A red light is on at a traffic signal near an apartment in downtown Seoul. (Photo by Asia Economy DB)

A red light is on at a traffic signal near an apartment in downtown Seoul. (Photo by Asia Economy DB)

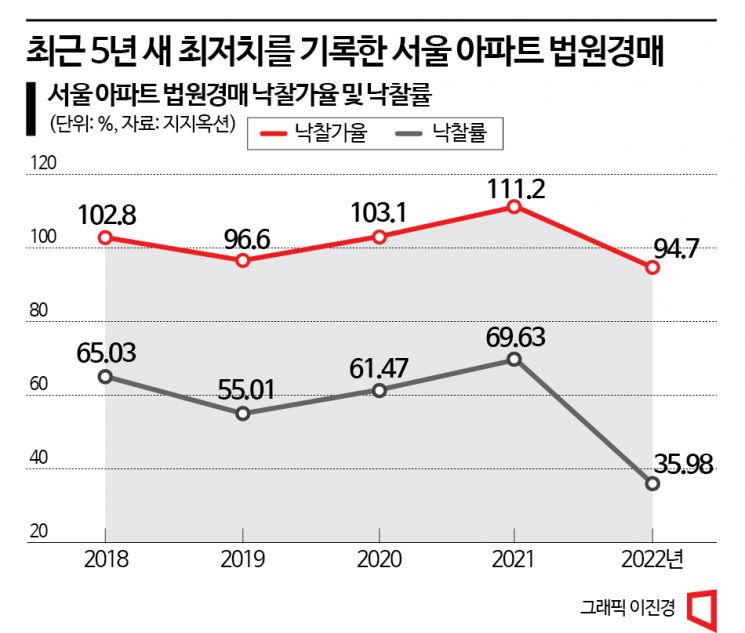

[Asia Economy Reporters Minyoung Kim and Taemin Ryu] The once red-hot auction market is rapidly cooling down. The winning bid rate for Seoul apartments has hit an all-time low, and there are cases where the appraised value exceeds the market price due to the decline in housing prices. With the housing market downturn and interest rate hikes coinciding, investors have decreased, while demand from actual homebuyers seeking to purchase homes at prices lower than market value has increased, leading to an auction market reshaped around real demand.

Transaction Cliff in Auction Market... Seoul Apartment Winning Bid Rate Halved Compared to Last Year

As the unprecedented real estate transaction cliff continues this year, the court auction market has also rapidly frozen. Only 1 to 2 out of every 10 auctioned properties have found new owners, and they are being sold at low prices around 60-70% of the appraised value.

According to court auction specialist Gigi Auction on the 15th, the average winning bid rate for Seoul apartments auctioned in court this year was tentatively calculated at 94.75% as of the 12th. This is a 16.45 percentage point drop from last year (111.2%). It is also 8.4 percentage points lower than the 2020 average winning bid rate of 103.1%. The winning bid rate is the ratio of the winning bid price to the appraised value; for example, a winning bid rate of 94.75% means an apartment appraised at 100 million KRW was sold for 94.75 million KRW.

The winning bid rate for Seoul apartments exceeded 110% for seven consecutive months from the first half of last year, setting a record high five times, but began to decline from the end of last year when the sales market started to freeze. It recorded 103.1% in January this year but dropped to 96.4% in May, and the downward trend deepened in the second half. It fell to 89.7% in September, dropping into the 80% range, and further declined to 76.6% as of the 12th of this month. This is a 43.3 percentage point drop compared to the record high of 119.9% in October last year. The average winning bid rate for Seoul apartments in the second half was 88.1%, 6.6 percentage points lower than this year's average.

The winning bid rate, which refers to the ratio of auctioned properties with determined winning bidders, also dropped significantly. The average winning bid rate for Seoul apartments this year was 35.98%, halving compared to last year (69.63%). This month, it fell to a record low of 13.3%, meaning only about 1.3 out of every 10 auctioned properties found new owners.

The metropolitan area shows a similar trend. The average winning bid rate for apartments in Incheon this year was 90.1%, down 20.4 percentage points from last year (110.5%). Especially this month, the winning bid rate recorded 67.3%, with apartments being sold at less than 70% of the appraised value. Considering that the highest winning bid rate for Incheon apartments was 123.9% in August last year, this represents about a 50% decrease. The winning bid rate also dropped sharply to 40.3% on average this year from 70.9% last year, and this month it was 23.1%, meaning about 2.3 out of every 10 properties were sold.

In Gyeonggi Province, the average winning bid rate this year was 90.0%, down 11.1 percentage points from last year (111.1%). This month, the winning bid rate was 71.9%, similarly sold at about 70% of the appraised value. The average winning bid rate this year was 46.0%, down 27.1 percentage points from last year (73.1%).

Investment Demand Declines, Real Occupancy Demand Increases

Although the winning bid rate has declined as auction investment shrinks, some apartments attractive for actual residence are drawing many bidders. An apartment in Gyeongnam Apartment, 3xx-dong, 3xxx-ho, Hogye-dong, Dongan-gu, Anyang-si, Gyeonggi Province, was auctioned with an appraised value of 1.061 billion KRW. The asking price for this apartment is around 1 to 1.1 billion KRW. After three failed auctions, it was sold for 721 million KRW, attracting as many as 52 bidders. Considering the average number of bidders for Gyeonggi apartments this year was 8.38, this shows the apartment's popularity. The apartment is located on flat land, adjacent to the Pyeongchon academy district, close to Line 4 subway, and within walking distance to an elementary school, making it a "Chopumai" (elementary school district). It is believed that bidders were motivated by school districts and location, aiming to live there rather than for investment.

For similar reasons, 40 bidders gathered for an auction property in Ssangyong Yega, 3xxx-dong 1xxx-ho, Byeollae New Town, Byeollae-dong, Namyangju-si, Gyeonggi Province. This property was sold at about 900 million KRW, 30% cheaper than the appraised value (1.325 billion KRW), while the current market price is 1.1 to 1.2 billion KRW. Byeollae New Town has the best accessibility to Seoul, bordering Nowon-gu to the west and Guri-si to the south. The complex is near Hanbyeol Elementary, Hanbyeol Middle, Byeollae High, kindergartens, libraries, and is conveniently located near Byeollae Station on the Gyeongchun Line.

Real estate auctions have been considered to have a relatively high entry barrier compared to the general real estate market due to many legal terms and complex content to understand. However, the industry explains that demand for purchasing homes through auctions has increased recently due to soaring house prices and increased financial burdens from interest rate hikes. Considering the market situation in the second half of this year, appraised values may decline further next year, and demand from buyers seeking to purchase below market price is expected to increase.

Senior researcher Juhyun Lee of Gigi Auction said, "Among Gyeonggi apartments, properties with excellent school districts and locations that are cheaper than market prices are attracting many bidders," adding, "The market, which was investor-driven, is shifting toward real demand-driven."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)