Easier Safety Inspection Approval Expected

Redevelopment-Eligible Complexes Increase from 0 to 12

Jechohwan Regulation Factors Remain

Experts: "Buying Sentiment Already at Bottom, Buffer Role Limited"

[Asia Economy Reporter Kim Min-young] With the relaxation of safety inspection standards, the reconstruction of complexes built from the late 1980s to the mid-1990s, such as Mokdong and Taereung, can accelerate. Complexes that had postponed detailed safety inspections due to concerns about failure, as well as those hesitant to undergo safety inspections, are expected to rush to submit safety inspection applications. However, there are concerns that for reconstruction to be fully activated, the easing of regulations on the final hurdle?the Reconstruction Excess Profit Recovery System (재초환)?must accompany these changes. Therefore, while the market welcomes this measure as positive news, there is uncertainty about whether it will significantly contribute to revitalizing reconstruction.

◆Number of complexes eligible for reconstruction after safety inspection relaxation rises from ‘0 to 12’= The government lowered the weighting criteria for structural safety, a key factor in safety inspections, making it easier for complexes that have reached the 30-year reconstruction threshold to pass safety inspections. In Seoul, there are 389 aged apartment complexes with more than 200 households that are over 30 years old. Structural safety, which assesses the risk of collapse, is considered the biggest obstacle to passing safety inspections.

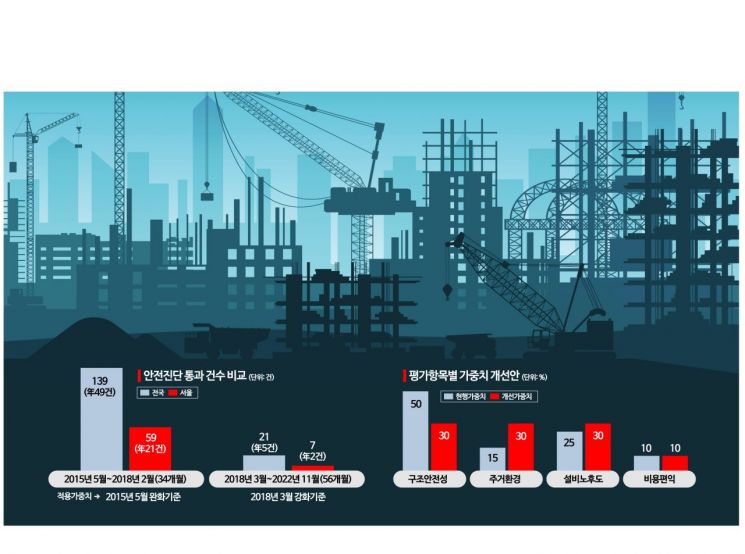

According to the Ministry of Land, Infrastructure and Transport, from May 2015 to February 2018?a period of 34 months?the total number of safety inspections passed nationwide was 139, averaging 49 per year. In Seoul, 59 complexes passed the safety inspection threshold. However, after the safety inspection standards were tightened in March 2018, only 21 complexes passed the safety inspection over 56 months until November this year. During the same period, only 7 complexes in Seoul passed. Moreover, among the 46 complexes that completed safety inspections after March 2018, none received a reconstruction approval.

The government expects the number of passing complexes to increase significantly with the recent relaxation. For example, among the 46 complexes that completed safety inspections under the current standards since March 2018, 54.3% (25 complexes) were judged as ‘maintenance and repair,’ making reconstruction difficult, while 45.7% (21 complexes) received a ‘conditional reconstruction’ judgment. Applying the two improved conditions to the same complexes reduces the ‘maintenance and repair’ judgment to 23.9% (11 complexes), making the rest effectively eligible for reconstruction.

Complexes that were previously classified as ‘maintenance and repair’ and effectively blocked from reconstruction under the current weighting can become conditionally reconstructible by applying the improved weighting to 14 complexes. By region, these include ▲Seoul: 1 in Nowon-gu, 2 in Yangcheon-gu, 1 in Yeongdeungpo-gu ▲Gyeonggi-do: 1 in Namyangju-si, 1 in Bucheon-si, 1 in Suwon-si, 1 in Ansan-si ▲Busan: 1 in Suyeong-gu, 1 in Busanjin-gu ▲Daegu: 1 in Dalseo-gu, 1 in Buk-gu, 1 in Seo-gu ▲Gyeongbuk: 1 in Gumi-si, totaling 14 complexes. Accordingly, a simulation by the Ministry of Land, Infrastructure and Transport on the 46 complexes that completed safety inspections shows that 26.1% (12 complexes) could receive a ‘reconstruction’ judgment, and 50% (23 complexes) could receive a ‘conditional reconstruction’ judgment.

◆Mokdong, Taereung, and 1st Generation New Towns Benefit... Must Overcome 재초환 Regulation= With the removal of the safety inspection bottleneck, Seoul reconstruction complexes such as Mokdong New Town’s 9th and 11th complexes and Taereung Woosung, as well as 1st generation new towns, stand to benefit. In particular, the Mokdong New Town apartment complex, consisting of 14 complexes with a total of 26,629 households, is cited as the biggest beneficiary of the safety inspection relaxation. Mokdong recently passed the district unit plan at the beginning of last month, and with the easing of reconstruction safety inspection regulations and the removal of Seoul’s 35-floor height restriction, it can achieve both profitability and speed in reconstruction promotion. There is also strong anticipation that the Nowon-gu ‘Sanggye Jugong 2 Complex,’ which passed the preliminary safety inspection last July and is preparing for a detailed safety inspection, will accelerate fundraising and get reconstruction back on track once the relaxation measures are announced.

However, there is another hurdle to overcome: 재초환. Known as the ultimate reconstruction regulation, the pace of reconstruction promotion is expected to depend on the extent of easing of the 재초환 regulation.

Lee Eun-hyung, a research fellow at the Korea Construction Policy Institute, said, “Even if safety inspection requirements change, it is important to note that reconstruction deterrents like 재초환 remain. Since 재초환 is still presented by the government as a ‘public interest recovery,’ it is necessary to closely monitor future policy changes.”

Park Won-gap, senior real estate specialist at KB Kookmin Bank, said, “These aged apartment complexes will first go through administrative procedures. However, the easing of 재초환, the final gatekeeper of reconstruction, must follow for the process to gain momentum.”

◆Buyer sentiment at rock bottom... Limited effect on smooth market landing= There are also forecasts that this regulatory relaxation will have difficulty reversing the frozen market. Until early this year, moves to ease reconstruction regulations supported housing prices, but now ‘interest rates’ have become the biggest factor determining the housing market atmosphere. While homeowners may raise asking prices due to expectations of regulatory easing, buyer sentiment remains frozen, resulting in a stalemate where buying demand does not follow.

Senior specialist Park Won-gap said, “There may be some price increases or quick sales due to homeowners’ expectations, but with the high-interest-rate storm and concerns about further price drops, buyer sentiment is at rock bottom, making transactions difficult. However, it may serve as a buffer to somewhat reduce further price declines and help with a smooth market landing.”

Research fellow Lee explained, “This is good news for existing complexes pursuing reconstruction, i.e., those planning to conduct safety inspections, but rapid price surges are unlikely. The uncertainty about how high prices will rise is more important than the rise in interest rates, and it is especially difficult to offset external factors with domestic policy changes.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)