Related Stocks Fall 14.36% from the 9th

US Stock Market-Related ETFs Also Trending Downward

[Asia Economy Reporter Myunghwan Lee] The aftershocks of the massive crash of stablecoins Terra and Luna are sweeping through the domestic stock market. Following Luna's collapse, the corporate values of stocks involved in cryptocurrency exchanges or blockchain-related businesses have all plummeted. In the U.S. stock market, exchange-traded funds (ETFs) that indirectly invest in cryptocurrencies are also showing a downward trend, raising warnings that the crypto asset market may face short-term contraction.

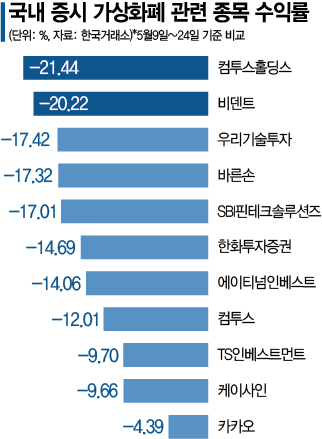

On the 25th, Asia Economy analyzed the returns of 11 stocks related to cryptocurrencies and found that they fell by an average of 14.36% from the 9th to the previous day. The 9th was the day when the depegging (value falling below $1) of TerraUSD (UST), the direct cause of the Luna crash, occurred. As the price of Terra, an algorithm-based stablecoin designed to maintain a fixed value of $1, dropped, investors engaged in panic selling, causing Luna to plummet by more than 99% over the following week.

During this period, the KOSPI fell by 1.46%, making the decline in cryptocurrency-related stocks particularly notable even considering the overall weakness in the domestic stock market.

Among these stocks, Com2uS Holdings recorded the largest loss, dropping 21.44%. Com2uS also fell by 12.01%. Com2uS is considered a Terra-related stock as it is building a blockchain platform using its own issued cryptocurrency 'C2X' and leveraging the technology of Terraform Labs, the issuer of Terra and Luna. Accordingly, Com2uS announced on the 13th that it would switch to another blockchain network.

Stocks related to cryptocurrency exchanges also fell across the board. Vidente, a shareholder of the cryptocurrency exchange Bithumb, dropped 20.22%, while Woori Technology Investment (-17.42%) and Barunson (-17.32%), which own shares in Dunamu, the operator of Upbit, as well as Hanwha Investment & Securities (-14.69%) and Atinum Investment (-14.06%), all showed declines exceeding 10%.

Cryptocurrency-related ETFs listed on the U.S. stock market also traced a downward curve during the same period. The 'Volt Crypto Industry Revolution and Tech ETF (BTCR)', which indirectly invests in companies holding large amounts of Bitcoin, fell 15.89%. The 'Global X Blockchain ETF (BKCH)', which invests in cryptocurrency-related companies, also dropped 14.81%. Other ETFs such as BITQ (-13.02%), NFTZ (-7.08%), and BITO (-6.19%) all recorded losses. The average loss rate of seven cryptocurrency-related ETFs during this period was 9.82%.

The securities industry has issued warnings about short-term contraction and uncertainty in the cryptocurrency market. SK Securities researcher Daehun Han said, "With the collapse of popular projects and many investors suffering losses, short-term market contraction is inevitable," advising that "this should be an opportunity to establish systems and regulations that can protect investors and build trust." NH Investment & Securities researcher Yeolmae Kim also pointed out that another stablecoin, Tether (USDT), experienced a temporary depegging issue, analyzing that "uncertainty remains in the digital asset market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)