'Jaebeoljip Maknaeadeul' Tops Non-Terrestrial Ratings This Year

Content Affiliates Still in the Red... Low Contribution to Sales

Disappointing Core Gaming Business... New Releases to Drive Growth Next Year

The drama "Jaebeoljip Maknae Adeul" produced and invested in by a Com2uS affiliate has recorded the highest viewership ratings this year, drawing attention to the potential profits Com2uS may gain. Contrary to the public perception of it being a "huge hit," the actual profit impact on Com2uS is expected to be limited.

"Jaebeoljip Maknae Adeul" Hits Big, Only Partial Impact on Com2uS Performance

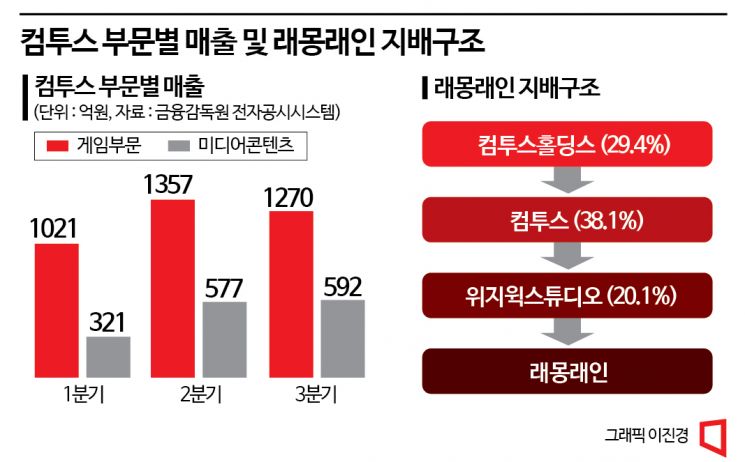

"Jaebeoljip Maknae Adeul" concluded on the 25th with a 26.9% viewership rating. It started its first broadcast on the 18th of last month with 6.1% and continued to rise. The final episode ranked first in non-terrestrial viewership ratings this year and second in all-time non-terrestrial drama ratings. Setting these viewership records is expected to positively influence the performance of the production company RaemongRaein’s largest shareholder Wysiwyg Studios and its parent company Com2uS. Com2uS holds a 38.1% stake in Wysiwyg Studios, which in turn holds a 20.1% stake in RaemongRaein as its largest shareholder.

Despite the viewership records, immediate large profits are hard to expect. RaemongRaein is reported to have earned about 46 billion KRW in revenue related to "Jaebeoljip Maknae Adeul." The production cost was approximately 35 billion KRW, so the profit is expected to be up to 10 billion KRW. Although RaemongRaein’s revenue and operating profit are reflected in Com2uS’s consolidated revenue, the contribution is low due to the small shareholding ratio. Securities firms estimate that less than 1 billion KRW in net profit will be reflected. Samsung Securities analyst Oh Dong-hwan analyzed, "Although the drama’s success is expected to increase consolidated media segment revenue and reduce losses, Wysiwyg’s 20.1% stake in RaemongRaein means the impact on controlling shareholder net profit will be limited." Furthermore, Wysiwyg Studios recorded an operating loss of 15.8 billion KRW on a consolidated basis through the third quarter this year, making a turnaround to profitability difficult.

The stock price of Wysiwyg Studios started at 17,400 KRW on the drama’s first broadcast day and recorded 17,250 KRW on the 26th. Although it rose to 22,600 KRW as "Jaebeoljip Maknae Adeul" gained popularity, it eventually returned to its original level. During the same period, RaemongRaein’s stock price fell about 2% from 23,000 KRW to 22,800 KRW. It once aimed to surpass 40,000 KRW but has already lost momentum.

However, Com2uS is expecting additional business opportunities utilizing the intellectual property (IP) of "Jaebeoljip Maknae Adeul," such as selling broadcasting rights to overseas online video services (OTT). The drama’s success is generating market expectations for future media content business growth.

Big Brother Game Business Struggles

While Com2uS is growing its content performance including "Jaebeoljip," its core game business is experiencing declining sales, diluting the overall effect. Com2uS’s cumulative revenue for the third quarter was 512.8 billion KRW. Of this, the game segment accounted for 364.8 billion KRW, or 71% of total revenue. Media and content cumulative revenue was 148 billion KRW, about 28% of total revenue, steadily growing its share since the first quarter of this year.

The problem is that Com2uS’s core game segment is facing revenue decline. The third quarter cumulative game revenue dropped by about 20 billion KRW compared to the same period last year (382.6 billion KRW). The biggest reason for the decline is a decrease of over 20 billion KRW in mobile game exports. The eagerly anticipated new titles are also struggling. Com2uS released the sequel to its key IP "Summoners War: Sky Arena," titled "Summoners War: Chronicle" (hereafter Chronicle), in August, but its ranking has fallen, pushing it out of the top 100 (by revenue) in major domestic and international markets.

Ultimately, the performance of new game releases next year has become even more critical for Com2uS’s transformation into a comprehensive content company. Com2uS conducted an internal test for "World of Zenonia," scheduled for release next year. More than 1,000 Com2uS group employees participated in the two-week test, which reportedly received favorable reviews. Additionally, Com2uS plans to launch six self-developed new titles in the first half of next year, including "The Walking Dead: Identity" and "Fishing God: Crew," determined to open a second golden era.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)