Hyundai Economic Research Institute "Urgent Need to Enhance Equipment and Material Technology, and Train Workforce"

An employee of Wonik IPS, a semiconductor equipment company that is a Samsung Electronics partner and listed on KOSDAQ, inspecting production equipment. (Photo by Samsung Electronics)

An employee of Wonik IPS, a semiconductor equipment company that is a Samsung Electronics partner and listed on KOSDAQ, inspecting production equipment. (Photo by Samsung Electronics)

[Asia Economy Reporter Moon Chaeseok] Concerns have been raised that the industrial ecosystem underpinning South Korea, recognized as the world’s leading country in memory semiconductors, is not robust. The country’s heavy reliance on overseas equipment and materials is the main issue. In particular, the high dependence on Chinese materials poses risks of critical damage such as production disruptions due to security, political issues, and global supply chain restructuring. The semiconductor workforce training system, which is weaker compared to competing countries, has also emerged as an urgent issue that needs improvement.

According to a report titled "Structural Changes and Implications of the Global Semiconductor Industry Supply Chain" recently released by Hyundai Research Institute on the 5th, the value of semiconductor equipment imported by South Korea increased more than twofold from $11.39 billion in 2019 to $26.59 billion last year. During the same period, export values were $6.9 billion and $9.37 billion, respectively. The trade deficit in equipment widened about fourfold from $4.49 billion in 2019 to $17.22 billion last year. This is due to increased imports of high-priced front-end equipment requiring advanced technology.

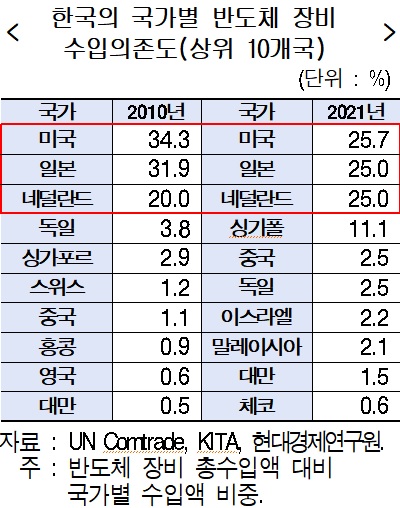

Dependence on imports from the United States, Japan, and the Netherlands remains high. Recently, the reliance on the Netherlands has been increasing. Compared to 2010, the share of imports from the U.S. decreased from 34.3% to 25.7%, and from Japan from 31.9% to 25%, while the Netherlands rose from 20% to 25%, and Singapore from 2.9% to 11.1%. Although this could be seen as diversification of the supply chain away from the U.S. and Japan, South Korea has not yet reached a level free from the influence of companies like the Dutch ASML, which monopolizes the production of extreme ultraviolet (EUV) lithography equipment.

Vice Chairman Lee Jae-yong of Samsung Electronics poses for a commemorative photo with Peter Wennink (left), CEO of ASML, and Martin van den Brink, CTO of ASML, at the ASML headquarters in Eindhoven, Netherlands, on the 14th of last month (local time).

Vice Chairman Lee Jae-yong of Samsung Electronics poses for a commemorative photo with Peter Wennink (left), CEO of ASML, and Martin van den Brink, CTO of ASML, at the ASML headquarters in Eindhoven, Netherlands, on the 14th of last month (local time). Thanks to Vice Chairman Lee's efforts, it has become possible to procure key semiconductor equipment, but there are concerns that maintaining a high level of competitiveness in the semiconductor industry cannot rely solely on individual efforts indefinitely. (Photo by Samsung Electronics)

This is why Samsung Electronics Vice Chairman Lee Jae-yong visited the Dutch ASML first during his recent business trip to Europe. A photo of him arm-in-arm with ASML CEO Peter Wennink and CTO Martin van den Brink at ASML’s headquarters in Eindhoven, Netherlands, became a hot topic. While it signifies that the chairman personally took action to resolve issues, it also sparked voices questioning whether fundamental improvements to South Korea’s semiconductor ecosystem are needed. It is reported that through this ASML visit, Lee secured contracts for the introduction of EUV lithography equipment produced this year and the 'High Numerical Aperture (NA) EUV' scheduled for release next year.

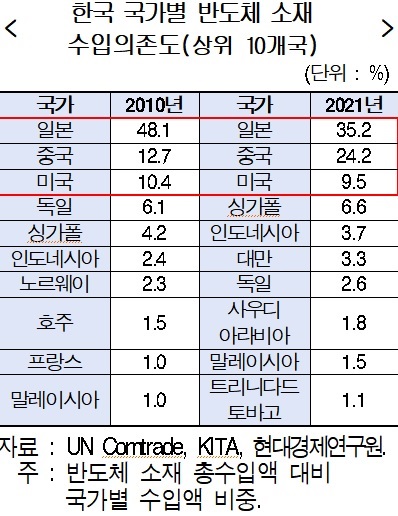

Since 2010, the import value of materials has hovered around $8 billion, while exports slightly increased from $4.1 billion to $6.4 billion during the same period, resulting in a trade deficit. South Korea’s import value for 18 semiconductor material items in the global market has remained around $8 billion since 2010. Exports have slightly expanded from $4.1 billion to $6.4 billion. The trade deficit narrowed slightly from $4 billion in 2010 to $1.9 billion in 2021. It is also positive that dependence on Japan decreased from 48.1% in 2010 to 35.2%.

The problem is that China ranks second. The share of China in South Korea’s semiconductor material imports rose by 11.5 percentage points from 12.7% in 2010 to 24.2% last year. Considering past incidents such as the THAAD (Terminal High Altitude Area Defense) dispute in 2016 that dealt a severe blow to Lotte Group, and last year’s nationwide 'urea solution crisis' caused by China’s export restrictions, if China precisely targets South Korea’s supply chain vulnerabilities, concerns over production disruptions at companies will inevitably increase.

High dependence on semiconductor materials is South Korea’s critical weakness. China is in a position to raise issues over South Korea’s participation in the U.S.-led 'anti-China coalition' on the international trade stage. If protectionist trade barriers increase due to the U.S.-China technology and trade war and global supply shortages worsen, restricting semiconductor equipment and material trade, major semiconductor companies could face production disruptions.

South Korea’s semiconductor research and development (R&D) workforce is also considered insufficient compared to competing countries. As of 2019, South Korea had 110,000 semiconductor manufacturing R&D personnel. The annual growth rate over the previous five years was only 1%. This is not significantly better than China’s 220,000 (6%), Japan’s 140,000 (-1%), or Taiwan’s 70,000 (3%) in terms of numbers and growth rates. According to the Ministry of Trade, Industry and Energy, about 1,500 new personnel are needed annually in the domestic semiconductor industry, but actual output is only about 650 per year. U.S. semiconductor companies are preparing legislation to recruit excellent overseas talent, and Taiwan is easing regulations on industry-academia cooperation in advanced technology industries to prepare for specialized semiconductor courses.

Park Yong-jung, a research fellow at Hyundai Research Institute, said, "To sustain the competitiveness of the domestic semiconductor industry, it is urgent to enhance technological capabilities such as developing core equipment and materials," adding, "Government efforts are needed to nurture R&D personnel and prevent the outflow of key talent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)