[Asia Economy Sejong=Reporters Kim Hyewon and Kwon Haeyoung] Last month, the consumer price inflation rate recorded 5%. Although it dropped by 0.7 percentage points in one month, easing the upward trend, it still remains at a high inflation rate above 5%. With processed food and dining-out prices expected to remain around 5% until early next year, household burdens are expected to increase.

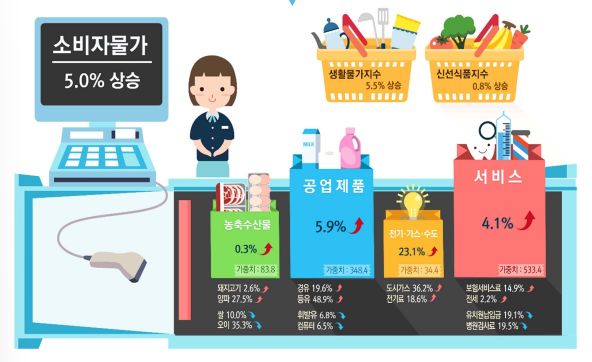

According to the 'November Consumer Price Trends' released by Statistics Korea on the 2nd, the consumer price index last month was 109.10 (2020=100), up 5.0% compared to the same period last year. This is the lowest inflation rate since April (4.8%).

The consumer price inflation rate rose to 6.3% in July, the highest since the foreign exchange crisis, then decreased to 5.7% in August and 5.6% in September, before increasing again to 5.7% in October.

Excluding October, when electricity and gas price hikes had an impact, the inflation trend appears to have eased since July. However, it is an unusual high inflation situation with the inflation rate exceeding 5% for seven consecutive months since May (5.4%).

The core inflation rate (index excluding agricultural products and petroleum products), which shows the underlying trend of inflation, was 4.8%, the same as last month when it surged to the highest level since the global financial crisis. It is the highest level since February 2009 (5.2%). Another core inflation indicator, the index excluding food and energy, rose 4.3% year-on-year, increasing more than the previous month (4.2%). This is the largest increase since December 2008 (4.5%).

Core inflation excludes seasonal factors and temporary shocks, showing the long-term trend of inflation. While consumer price inflation peaked in July (6.3%) and then eased, core inflation has yet to show a peak. Moreover, with the prolonged Russia-Ukraine war and the possibility of international oil prices rising again, the government believes it is too early to predict price stability.

Eo Unseon, Director of Economic Trend Statistics at Statistics Korea, said, "Due to the increase in raw milk prices, processed food wholesale prices are expected to continue rising, and petroleum prices may also see some upward trend." He added, "From next month onwards, there are both upward and downward factors, so the inflation rate may fluctuate around the current level."

By item, processed foods, personal services, and electricity, gas, and water charges continued to rise. Industrial products increased by 5.9%, with processed foods up 9.4% and petroleum products up 5.6%. Although the petroleum price increase has significantly declined since peaking at 39.6% in June, processed foods have gradually risen from 7.9% in June, 8.2% in July, to 9.5% in October, remaining at a high level. Bread (15.8%) and snacks (14.5%) saw significant price increases.

In personal services, dining out rose 8.6%, and insurance service fees increased 14.9%, resulting in a 6.2% rise overall. Although the upward trend in dining out has slowed down following 9.0% in September and 8.9% in October, it continued to rise, centered on items like raw fish (9.0%). Among the 5.0% inflation rate, processed foods and dining out contributed 0.81 percentage points and 1.10 percentage points, respectively. Electricity, gas, and water charges rose 23.1% in October due to public utility price hikes, the largest increase since statistics compilation began in January 2010.

However, the 0.7 percentage point drop in inflation last month was largely due to a decline in prices of agricultural, livestock, and fishery products. These products rose 0.3% month-on-month, significantly lower than the previous month (5.2%). Agricultural products fell by 2.0%, while livestock and fishery products rose by 1.1% and 6.8%, respectively. Among agricultural products, vegetables such as cucumber (-35.3%), lettuce (-34.3%), and pumpkin (-34.9%) saw large price drops.

Although the inflation rate slowed significantly from 5.7% in October to 5.0% in November, core inflation remains high, and the base effect is at play, making it premature to conclude a downward stabilization of prices. The Bank of Korea also expects high inflation above 5% to continue until the first quarter of next year. Earlier, Bank of Korea Governor Lee Chang-yong predicted that "November will be a very exceptional month" regarding inflation. He explained, "In November last year, vegetable prices rose by 7-8%, and oil prices also increased significantly, so the inflation indicator is likely to be considerably lower than in October. Once the base effect disappears in early next year, the inflation rate will continue to rise above 5% in January and February."

The prolonged Russia-Ukraine war and winter energy insecurity in Europe leave the possibility of international oil prices rising again. If exchange rates, which have stabilized due to major countries' interest rate hikes, jump again, import prices could surge once more. A Ministry of Economy and Finance official said, "Although the inflation rate in November slowed due to improved supply conditions for agricultural products centered on vegetables like napa cabbage and radish, domestic and external risks such as year-end and early-year product price adjustments and logistics disruptions caused by the Cargo Solidarity's collective transport refusal still remain latent." He added, "We will continue to closely monitor inflation and prioritize price stability for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)