Stock Market Volatility Increases, ELS and DLS Issuance Plummets

Concerns Over Principal Losses Grow... Financial Supervisory Service to "Inspect Securities Firms' Derivative-Linked Securities Management Status"

[Asia Economy Reporter Lee Seon-ae] As losses increased due to the sharp decline in the stock market, the issuance volume of derivative-linked securities (ELS·DLS) recently shrank sharply on a monthly and quarterly basis. Equity-linked securities (ELS) and other derivative-linked securities (DLS) are products that pay the promised returns if the underlying assets such as indices, stocks, or exchange rates maintain a certain level until maturity. Conversely, if the price falls below the loss occurrence threshold called the "knock-in barrier," the principal may be lost. As of the third quarter of last year, the balance of ELS·DLS that entered the principal loss (knock-in) zone exceeded 1 trillion won.

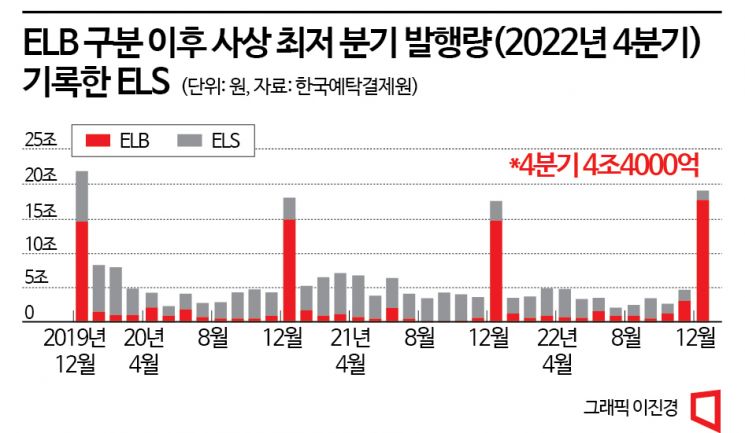

According to the Korea Securities Depository on the 13th, the issuance volume of ELS in the fourth quarter of last year was 4.4 trillion won. This is the lowest quarterly figure since 2013 when equity-linked bonds (ELB) and ELS were separately aggregated. The previous lowest issuance volume was 5.6 trillion won recorded in the third quarter of last year. The fourth-quarter issuance volume is only 55% of the average issuance volume of the previous three quarters (7.9 trillion won). On a half-year basis, ELS issuance in the second half was reduced by half compared to the first half.

The sharp decline in ELS issuance is interpreted as being caused by a decrease in new capital inflows amid delayed early redemption of existing ELS issuance due to increased volatility and significant price drops in the KOSPI 200 as well as global stock markets. Additionally, the global stock market showed a period of adjustment in the fourth quarter of last year, reducing volatility levels to about half of those in the first half, which weakened the competitiveness of ELS. Moreover, at the end of the year, issuers focused on ELB issuance, relatively shrinking ELS sales activities. The issuance volume of ELB in the fourth quarter of last year was 21.8 trillion won, setting a record for the largest quarterly issuance.

Jeon Gyun, a researcher at Samsung Securities, noted, "The ELS issuance volume showed a shrinking trend throughout last year," adding, "Especially, the issuance volume in the fourth quarter sharply dropped to about half of the first quarter, indicating that investment demand for ELS has been severely contracted."

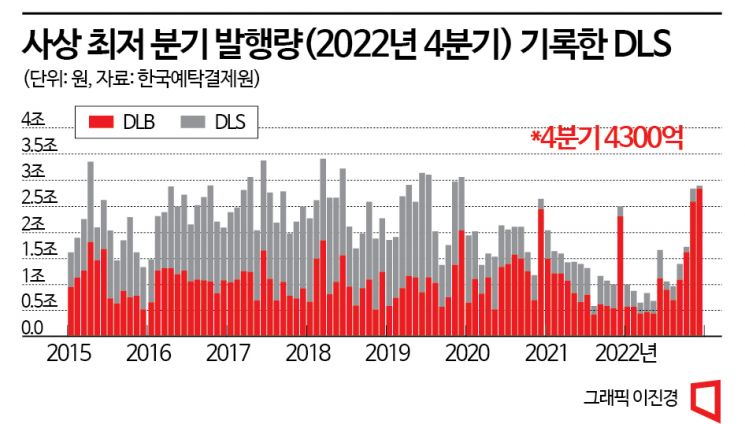

The situation for DLS is similar. The issuance volume of DLS in the fourth quarter of 2022 was 430 billion won, the lowest quarterly figure ever recorded. The issuance volume for December alone was only 71 billion won, also marking the lowest monthly figure. The previous lowest monthly issuance was 118 billion won recorded in October of the same year.

Since most of the underlying assets for DLS are credit risks, the decline in investment demand for credit risk due to the bond market downturn and increasing credit risk of marginal companies in the second half of last year is considered the main factor for the decrease in DLS issuance. Furthermore, investment demand for principal non-guaranteed products was also weakened due to the unstable volatility and confusing directionality of commodities and currencies.

On an annual basis last year, the issuance volume of ELS was 28.1 trillion won, the smallest scale since 2010. In particular, ELB issuance reached a record high of 29.6 trillion won since data aggregation began, marking the first year ELB surpassed ELS. The annual issuance volume of DLS last year was 3.3 trillion won, the lowest since 2009.

In contrast, the issuance volume of other derivative-linked bonds (DLB) was 13.2 trillion won, the second-largest record since 14.3 trillion won in 2020. Although DLS issuance decreased due to increased credit risk and volatility in commodity and currency markets, interest rate-linked DLB issuance increased. Since 2020, when DLB began to surpass DLS in annual issuance volume, DLB has maintained its dominance for three consecutive years.

Researcher Jeon analyzed, "The contraction of principal non-guaranteed products (ELS·DLS) is directly caused by the unstable environment of the underlying asset markets, but indirectly, the implementation of high-difficulty financial investment products since 2020 has also dampened investment demand and issuance willingness."

Meanwhile, the principal loss amount of ELS·DLS has already exceeded 1 trillion won as of the third quarter of last year, raising concerns about investor losses. According to the Financial Supervisory Service, as of the end of September last year, the balance of ELS·DLS that entered the knock-in zone due to a decline in underlying asset prices was 1.0651 trillion won. Among these, ELS linked to the Hong Kong H Index accounted for the majority with 677.1 billion won. Of the volume that entered the knock-in zone, about 25 billion won will mature this year. The remaining 923.3 billion won will mature in 2024. If the underlying asset prices do not exit the knock-in zone until maturity, investors may lose up to 100% of their investment principal.

An official from the Financial Supervisory Service stated, "Since the third quarter of last year, additional declines in the Hong Kong H Index have increased the scale of knock-in occurrences and investor loss risks," adding, "We plan to strengthen monitoring of investor loss risks, especially for products linked to the H Index." The official also emphasized, "We will review the management status of derivative-linked securities and encourage securities firms to strengthen their own risk management capabilities." This is based on the judgment that it is necessary to be cautious about the operational risks of derivative-linked securities by securities firms amid ongoing financial uncertainties such as interest rate hikes and high inflation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)