Turnaround Late 2022 to Early 2023

Annual Increase of 12 Billion Won with $10 Rise in Jet Fuel

[Asia Economy Reporter Hwang Yoon-joo] An analysis has emerged that the performance improvement of Jeju Air will be delayed due to high exchange rates and high oil prices.

Ryu Jae-hyun, a researcher at Mirae Asset Securities, stated about Jeju Air, "We expect Q2 sales this year to increase by 64.1% year-on-year to 123.2 billion KRW, with an operating loss of 60.7 billion KRW."

Domestic sales are expected to increase by 60% compared to the previous year despite an 8.7% reduction in supply, as the trend of rising unit prices continues, while international sales increased by 520%.

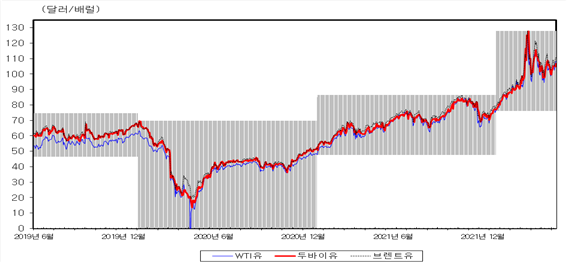

Although fixed costs increased due to high exchange rates and high oil prices, resulting in continued operating losses, the deficit is expected to improve. However, the rise in international oil prices again is a burden. Generally, a $10 increase in jet fuel results in an annual cost increase of 12 billion KRW.

Researcher Ryu expects losses to shrink in the second half of the year but anticipates a turnaround to be possible from 2023.

He forecasted, "Operating loss in Q3 is expected to be 37.8 billion KRW," and predicted, "Loss reduction will continue along with the recovery of international routes."

He also pointed out, "International route supply has recovered to about 20% compared to pre-COVID-19 levels, but cost burdens remain due to high oil prices and the suspension of employment retention subsidies."

Researcher Ryu diagnosed, "An operating profit turnaround is possible from late 2022 to early 2023," adding, "A turnaround is expected when passenger demand recovers to more than 50% of pre-COVID-19 levels," and "Fixed costs will also decrease due to aircraft returns (2 by the end of the year, currently 39 aircraft)."

He continued, "We expect cash burn to continue until the end of the year, and the possibility of additional funding remains," and added, "We maintain a 'sell' investment opinion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)