Loan Interest Rates in the 7% Range... Base Rate Raised but No Immediate Further Increase

Bank Bond Yields Actually Decline

No Impact on Loan Interest Rates

[Asia Economy Reporters Sim Nayoung and Yoo Jehun] Although the Bank of Korea raised the base interest rate by 0.25 percentage points, loan interest rates at commercial banks appear to have stalled without immediate further increases. In a situation where the upper limit of interest rates for all loan products has surpassed 7% and is soaring, the absence of a sharp upward trend is a relief for financial consumers.

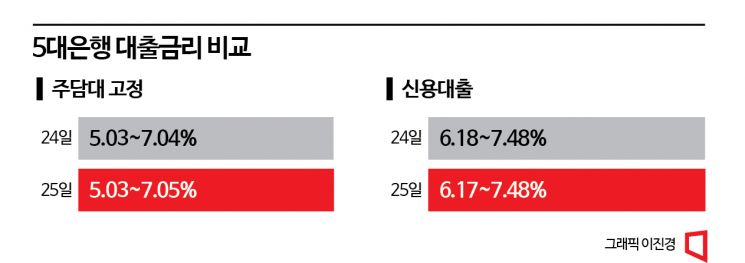

As of the 25th, the fixed-rate mortgage loan interest rates at the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) ranged from 5.03% to 7.05%, showing almost no change from the previous day (5.03% to 7.04%). Credit loan interest rates (based on 6 months) also showed a similar trend at 6.17% to 7.48%, compared to the previous day (6.18% to 7.48%).

Although the base rate was raised the day before, bond yields actually fell, so there was no impact on loan interest rates. On the 24th, when the Bank of Korea took a baby step, AAA-rated bank bond yields all declined compared to the previous day. The 6-month yield dropped from 4.68% to 4.65%, the 1-year from 5.02% to 4.89%, and the 5-year from 4.95% to 4.82%, all showing slight decreases.

Bond Yields Stabilize, Limiting Impact on Loan Interest Rates

Among loan products, funds needed for fixed-rate mortgages and credit loans are raised by commercial banks issuing bank bonds. Therefore, loan interest rates fluctuate according to bank bond yields. A commercial bank official explained, "Since the Legoland incident, the volume of bank bonds issued by commercial banks has significantly decreased, and bond market stabilization funds have been released. Although bond yields usually follow base rate hikes, this market situation is an exception."

However, it is too early to be complacent. There is a high possibility of another increase in December for variable-rate mortgage loans and jeonse (key money deposit) loans. The interest rates for these loan products follow the COFIX (Cost of Funds Index) announced monthly by the Banks’ Association. October’s COFIX rose to a record high of 3.88%, and if the November COFIX, to be announced on the 15th of next month, continues to rise, the upper limit of variable-rate mortgage and jeonse loan interest rates is expected to approach 8%, according to banking circles.

Similar Trends in Secondary Financial Sector... But Still Too Early to Relax

Bond yields for credit finance companies, which had been soaring, are also gradually declining. According to the Korea Financial Investment Association, on the 24th, when the Bank of Korea raised rates by 0.25 percentage points, AA+ rated credit finance bonds showed a downward trend. Specifically, 1-year yields fell from 5.929% to 5.839%, 2-year from 5.955% to 5.852%, and 3-year from 5.963% to 5.848%.

Credit finance companies, which do not have deposit functions, mainly raise funds by issuing credit finance bonds. Bond yields directly translate into loan interest rates. This year, credit finance bond yields surged from 2.420% (AA+ rated 3-year bonds) at the beginning of the year to 6.088% on the 7th of this month, reaching the highest level since 2009, but have recently been stabilizing again.

An official from a credit finance company explained, "Due to government intervention, the issuance volume of public and bank bonds, which had been suppressing the market, has decreased, and bond purchase programs have been activated, easing supply and demand conditions somewhat. The Bank of Korea’s statement on the final interest rate also contributed to market stabilization."

However, there is still ample room for long-term card loan (card loan) interest rates to rise, so it is premature to make conclusions. In particular, the refinancing period for bonds issued during low-interest-rate periods is approaching, which is a significant burden. According to the Korea Securities Depository, the scale of card bonds maturing next year amounts to 46.3 trillion won. Since many of these bonds were issued with coupon rates in the 1-2% range during low-interest periods, refinancing at annual rates in the 6% range is inevitable. This is likely to lead to increased funding costs for card companies and higher card loan interest rates.

An official from a card company said, "As loan demand has decreased this year, card companies have been defending interest rates through adjusted rates. However, as the refinancing period for bonds issued during past low-interest periods approaches in the second half of the year, the possibility of further interest rate increases is not small."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)