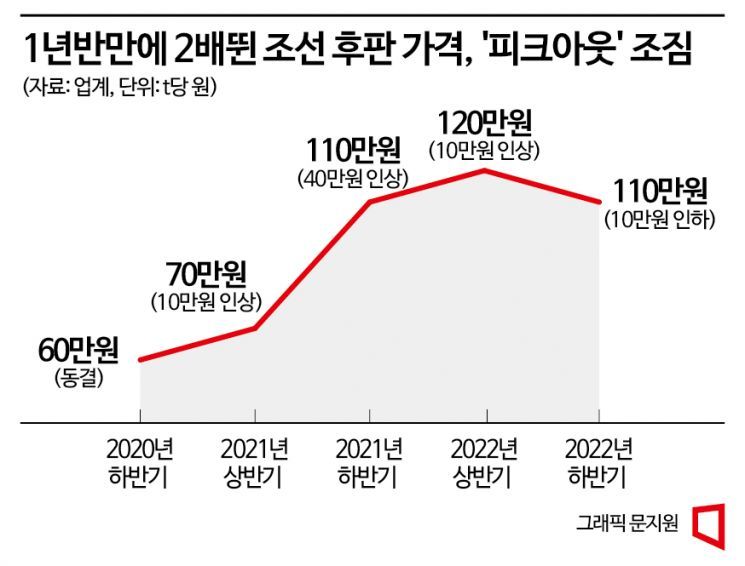

The price of shipbuilding steel plates (thick steel plates over 6mm) is showing a peak-out (declining after reaching a high), leading to forecasts that shipbuilding companies will turn around to profitability in the new year. On the 23rd, steel and shipbuilding industry insiders revealed that major steel and shipbuilding companies recently concluded negotiations on steel plate prices, deciding to lower the price from 1.2 million KRW per ton in the first half of this year to 1.1 million KRW per ton in the second half, a decrease of 100,000 KRW.

Steelmakers and shipbuilders negotiate supply prices every six months. The price of steel plates had risen for three consecutive half-year periods since last year due to soaring prices of raw materials such as iron ore and coking coal. The price of iron ore, which was around 120 USD per ton in June 2020, surged to a record high of 220 USD in May last year. The price of coking coal, which was in the 100 USD range, rose to about 250 USD in March this year.

As a result, the price of steel plates nearly doubled in a year and a half. In the first half of last year, the price of steel plates was about 700,000 KRW per ton, 100,000 KRW higher than the previous year. In the second half of the same year, it increased by another 400,000 KRW to reach the 1.1 million KRW range, and in the first half of this year, it rose by an additional 100,000 KRW to reach around 1.2 million KRW.

With steel plate prices, which account for 20-30% of shipbuilding costs, entering a declining phase, the cost burden on shipbuilders is expected to ease. The industry estimates that major shipbuilders use about 4.3 million tons of steel plates. A 100,000 KRW per ton price reduction could reduce domestic shipbuilders' annual production costs by over 400 billion KRW. For liquefied natural gas (LNG) carriers, which use about 26,000 tons of steel plates, cost savings of approximately 2.6 billion KRW are possible.

As iron ore and coking coal prices stabilize, the outlook for next year's steel plate price negotiations is positive for shipbuilders. Despite a boom in orders this year, the three major shipbuilders still have not escaped a deficit structure in terms of performance. In particular, the prolonged strike by Daewoo Shipbuilding & Marine Engineering's subcontractor union and raw material price inflation have been obstacles. Consequently, securities firms expect the three shipbuilders to record operating losses in the thousands of billions of KRW this year as well.

However, the situation is expected to change from next year. Shipbuilders are enjoying the largest order boom in 14 years since 2008. Starting from the second half of 2020, LNG carrier orders have been steadily received, and deliveries will begin in earnest next year, allowing shipbuilders to receive construction payments. Accordingly, Korea Shipbuilding & Offshore Engineering, Samsung Heavy Industries, and Daewoo Shipbuilding & Marine Engineering all expect to return to profitability next year. Korea Shipbuilding & Offshore Engineering has already succeeded in turning a profit in the third quarter, and depending on the results of steel plate price negotiations in the first half of next year, Daewoo Shipbuilding & Marine Engineering and Samsung Heavy Industries may also see an earlier performance rebound. Financial information provider FnGuide forecasts that Daewoo Shipbuilding & Marine Engineering will post an operating profit of 44.7 billion KRW in the third quarter of next year, and Samsung Heavy Industries will turn profitable with 8.1 billion KRW in operating profit in the second quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)