[Asia Economy Sejong=Reporter Kim Hyewon] This year, 7,042 major shareholders of listed corporations and other persons obligated to file preliminary reports who transferred stocks in the first half (January to June) must report and pay capital gains tax by the 31st of this month.

The National Tax Service announced that starting from the 2nd, it will send mobile notification letters for preliminary capital gains tax reporting to major shareholders of listed corporations and shareholders of unlisted corporations traded on the Korea Over-the-Counter Market (K-OTC). For those who cannot receive mobile notifications due to refusal or for taxpayers aged 60 or older, paper notification letters will be sent.

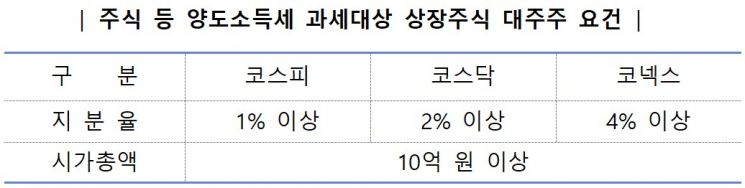

Based on corporations with December fiscal year-end, major shareholders include those who, as of the end of 2021, meet the major shareholder requirements through their shareholding ratio or market capitalization including themselves and their spouses or other related parties, as well as those who were not major shareholders at the end of last year but meet the shareholding ratio requirements due to stock acquisition during this year. Eligible persons can access Hometax or Sontax and file electronically with only identity verification, without membership registration.

The National Tax Service explained, "As a quarantine measure to prevent the spread of COVID-19, we will provide tax administration support such as extension of payment deadlines upon application for business operators facing difficulties in business or livelihood." The payment deadline extension is within three months, but if the relevant reasons persist, additional extensions can be granted up to a maximum of nine months.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.