Following the Chuseok holiday, the housing market, which usually gains momentum during the autumn moving season, is expected to show little activity this year. Due to interest rate hikes, loan regulations, and a decline in buying sentiment amid concerns over peak housing prices, the real estate sales market shows no signs of recovering from the worst transaction freeze.

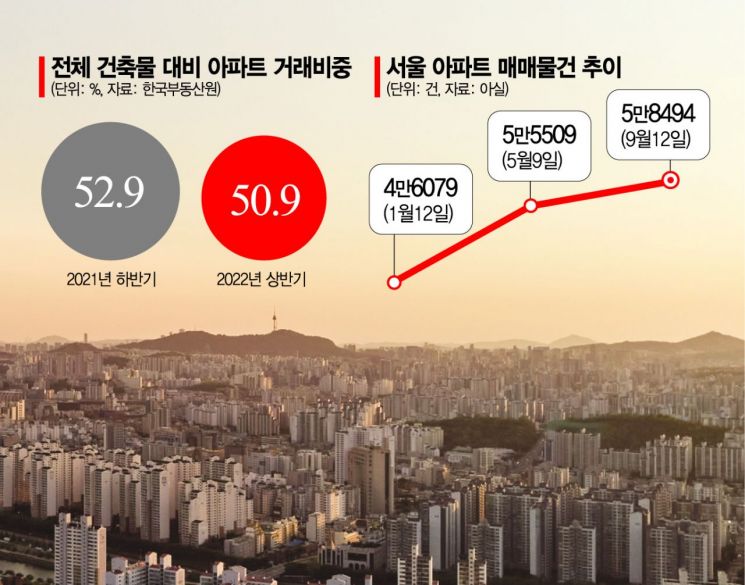

According to real estate big data firm Asil on the 13th, the number of apartment listings (for sale) in Seoul increased by 5.4%, from 55,509 units on May 9, just before the implementation of the heavy capital gains tax on multi-homeowners, to 58,494 units as of the previous day. This indicates a continued accumulation of listings as transactions fail to occur. The days on market for listings have also increased. Days on market refers to the period from when a property is listed online until it is removed due to a sale or other reasons, meaning that properties are not being absorbed. According to the real estate platform Budongsan Ziin, the average days on market for sale listings in Seoul rose from 30.6 days in early May to 32.4 days in September.

The impact of the real estate market slump is more pronounced in the apartment sector. According to monthly building-use transaction data from the Korea Real Estate Board, apartment transactions in the first half of this year totaled 388,383 units. When viewed as a percentage of total building transactions, this was 50.9%, down from 52.9% in the second half of last year, marking the lowest level since statistics began. Conversely, commercial and office buildings (including officetels) accounted for 20.85% (158,679 units) during the same period, the highest ratio since related surveys started. An industry insider explained, "While the apartment market is hampered by loan regulations, the offline and commercial real estate markets are seeing continued investment inquiries due to the lifting of social distancing measures and rising expectations for monthly rental yields."

The housing market traditionally enters its peak season after Chuseok, but even the usual optimistic sentiment is hard to find this time. The U.S. interest rate hikes, which have influenced the market downturn, are scheduled again this month, and the government is also emphasizing the notion of peak housing prices. On the 5th, Minister of Land, Infrastructure and Transport Won Hee-ryong appeared before the National Assembly Land, Infrastructure and Transport Committee’s 2021 fiscal year audit and stated, "Compared to income, current housing prices are excessively high," adding, "A downward stabilization trend needs to continue for a considerable period."

Although the government has introduced some regulatory easing measures, such as raising the loan-to-value ratio (LTV) cap to 80% for first-time homebuyers since last month, the prevailing view is that it is difficult to thaw the frozen market. For first-time homebuyers, the LTV increased from 40% to 80% in speculative and overheated districts, and from 50% to 80% in regulated areas, but the debt service ratio (DSR) regulations remain unchanged. In fact, since July, borrowers with total loans exceeding 100 million KRW face income-based loan restrictions, rendering the easing effect minimal. The government is also considering easing the loan restriction on loans exceeding 1.5 billion KRW in regulated areas, but unless the DSR is relaxed simultaneously, the impact on the market will be very limited.

Excessive loan regulations not only dampen genuine buyers’ desire to own homes but may also stimulate financial balloon effects such as increased unsecured loans, highlighting the need for more detailed loan regulation and management. Kim Ji-hye, a senior researcher at the Korea Research Institute for Human Settlements, said, "Considering that the average LTV in advanced countries is about 85.1%, Korea’s proportion of mortgage loans within household debt is relatively low compared to major countries," adding, "It is necessary to consider microscopically and selectively easing LTV limits for genuine buyers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)