 billion KRW, but about 50% goes to the government as comprehensive income tax and local taxes. Simply put, about half of 31.2 billion KRW, or 15.6 billion KRW, can be contributed toward inheritance tax payments.

◆Mixed fortunes in inherited share value= Inheritance tax on shares is based on the average stock price over four months, two months before and after the deceased’s death. When Lee inherited the estate (as of April 30, 2021), Samsung Electronics and Samsung C&T stock prices were 81,500 KRW and 136,000 KRW respectively, but now they have fallen to about 61,800 KRW and 118,800 KRW. Conversely, LG Corp shares inherited by Koo from his father have risen significantly. On November 2, 2018, when the inherited shares were disclosed, LG Corp’s stock price was 67,000 KRW, but now it is 81,100 KRW.

Of course, selling these shares is not easy. Doing so could destabilize corporate governance and damage management rights. There are calls in the business community for reform of excessive inheritance taxes. Current inheritance law applies the highest tax rate of 50% if inherited property exceeds 3 billion KRW. For shares of major shareholders, a surcharge applies, raising the maximum rate to 65%.

Lee, who declared he would not pass the company to his son, said when people doubted him, “Even if I want to pass it on, I don’t have the ability to do so.” According to current law, the first generation founder can pass the company to the second generation, but realistically, passing it on to the third or fourth generation is impossible. The government plans to establish a Tax Reform Promotion Team under the Ministry of Economy and Finance this month to oversee reforms of inheritance, gift, and holding taxes and to revise the system.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)