[Asia Economy Reporter Park Byung-hee] Bloomberg reported on the 1st (local time) that Apple issued $5.5 billion worth of corporate bonds to repurchase its own shares and pay dividends.

Apple issued four types of corporate bonds with maturities ranging from 7 to 40 years. The interest rate on the longest maturity, the 40-year bond, was issued at a level 1.18 percentage points higher than the U.S. Treasury bond rate. According to officials, the initially discussed interest rate level was 1.5 percentage points higher than the Treasury bond rate. It appears that the demand for Apple corporate bonds was high, causing the interest rate to fall.

Despite holding a large amount of cash-like assets, Apple has consistently issued corporate bonds to repurchase its own shares and pay dividends. In July last year, it also issued four types of corporate bonds with different maturities, raising $6.5 billion.

On July 30 last year, when Apple issued corporate bonds, the U.S. 10-year Treasury bond rate was 1.24%. However, this year, the U.S. central bank, the Federal Reserve (Fed), has repeatedly raised the benchmark interest rate sharply, causing the current 10-year Treasury bond rate to rise significantly compared to a year ago.

The U.S. 10-year Treasury bond rate was around 1.7% at the beginning of the year but soared to 3.47% in June. Afterwards, due to the Fed's aggressive tightening measures and forecasts that the U.S. economy would fall into a recession, the rise was partially reversed. Last month, the 10-year Treasury bond rate fell by 0.33 percentage points, marking the largest monthly drop since March 2020, when the COVID-19 pandemic was declared.

On the day Apple issued corporate bonds, the 10-year Treasury bond rate was 2.61%. Compared to June, it dropped nearly 1 percentage point, but it is still more than double compared to a year ago.

Bond expert Martin Frison said, "Apple's Chief Financial Officer (CFO) may have judged that now is the right time to borrow funds, anticipating that interest rates will rise in the future." Although interest rates have recently fallen significantly, it is analyzed that they expect rates to rebound later. According to Frison, based on the current analysis model using JP Morgan's Treasury Inflation-Protected Securities (TIPS), the expected inflation rate in five years is 2.8%, still exceeding the Fed's monetary policy target of 2%, and market participants do not seem surprised by this. Inflation risk remains high, and there is room for interest rates to rise due to the Fed's tightening.

In fact, although the bond issuance market shrank significantly due to the sharp rise in interest rates this year, bond issuance has been increasing again since mid-last month as interest rates have fallen significantly. Besides Apple, seven other investment-grade companies issued corporate bonds on the same day.

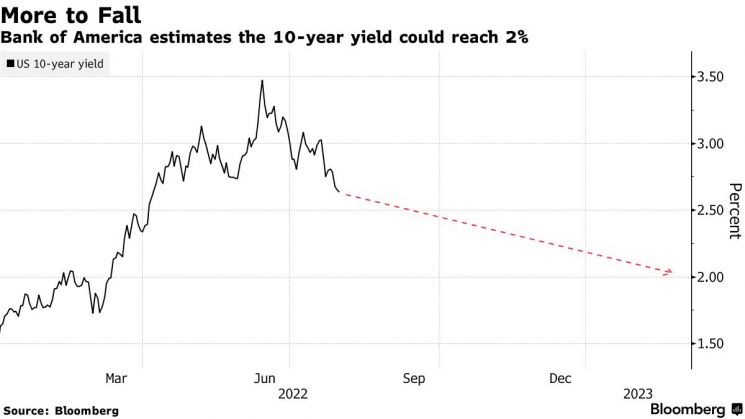

BOA expected that US Treasury yields could continue to decline and fall to 2% within the next 6 to 12 months. [Image source= Bloomberg]

BOA expected that US Treasury yields could continue to decline and fall to 2% within the next 6 to 12 months. [Image source= Bloomberg]

On the other hand, there are also forecasts that interest rates will continue to fall. Bank of America (BOA) predicted in a report released that day that the 10-year Treasury bond rate could fall to 2% within the next 6 to 12 months. This suggests that the U.S. economy may enter a recession phase and the Fed might lower the benchmark interest rate again. BOA's investment strategist Bruno Brezinha argued that the Fed could induce a soft landing for the U.S. economy, but market participants seem to lean toward a more severe situation than a soft landing, thus expecting a decline in Treasury bond rates.

The inversion phenomenon of short- and long-term interest rates, considered a signal of economic recession, is also intensifying. On that day, the 2-year Treasury bond rate was 0.32 percentage points higher than the 10-year Treasury bond rate, marking the largest gap since 2000.

Credit rating agency Moody's upgraded Apple's credit rating to the highest grade, Aaa, in December last year. Currently, only three companies?Apple, Microsoft, and Johnson & Johnson?have been assigned the Aaa rating by Moody's. Apple currently holds nearly $180 billion in cash-like assets and had $94.7 billion in long-term debt as of the end of Q2 this year. Apple has paid approximately $14 billion in dividends annually over the past three years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)