Fair Trade Commission Approves KG and Ssangyong Motor Merger... "No Concerns Over Competition Restriction"

No Issues with KG Steel's Steel Production... Only Rehabilitation Plan Approval Remains

Ssangyong Motor Implements Continuous Two-Shift System During the Day Due to Increased Torres Production Volume

Ssangyong Motor Implements Continuous Two-Shift System During the Day Due to Increased Torres Production Volume(Seoul=Yonhap News) Ssangyong Motor announced on the 11th of last month that it will resume the continuous two-shift system during the day for the first time in a year since July last year due to the increase in Torres production volume. The photo shows the main gate of Ssangyong Motor's Pyeongtaek plant. 2022.7.11 [Provided by Ssangyong Motor. Redistribution and DB prohibited]

Photo by Yonhap News

(End)

<Copyright (c) Yonhap News, Unauthorized reproduction and redistribution prohibited>

[Asia Economy Sejong=Reporter Lee Jun-hyung] The competition authorities have approved KG Group's acquisition of Ssangyong Motor. It has been about a month since KG Group reported the acquisition of Ssangyong Motor. If Ssangyong Motor obtains consent for the rehabilitation plan at the creditors' meeting scheduled for the 26th, the acquisition process will be completed.

The Korea Fair Trade Commission (KFTC) announced on the 24th that it approved KG Mobility's acquisition of Ssangyong Motor shares after reviewing the case and determining that there are minimal concerns about competition restrictions. Earlier, KG Mobility reported a business combination to the KFTC on the 22nd of last month to acquire about 61% of Ssangyong Motor's shares. KG Mobility is a holding company established by the KG Consortium, centered on KG Group, to acquire Ssangyong Motor.

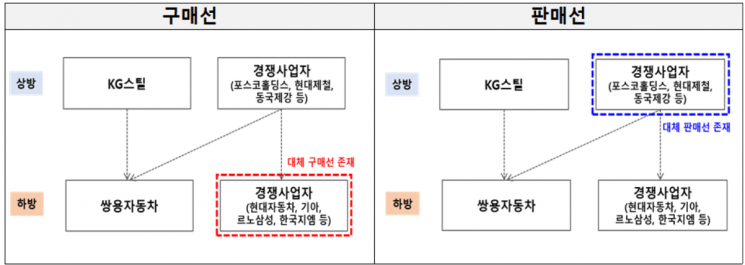

During the review process, the KFTC focused on the business area of KG Steel (formerly Dongbu Steel). KG Steel, acquired by KG Group in September 2019, is a steel manufacturer specializing in cold-rolled steel sheets and galvanized steel sheets used in automobiles. If KG Group acquires Ssangyong Motor, vertical integration will occur in the domestic cold-rolled steel sheet and automobile manufacturing markets. Accordingly, the KFTC subdivided the cold-rolled steel sheet market, KG Steel's main production area, into cold-rolled steel sheets and galvanized steel sheets closely related to automobile manufacturing to examine the possibility of competition restrictions.

Conceptual diagram of the blocking effect between upstream and downstream markets related to KG Mobility's acquisition of Ssangyong Motor. [Photo by Korea Fair Trade Commission]

Conceptual diagram of the blocking effect between upstream and downstream markets related to KG Mobility's acquisition of Ssangyong Motor. [Photo by Korea Fair Trade Commission]

The KFTC ultimately judged that there are no concerns about competition restrictions resulting from KG Group's acquisition of Ssangyong Motor. This is because KG Steel's market share in the cold-rolled steel sheet market is around 10%, which is not large. There are many competitors such as Hyundai Steel and POSCO Holdings, so the possibility of blocking parts procurement sources for automobile manufacturers like Hyundai Motor is low. Additionally, Hyundai Motor Group procures most of the steel products needed for automobile manufacturing internally through Hyundai Steel.

Ssangyong Motor's market share also influenced the KFTC's judgment. According to the KFTC, Ssangyong Motor's share of the domestic finished car market is about 3%. The KFTC viewed that since Ssangyong Motor is not a major buyer of steel for automobile manufacturing, the possibility of blocking sales channels for other steel manufacturers is low. The cold-rolled steel sheets and galvanized steel sheets produced by KG Steel are used for various purposes beyond automobiles, such as electrical and electronic products and building materials, so alternative sales channels are not scarce.

Chairman Kwak Jae-sun of KG Group attending the Torres launch event

Chairman Kwak Jae-sun of KG Group attending the Torres launch event(Yeongjongdo=Yonhap News) Reporter Ryu Hyo-rim = Kwak Jae-sun, chairman of KG Group, the final selected bidder for Ssangyong Motor, is giving a greeting at the Ssangyong Motor SUV Torres press conference held at Nest Hotel in Yeongjongdo, Incheon on July 5th last month. 2022.7.5

ryousanta@yna.co.kr

(End)

<Copyright(c) Yonhap News Agency, unauthorized reproduction and redistribution prohibited>

Following the KFTC's decision, KG Group's acquisition of Ssangyong Motor has entered the final stages. The KG Consortium has already paid the remaining acquisition amount of 331.9 billion KRW, excluding the deposit, on the 19th. If the rehabilitation plan obtains the consent of three-quarters of secured creditors, two-thirds of rehabilitation creditors, and more than half of shareholders at the creditors' meeting scheduled for the 26th, it can receive final court approval. If the rehabilitation plan is approved by the court, there is a possibility that Ssangyong Motor's rehabilitation process will conclude within the year.

Meanwhile, the KFTC stated that it intends to review business combinations aimed at enhancing the competitiveness of companies facing management difficulties such as restructuring as quickly as possible. A KFTC official said, "We conducted a swift review for the prompt normalization of Ssangyong Motor's management," adding, "We expect this combination to help strengthen the corporate competitiveness of Ssangyong Motor, which is undergoing rehabilitation procedures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)