[Asia Economy (Suwon) = Reporter Lee Young-gyu] There has been a claim that in order to cope with the increasing financial demands of local governments, it is necessary to guarantee taxation autonomy and establish new local tax items such as environmental taxes.

The Gyeonggi Research Institute under Gyeonggi Province suggested in a report titled "Decentralization Begins with Changes in the Local Finance System" on the 14th that to meet the financial demands of local governments, local governments should be guaranteed taxation autonomy and various local tax items, including environmental taxes, should be newly established.

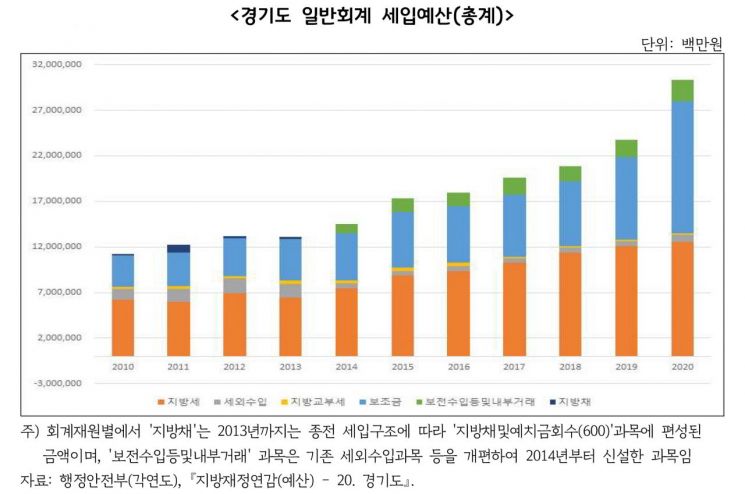

According to the report, the proportion of integrated fiscal expenditures by institution in 2021 was 42.8% for the central government, 44.0% for local governments, and 13.2% for local education. Compared to 2010, when the central government was 43.7%, local governments 42.8%, and local education 13.5%, the share of local government fiscal expenditures has increased.

However, the ratio of national taxes to local taxes remains at about 75.3% to 24.7%.

In the case of Gyeonggi Province, the financial independence ratio based on the general account budget (the proportion of autonomous resources among total resources) fell from 75.9% in 2009 to 63.7% in 2021, and the financial autonomy ratio (the proportion of discretionary resources among total revenue) dropped from 84.4% in 2009 to 73.7% in 2021.

Researcher Lee Hyun-woo of the Gyeonggi Research Institute emphasized, "The ability of local governments to cover financial revenues and the discretion over financial expenditures have significantly weakened," adding, "For stable financial management of local governments, it is necessary to operate finances centered on autonomous resources and establish a local tax system based on taxation autonomy."

As specific measures, the report proposed ▲ relaxing the principle of taxation by law to guarantee practical taxation autonomy allowing taxation of tax bases discovered considering regional characteristics according to ordinances ▲ establishing a 'period tax' system that sets the timing and duration of taxation like acquisition tax ▲ introducing new local tax items such as environmental tax, welfare tax, local business tax, robot tax, and pet tax considering regional conditions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)