Trade Volume with Korea Hits $80.7 Billion... 164-Fold Growth in 30 Years

Becomes Korea's 3rd Largest Trading Partner and 4th Largest Export Destination

Companies Choose as 'Post-China' After THAAD and COVID-19 Crises

Favorable to Korean Culture... Food and Beverage Culture Well Matched

President Yoon Suk-yeol is making a toast at the state banquet held on the 5th at the Blue House's Yeongbingwan in honor of Nguyen Xuan Phuc, President of Vietnam. Photo by Yonhap News Agency

President Yoon Suk-yeol is making a toast at the state banquet held on the 5th at the Blue House's Yeongbingwan in honor of Nguyen Xuan Phuc, President of Vietnam. Photo by Yonhap News Agency

[Asia Economy Reporter Moon Hyewon] This year marks the 30th anniversary of diplomatic relations between Korea and Vietnam, and Korean retail companies are seeking a second leap forward in the Vietnamese market. Vietnam is a young country with a population of 100 million, of which 70% are of working age. Diverse content including K-pop, dramas, food, fashion, and beauty has deeply penetrated the daily lives of Vietnamese people.

According to KOTRA on the 11th, the trade volume between Korea and Vietnam has grown about 164 times from $490 million in 1992, when diplomatic relations were first established, to $80.69 billion as of the end of last year. Vietnam has become Korea’s third-largest trading partner and fourth-largest export destination.

Vietnam is an emerging consumer market known globally as Post China. Domestic retail companies, which gradually withdrew from the Chinese market?where they suffered due to a saturated domestic market, THAAD retaliation measures, anti-Korean sentiment, and COVID-19 lockdown policies?have early on designated Vietnam as Post China and strengthened their local businesses.

Lotte Group has designated Vietnam as a global hub with 19 affiliates including department stores, marts, hotels, duty-free shops, and trading companies, and has embarked on aggressive investments. Starting with Lotteria in 1998, followed by Lotte Mart and Lotte Cinema in 2008, Lotte Hotel in 2013, and Lotte Department Store in 2014, the group has successively entered Vietnam, building a friendly image among locals and tourists and solidifying its position.

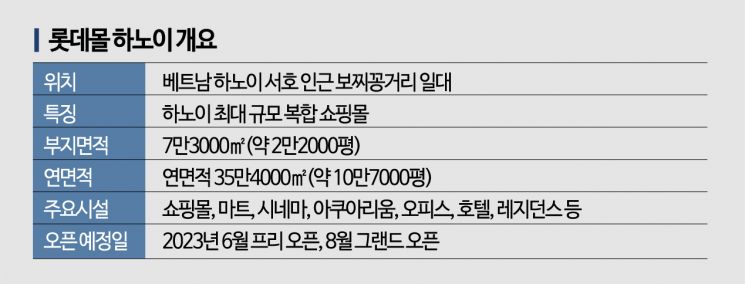

Next year in the second half, Lotte will open ‘Lotte Mall Hanoi,’ a complex commercial complex with a total floor area of 354,000㎡ (about 107,000 pyeong) on a 73,000㎡ (about 22,000 pyeong) site near West Lake in Hanoi’s Bo Chi Kong Street area. This largest complex shopping mall in Hanoi, with a total project cost of 1.23 trillion KRW, includes a shopping mall, mart, cinema, aquarium, offices, hotel, and residences. After a special pardon on Liberation Day, Lotte Chairman Shin Dong-bin was the first to visit Vietnam and met with President Nguyen Xuan Phuc, promising to make additional investments with new projects in Vietnam.

Lotte Mart entered the Vietnamese market in 2008 by opening the ‘Nam Saigon Branch’ in Ho Chi Minh City, the first domestic retail company to do so, and currently operates 15 stores. Except for 2020 and 2021, when COVID-19 had a significant impact, Lotte Mart’s Vietnam business has grown sales by more than 10% annually.

