[Asia Economy Reporter Kim Hyemin] Recently, as housing prices have entered a correction phase, cases of reverse jeonse (where the jeonse deposit is higher than the sale price) have been increasing in gap investment (purchasing with a jeonse deposit) areas, raising concerns about "empty-can jeonse." Reverse jeonse occurs when the jeonse price is higher than the sale price, posing a high risk that tenants may not receive their deposits on time. Recently, this trend has been spreading to the metropolitan area as well.

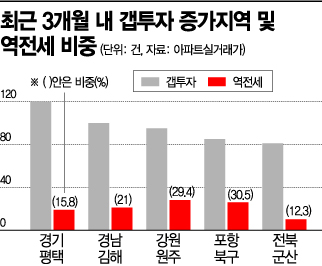

According to Apartment Real Transaction Data (Asil), a real estate big data company, the region with the most active gap investment transactions over the past three months since May was Pyeongtaek, Gyeonggi Province, with a total of 120 gap investment transactions. This was followed by Gimhae, Gyeongnam (100 cases), Wonju, Gangwon (95 cases), Buk-gu, Pohang (85 cases), and Gunsan, Jeonbuk (81 cases). In the metropolitan area, Anseong, Gyeonggi (62 cases) was included in the top 10.

The problem is that in these areas, cases where the jeonse price is higher than the sale price are frequently found. In Pyeongtaek, there were 15 cases of "reverse jeonse" during this period. For example, a 27㎡ unit in Ihan Rexville Plus, Jisan-dong, Pyeongtaek, was sold for 96 million KRW at the end of June and then leased for jeonse at 120 million KRW on the 11th of the following month. The gap investor who purchased this property without any equity capital actually earned 24 million KRW. Essentially, the tenant's deposit was exploited for gap investment. This property had a jeonse rate of 125%, indicating a high risk that the deposit may not be returned depending on the gap investor's capital capacity.

The same applies to Gimhae (21%) and Wonju, Gangwon (29.4%), where gap investment transactions were frequent. In particular, Buk-gu, Pohang had a reverse jeonse ratio of 30.5% among gap investments. A unit of 84㎡ in Duho SK View Prugio, Duho-dong, Buk-gu, Pohang, was traded for 506 million KRW in March and leased for jeonse at 494 million KRW on the same day. The jeonse rate reached 98%. However, as housing prices entered a correction phase, the sale price for the same size unit in this complex dropped to 416 million KRW by mid-last month.

In Seoul, cases where jeonse prices exceed sale prices are found mainly in one-room officetels or urban lifestyle housing. For example, a 13㎡ unit in Gangdong Y City, Gil-dong, Gangdong-gu, was sold for 119 million KRW at the end of May and leased for jeonse at 170 million KRW a week later. According to Asil, there have been 33 gap investment cases with a jeonse rate exceeding 80% in the past three months.

The real estate industry views a jeonse rate exceeding 80% as a high risk for empty-can jeonse. This is because 80% is the average auction sale rate, and if the jeonse rate exceeds this, the deposit that can be recovered by selling the house later may decrease. Professor Kwon Daejung of Myongji University's Department of Real Estate said, "The risk of empty-can jeonse can increase in areas where gap investment has flourished without equity capital," adding, "Tenants should subscribe to jeonse deposit return guarantees or carefully check whether landlords have loans before signing contracts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)