[Asia Economy Reporter Myunghwan Lee] An analysis from the securities industry suggests that the proportion of industrial robots in the production processes of the electrical, electronics, and automotive industries will increase. However, selective investment considering the growth speed and performance of robot companies is also advised.

According to Ebest Investment & Securities on the 30th, the global industrial robot adoption scale was 380,000 units as of 2020. By industry, the electrical, electronics, and automotive sectors account for nearly 50%. The global robot market size in 2019 was $30.5 billion (approximately 36 trillion KRW), with industrial robots accounting for $13.7 billion (about 17 trillion KRW) and the service robot market size at $16.8 billion (about 21 trillion KRW). Ebest Investment & Securities forecasts an 8% growth rate in the industrial robot market from 2020 to 2024.

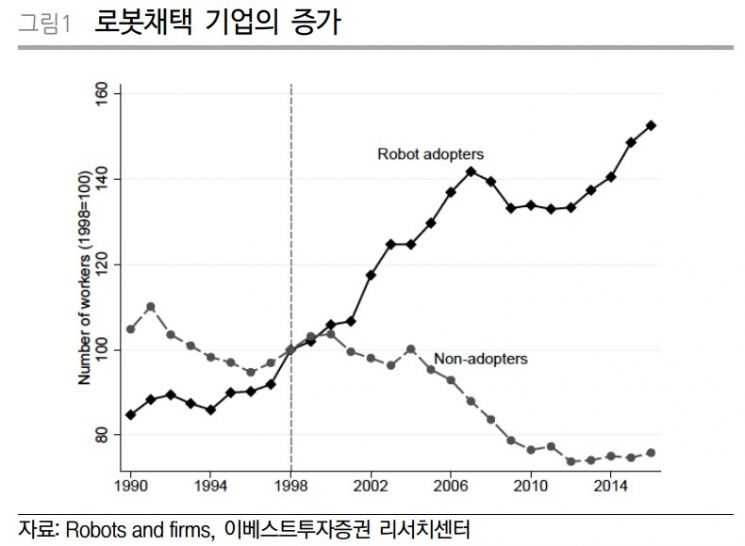

Ebest Investment & Securities analyzes that the proportion of industrial robots will continue to rise. Since 2010, the number of companies adopting robots has surged, and automation equipment equipped with robotics technology has increased productivity. Not only the quantitative increase in global robot investment but also the rise in automation equipment rates to respond to labor cost increases have accelerated the growth of the industrial robot market.

However, a selective approach is necessary in terms of companies' technological capabilities, growth speed, and performance. It will take time for the high growth of the robot industry to be confirmed through the performance of related companies. Recently, the stock prices of domestic robot-related companies have shown increased volatility whenever government policies and growth strategies of major global companies were announced. For example, when Samsung Electronics proposed the robot business last month as part of discovering new industries, the stock prices of related companies surged significantly.

Researcher Eun-ae Jo of Ebest Investment & Securities stated, "We positively evaluate the growth strategy of companies that have succeeded in domestic production and mass production of drive mechanism products (motors, reducers, controllers), which account for about 70% of the robot manufacturing cost." She added, "From the demand side perspective, mid- to long-term interest is also needed in the penetration increase of automated dispensing solutions and Electronic Shelf Labels (ESL), whose production efficiency has been proven."

Ebest Investment & Securities suggested SPG, Yuil Robotics, and Everybot as domestic robot industry-related stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)