Lotteria’s local subsidiary’s business performance surged about 87% compared to the same period last year, playing a key role in driving the growth of Lotte GRS’s overseas business. Having entered Vietnam in 1998 and operating over 270 stores, Lotteria has become the number one burger fast-food company in Vietnam, surpassing McDonald’s and Burger King. Through aggressive investments such as menu improvements tailored to local consumer culture, renovation of aging stores, and expanded marketing investments, cumulative gross sales are expected to exceed 100 billion KRW by the end of this year.

CJ CheilJedang Vietnam Kizuna Factory located in Can Duoc District, Long An Province, Vietnam. Photo by CJ CheilJedang

CJ CheilJedang Vietnam Kizuna Factory located in Can Duoc District, Long An Province, Vietnam. Photo by CJ CheilJedang

CJ Group has entered various fields including food, logistics, retail, theaters, and content production through eight affiliates.

CJ CheilJedang, the main affiliate that entered Vietnam in 1997, holds over 50% market share in the Vietnamese kimchi market. Earlier this year, it completed the Kizuna factory in Can Duoc District, Long An Province, Vietnam, with a total area of 34,800㎡ producing dumplings, processed rice, kimchi, and K-sauces. Utilizing Vietnam’s geographical advantages, it plans to expand export volumes more than threefold by 2025 compared to this year, using Vietnam as a global export base to China, Japan, Southeast Asia, the European Union (EU), Australia, and more.

CJ Foodville’s Tous Les Jours operates 37 stores nationwide in Vietnam, ranking as the number one local bakery business with sales per pyeong reaching 2 million KRW. The membership application launched in April this year surpassed 250,000 members in just seven months and is expected to exceed 500,000 next year.

CJ CGV Vietnam attracted 24 million visitors in 2019, accounting for 42% of the total 56 million viewers, and is expected to reach 16 million this year, establishing itself as the number one multiplex company in Vietnam.

During a solo meeting with President Nguyen Xuan Phuc, who visited Korea on the 5th, CJ Group Chairman Sohn Kyung-shik emphasized, “Vietnam will become CJ’s production and business hub in Southeast Asia.”

Domestic food and beverage companies are also actively entering the Vietnamese market and achieving visible results. The industry analyzes that the popularity of Korean food in Vietnam is due to the young population structure. Half of Vietnam’s total population is under 35 years old, and one in four is under 15. Since the young generation is at the center of the Korean Wave, interest in Korean food and beverages is correspondingly high.

Orion’s Choco Pie, famous as a long-selling snack in Korea with its uniquely sweet taste, holds the number one market share in the Vietnamese snack market. Orion has captivated Vietnamese consumers’ tastes by releasing Vietnam-exclusive products such as peach and yogurt-flavored Choco Pies. Thanks to this, it recorded its largest-ever sales of 300 billion KRW last year.

Thanks to the strategy of ‘Korean-style spiciness,’ Samyang Foods’ Buldak Ramen has seen sales growth every year in Vietnam, from 6.7 billion KRW in 2019 to 7.4 billion KRW in 2020 and 9 billion KRW in 2021.

Considering the preference for sweet foods due to the hot weather, HiteJinro, which entered the Vietnamese market with fruit soju, recorded an average annual growth rate of 26% in soju exports within Vietnam for four years from 2016 to 2020. Despite the COVID-19 situation, soju sales in Vietnam grew about 5% last year, ranking first in the distilled liquor market, surpassing local liquors.

‘Dookki,’ which sells unlimited refill tteokbokki, has upgraded its menu with Korean-style chicken, fried foods, fried kimchi, sushi topped with spam and tuna mayo, and currently operates 75 stores nationwide in Vietnam. It is so popular that locals line up in long queues whenever a new store opens.

An official from the retail industry said, “Since the domestic retail and food and beverage markets are already saturated, companies are turning their eyes overseas as a survival strategy. Vietnam, which is friendly to Korean culture and whose food and beverage culture fits well with Korea’s, is a blue ocean that Korean companies will put a lot of effort into and actively pioneer in the future.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)