The Start of Complete Vehicle Labor-Management Negotiations

Renault Korea Kickoff Meeting

Union Demands Facility Investment and Workforce Supply

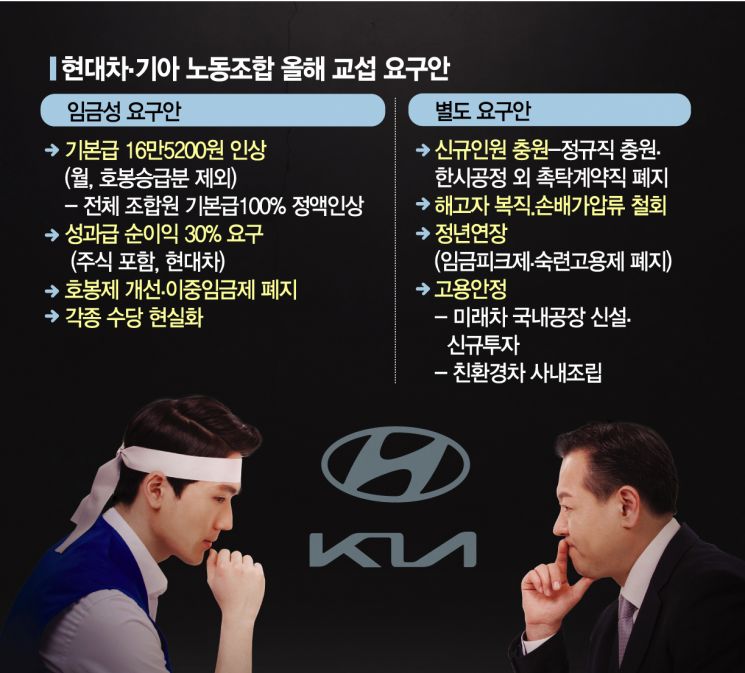

Hyundai Motor and Kia Meet on the 10th

Domestic Investment in Future Vehicle Production Facilities

Employment Stability Demands Including New Hiring

Performance Bonus Negotiations May Become an Obstacle

[Asia Economy Reporter Choi Dae-yeol] The curtain has risen on wage and collective bargaining negotiations between labor and management at major domestic automakers. Although negotiations have rarely been smooth in the past, the conditions surrounding the automotive industry are changing faster than ever, leading to expectations that the gap between labor and management positions will be stark. In particular, at Hyundai Motor and Kia, the country's largest automakers, a strong-willed labor union has emerged, and with key affiliates of the group also raising their voices together, it is widely anticipated that confrontations with the company will intensify.

According to industry sources on the 3rd, Renault Korea Motors labor and management held a kickoff meeting (first meeting) on the same day to start this year's wage and collective bargaining negotiations. Earlier, the Renault Korea union held a delegates' meeting in late last month and decided to demand facility investment and workforce supply in this year's negotiations. Currently, Renault Korea has four multiple unions. They have agreed to fight jointly this year to strengthen their bargaining power.

However, recalling the heavy losses both inside and outside the company due to last year's protracted negotiations, there is also a possibility that they may choose practicality over confrontation. Renault Korea's situation has not been favorable, with losses recorded in 2020 due to worsening management and issues securing production volume. As a foreign company, allocation of production volume from the headquarters is crucial, so to receive additional allocations for eco-friendly vehicles in the future, the Korean plant must prove its production competitiveness through performance.

Stefan Deblaes, the new CEO who took office in March, is also making efforts to improve labor-management relations. In mid-last month, he personally visited the union office to request cooperation and even participated directly in the delegates' meeting to explain the mid- to long-term management plan.

The Hyundai Motor and Kia unions also jointly drafted their wage and collective bargaining demands this year. Starting with a preliminary meeting on the 10th, formal negotiations will begin. While wage increases will align with the guidelines of the higher-level organization, they plan to demand employment stability measures such as hiring new personnel, abolishing contract workers, and extending retirement age. This is because the production volume of internal combustion engine vehicles is decreasing, reducing the scale of production personnel needed by the company. Despite worsening external conditions such as COVID-19 and parts supply shortages, last year's strong performance has led to increased demands for performance bonuses, especially from the union and younger employees, which could become a stumbling block in negotiations.

In particular, the union has clearly stated that production facilities related to future automotive industries such as autonomous driving and electric vehicles must be invested in domestically. This is interpreted as a response to the rapidly changing paradigm of the automotive industry and the increased uncertainty about the future. Not only the finished car affiliates like Hyundai Motor and Kia but the entire group is transforming into a future mobility company, and the union has been raising its voice accordingly.

The National Metalworkers' Union, Hyundai Motor, Kia Motors, and Korea GM, the three completed car manufacturers, held a press conference in front of the National Assembly in Yeouido, Seoul, last March, urging legislation for retirement age extension linked to the National Pension Service. Photo by Moon Honam munonam@

The National Metalworkers' Union, Hyundai Motor, Kia Motors, and Korea GM, the three completed car manufacturers, held a press conference in front of the National Assembly in Yeouido, Seoul, last March, urging legislation for retirement age extension linked to the National Pension Service. Photo by Moon Honam munonam@

To produce electric vehicles as well as urban air mobility (UAM) and purpose-built mobility (PBV), existing production infrastructure must be converted or newly built. Since overseas demand is higher than domestic demand and localization requirements are considered, the company has actively invested in overseas facilities. While both sides share concerns about the future, their approaches to overcoming challenges differ. The global automotive industry’s shift from hardware-centric to software companies is also a concern for both the company and the union.

Korea GM has overcome a major hurdle as the painful workforce transfers between plants have been completed. Starting this month, Bupyeong Plant 2 will switch to a single-shift system, while personnel at Bupyeong Plant 1 and Changwon Plant will be increased. As Kaher Kazem, President of Korea GM, is moving to the position of Executive Vice President in charge of China at the headquarters, it is expected that the next appointed president will conduct wage and collective bargaining negotiations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)