Market Cap at Early New Year at One-Third of a Year Ago

Adverse Factors Including Interest Rate Hikes, Binance Crisis, Ripple Lawsuit, and Regulations

Last year, the virtual asset market was full of adverse factors. In addition to concerns about tightening from the U.S., unpredictable variables such as the Terra-Luna incident and the bankruptcy of the global exchange FTX repeatedly struck the market. Until November 2021, the market capitalization of virtual assets reached $3 trillion (approximately 3,804 trillion KRW), but it shrank to less than one-third of that level at the beginning of the new year.

What about the new year? Uncertainty still abounds. Four major variables shaking the market can be summarized as the U.S. interest rate hikes, the crisis of Binance, the securities-related lawsuit over Ripple coin, and the enactment of virtual asset regulatory laws.

The Dark Cloud of Interest Rate Hikes

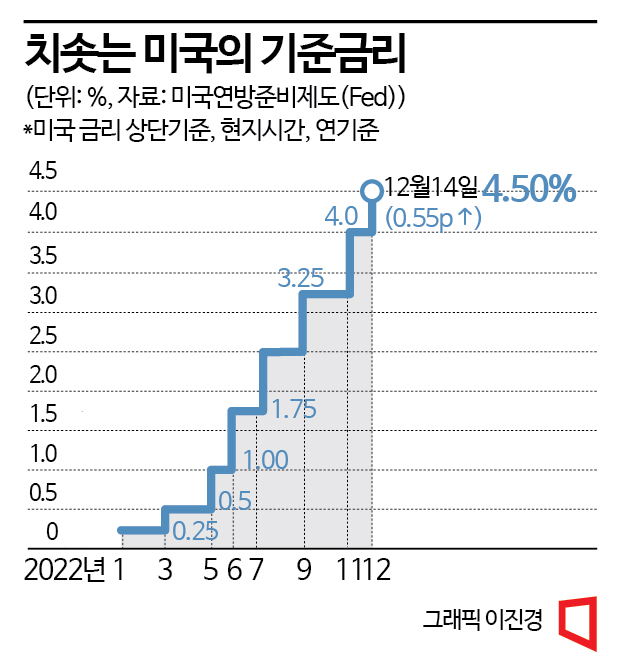

The U.S. benchmark interest rate is considered the factor that most significantly affects virtual asset prices. Coins are among the riskiest investment assets because many virtual assets lack proper fundamentals. When the benchmark interest rate rises, preference shifts from risky assets to safe assets. Virtual assets are classified as riskier than stocks. During periods of interest rate hikes, investment funds tend to flow out more easily. The virtual asset market begins to fluctuate even before the Federal Reserve (Fed) implements interest rate hikes. An industry insider explained, "The indicator that coin investors must consider most carefully is the U.S. benchmark interest rate."

Because the impact of the benchmark interest rate is so significant, coin investors are on high alert about when, how much, and until when the Fed will raise rates. If interest rate hikes continue into the new year, there are growing concerns that the coin market, which is already being called a 'bubble,' might collapse.

The market outlook is not easy. It is widely expected that U.S. interest rate hikes will continue from March to May this year, reaching a final rate level of 5.0?5.5%. Analysis also suggests that the Fed's pivot (direction change) may not occur until the third quarter. However, this is based on the premise that U.S. inflation will rapidly decelerate. If inflation does not fall, Fed Chair Jerome Powell's statement that there will be no rate cuts this year could become reality. Numerous variables affect inflation, including an overheated labor market and rising wages.

Binance Transparency Controversy

The crisis of Binance, the world's largest exchange by market share, is another factor that could shake the virtual asset market landscape. The bankruptcy protection filing of global exchange FTX due to financial insolvency and a bank run had repercussions on Binance. Suspicions were raised about Binance's financial structure, and claims emerged that the report proving transparency was not a formal audit but prepared at the exchange's request. Global accounting firm Mazars also announced it would cease transactions with exchanges including Binance. Additionally, the U.S. prosecutors investigating Binance CEO Zhao Changpeng on charges such as money laundering is another adverse factor.

