Underlying Assets Are Hanwha Financial Group Office

REITs Stocks That Plummeted Recently Rebound Sharply

[Asia Economy Reporter Park So-yeon] Hanwha REITs, which invests in Hanwha Group's real estate, is scheduled to be listed on the KOSPI market at the end of March. A REIT (Real Estate Investment Trust) is a real estate investment company that raises funds from multiple investors and invests more than 70% of its total assets in real estate-related capital and equity to generate profits, typically distributing more than 90% of the profits to shareholders in the form of dividends.

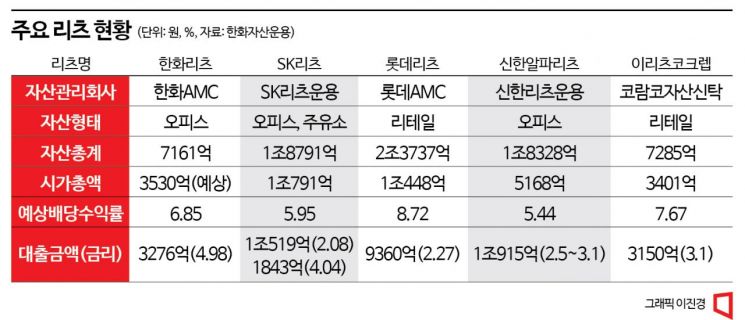

According to the financial investment industry on the 20th, Hanwha REITs, which is established based on Hanwha Group's office assets, announced its listing at the end of March today. Hanwha Asset Management, the operator of Hanwha REITs, projected an expected dividend yield of 6.85% for Hanwha REITs.

Hanwha REITs is based on assets including the Yeouido Hanwha General Insurance Building, Hanwha Life Nowon Office, Hanwha Life Pyeongchon Office, Hanwha Life Jungdong Office, and Hanwha Life Guri Office, all owned by Hanwha Group.

Although it is taking its first step with office assets held by Hanwha Group’s financial affiliates such as Hanwha Life and Hanwha General Insurance, the industry expects Hanwha REITs to add core Hanwha Group offices such as Janggyo-dong Hanwha Building and Yeouido 63 Square to its REIT assets in the future.

All assets incorporated into Hanwha REITs are leased by various financial companies, including Hanwha Group’s financial affiliates, so stable dividend income is expected. However, the high loan interest rates due to fundraising in a high-interest-rate environment are considered a factor threatening profitability.

The total assets of Hanwha REITs, scheduled to be listed in March, amount to 179.1 billion KRW, with an expected market capitalization of 353 billion KRW. The total loans raised for REIT asset incorporation amount to 327.6 billion KRW, with an interest rate of approximately 4.98%. The maturity is November 2025. Compared to large corporations and financial sector REITs that have previously listed and raised funds at interest rates of 2-3%, this is more than twice as high.

In the case of SK REITs, they bear an interest burden of 2.08% annually on 1.0519 trillion KRW and 4.04% on 184.3 billion KRW. Lotte REITs bear an interest burden of 2.27% annually on 936 billion KRW in loans, and Shinhan Alpha REITs have about 1 trillion KRW in loans with interest rates ranging from 2.6% to 3.1%. IREIT KOREA holds 315 billion KRW in loans with an interest rate of 3.1%. Hanwha REITs plans to convert secured loans into corporate bonds through public bond issuance.

REIT-related stocks, which had plunged due to the real estate market slump and rising funding costs caused by interest rate hikes, have recently rebounded sharply. As monetary tightening worldwide is coming to an end and funding costs decrease, dividend yields have also increased due to the sharp drop in stock prices. According to the Korea Exchange on the 19th, the 'KRX REITs TOP10' index, which aggregates the top 10 REITs by market capitalization listed on the domestic stock market, recently recovered to the 910 level. This index, which was above 1000 until September last year, dropped to the 760 level after the Legoland incident in October last year but has since rebounded significantly. The market capitalization of these 10 listed companies, which had shrunk to the 4 trillion KRW level in October last year, has recently recovered to the 6 trillion KRW level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)