High Interest Rates Along with High Appraisal Recognition and Loan Regulations

Signs of a Slowdown in Deregulation

Buyers Continue to Remain Cautious

Risk of Becoming an Exclusive League... "Loan Restrictions Should Be Eased for Actual Owners First"

[Asia Economy Reporters Kim Hyemin and Hwang Seoyul] The real estate market is experiencing a longer-than-expected "transaction cliff," where property sales are sharply reduced. The transaction volume, which plummeted ahead of last year's presidential election, has shown no signs of recovery even three months after the election. Experts warn that if this temporary phenomenon turns into a prolonged slump, it could lead to increased hardship for ordinary citizens.

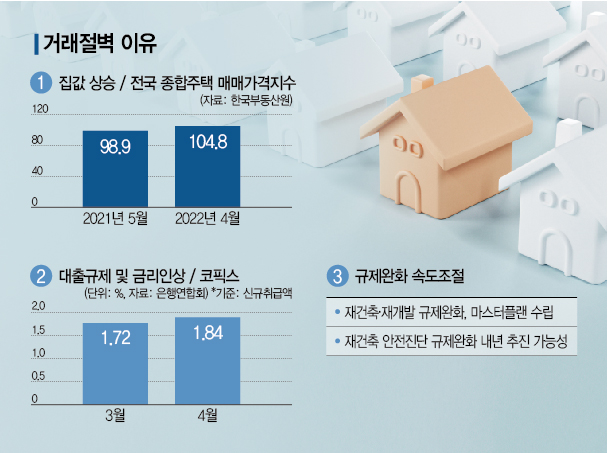

The prevailing analysis is that the transaction cliff is not due to a lack of properties on the market but rather the prolonged cautious stance of buyers. Various factors, including soaring home prices, tightened loan regulations, interest rate hikes, and the possibility of slowing down real estate deregulation, have collectively halted apartment purchases.

Rising home prices are cited as the biggest reason for the transaction cliff. According to the Korea Real Estate Board, the nationwide comprehensive housing sales price index recorded 104.8 for three consecutive months since February this year, the highest since the index began in November 2003. This index, which tracks housing price trends, has steadily increased since hitting 89.7 in September 2019. According to KB Kookmin Bank’s Liv Real Estate, during the same period, the average nationwide apartment sales price rose from 370.16 million KRW to 560.45 million KRW.

However, despite high housing prices, loans necessary for actual buyers to purchase homes remain restricted. With strengthened Loan-to-Value (LTV) regulations and the addition of Debt Service Ratio (DSR) rules, the loan limits have significantly decreased. Particularly, as interest rates began rising earlier this year, the burden of interest payments has increased. According to the Korea Federation of Banks, the COFIX rate applied to variable-rate mortgage loans rose to 1.84% last month based on new contracts, marking the highest level since May 2019.

The Yoon Seok-yeol administration, which hinted at real estate deregulation before the election, has emphasized a slowdown in policy changes since taking office, contributing to the cautious market sentiment. Expectations that rapid policy shifts are unlikely have reduced the urgency to buy homes quickly. Song Seunghyun, CEO of Urban and Economy, noted, "One reason could be that many buyers purchased homes in advance."

As transactions shrink, some regions are effectively entering a real estate market slump. In Daegu, oversupply has led to a significant increase in unsold housing units. An increase in unsold homes indicates a decline in housing demand and is considered a precursor to falling home prices. According to the Ministry of Land, Infrastructure and Transport, as of the end of March, nationwide unsold housing units totaled 6,572, a 44% increase from the previous month.

Experts are cautious about the prolonged transaction slump. If the current loan limits for ordinary citizens remain unchanged, apartment sales could become a league dominated by cash-rich buyers. This would block opportunities for asset formation among ordinary people and, if prolonged, could expand side effects such as downturns in related industries. There is also concern that a sharp short-term drop in home prices could worsen hardships for "Yeongkkeuljok" (borrowers who have taken out loans to the maximum extent possible) during high-interest periods. Yoon Jihae, chief researcher at Real Estate R114, said, "In the second half of the year, measures such as easing loan regulations for actual homeowners should become visible to help recover transaction volumes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)