Binance's crisis could cause a much larger impact than the FTX incident. Binance's daily trading volume is more than seven times that of the second-largest exchange. Also, the FTT coin issued by FTX plummeted in price, hurting holders. Compared to the market capitalization of FTT, which was ranked in the top 20, the coins issued by Binance are overwhelmingly larger in scale. Binance-issued coins include Binance Coin and BUSD, a type of stablecoin pegged to fiat currency, ranking 5th and 7th in market capitalization, respectively.

Furthermore, Binance operates not only spot and futures trading but also peer-to-peer (P2P) trading and a non-fungible token (NFT) marketplace. Hong Ki-hoon, a professor of business administration at Hongik University, said, "If something happens to Binance, the coin market itself could disappear," adding, "Because it is the world's largest exchange, trust in the coin market could be completely destroyed."

Securities Lawsuit over Ripple Coin

The outcome of the lawsuit between Ripple and the U.S. Securities and Exchange Commission (SEC) is also a turning point that could change the coin market landscape. In December 2020, the SEC sued Ripple, alleging that the issued coin Ripple violated securities laws. The key issue in the lawsuit is whether Ripple coin is a security. If the SEC wins, many coins could be recognized as securities, placing them under SEC jurisdiction. As a result, they would face stronger regulations in disclosure, trading, operations, issuance, and distribution than before.

For virtual assets to be considered securities, they must meet the Howey test criteria. In the U.S., if four criteria are met, the asset is regarded as a security: ▲ Was money invested? ▲ Was there an expectation of profit from the investment? ▲ Is the invested money part of a common enterprise? ▲ Are the profits derived from the efforts of others rather than the investor's own efforts? The SEC judged that Ripple meets these criteria.

Ripple argues that Ripple coin serves as a store of value and medium of exchange, with its price formed by the market. It claims it does not have securities characteristics and that the SEC did not provide clear notice. If this argument is accepted and Ripple wins, the U.S. Commodity Futures Trading Commission (CFTC) is more likely to handle most virtual assets. Regulations under the CFTC are expected to be less stringent than under the SEC, which could act as a positive factor leading to coin price increases, according to hopeful analyses.

Ripple and the SEC have requested summary judgment, which is currently under review and decision. It is expected that the lawsuit result will be announced before the second half of the year. However, if the summary judgment request is denied, the lawsuit could be prolonged.

Moves to Enact Virtual Asset-Related Legislation

Legislative movements related to virtual assets in various countries are also important variables. The European Union (EU) has prepared the regulatory law MiCA, which is expected to be implemented as early as 2024. MiCA covers virtual assets and virtual asset service providers. It includes issuance qualifications, major obligations at issuance, disclosure obligations such as white papers, regulations on unfair trading, and investor protection measures. In the U.S. Senate, several related bills have been submitted, starting with the 'Responsible Financial Innovation Act' proposed in June.

In South Korea, related amendment bills have been submitted, with 17 bills pending in the National Assembly. Representative bills include the 'Act on Restoring Fairness and Creating a Safe Trading Environment in the Digital Asset Market' proposed by Yoon Chang-hyun of the People Power Party and the 'Act on Regulation of Unfair Trading of Virtual Assets' proposed by Baek Hye-ryun of the Democratic Party. Both bills include provisions on user protection and regulation of unfair trading. They also require virtual asset service providers to separate users' deposits from proprietary assets, entrust them to management institutions, and mandate reserve accumulation. Regulations on unfair trading practices such as insider trading and market manipulation have also been strengthened.

Chairman Yoon Chang-hyun of the Digital Asset Special Committee of the People Power Party. Photo by Yonhap News

Chairman Yoon Chang-hyun of the Digital Asset Special Committee of the People Power Party. Photo by Yonhap News

Due to incidents like the Terra-Luna crisis and the FTX crisis, calls for strengthening investor protection and regulation of unfair practices in the virtual asset market have increased. However, the processing of pending bills stalled in the Political Affairs Committee, ultimately carrying over into the new year.

Experts believe that if virtual asset regulatory bills pass the National Assembly, the virtual asset market will reach a new turning point. Kim Gap-rae, a senior researcher at the Korea Capital Market Institute, emphasized, "It is urgent to prepare virtual asset-related legislation to fill the regulatory gap." He added, "The importance of the Ripple-SEC lawsuit regarding securities recognition is ultimately because there is no law defining virtual assets. Once virtual asset-related laws are established, even if securities status is not recognized, regulation can be enforced, reducing the regulatory gap and lessening the lawsuit's significance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)