Kurly and Others Strengthen Dawn Delivery... Expanding Infrastructure Investment Including Logistics Centers

Lotte ON Focuses on 2-Hour Immediate Delivery, Hello Nature Shifts to B2B Business

Various forms of delivery services, which were rapidly introduced to respond to the booming online market due to COVID-19, are now finding their own places. Leading players in the dawn delivery league have started investing to achieve economies of scale by securing nationwide logistics centers, while some have decided to focus on immediate delivery within 2 to 3 hours, considering the high logistics and labor costs of dawn delivery and aiming to do better in this area.

According to the distribution industry on the 19th, Market Kurly has decided to invest 63 billion KRW this month to expand dawn delivery in the Gyeongnam region by building a small to medium-sized logistics center in the Dudong district of the Busanjinhae Free Economic Zone, Jinhae-gu, Changwon-si, Gyeongnam by 2023, and has begun preparations related to this. Market Kurly, which currently operates logistics centers in Jangji, Seoul, and Gimpo, Gyeonggi-do, plans to continue investing in logistics centers to expand its nationwide Saetbyeol delivery (dawn delivery). It will also establish a logistics center in Pyeongtaek to cover the southern Gyeonggi region. Coupang is also continuing its investment in logistics centers, opening the Daegu Advanced Logistics Center last month with an investment of over 320 billion KRW. SSG.com is also investing more than 1 trillion KRW by 2025 to build infrastructure such as logistics centers.

They plan to expand their market share in the rapidly growing dawn delivery market and create a virtuous cycle through economies of scale. The dawn delivery market size grew from 500 billion KRW in 2018 to 2.5 trillion KRW in 2020, and is expected to reach about 11.9 trillion KRW in 2023. They are accepting current losses and making additional investments for the bigger picture.

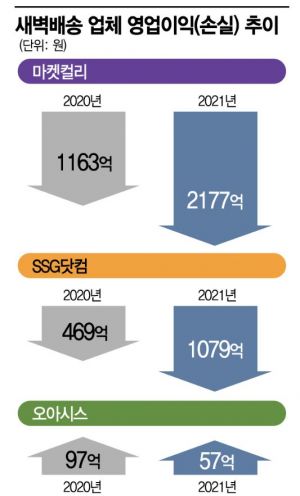

Currently, major dawn delivery companies including Market Kurly, SSG.com, and Coupang are still operating at a loss. Last year, operating losses were 217.7 billion KRW for Market Kurly, 107.9 billion KRW for SSG.com, and about 1.8 trillion KRW for Coupang, with losses widening compared to the previous year. However, their transaction volumes last year continued to grow, with Market Kurly reaching 2 trillion KRW and Coupang (Rocket Fresh) 2.3 trillion KRW.

Companies that quickly judged they would not gain an advantage in economies of scale are withdrawing from the dawn delivery market. Their strategy is to choose and focus on delivery and businesses they can do better. Lotte Shopping’s online platform Lotte On and BGF’s online food market Hello Nature are ending their dawn delivery services this month. They judged that profitability is difficult due to high-cost structures and recent increases in logistics costs, making the market outlook bleak. Instead, Lotte On plans to focus on immediate delivery services within 2 hours. Hello Nature is shifting its business to B2B (business-to-business). In the case of dawn delivery, labor costs are 1.5 to 2 times higher than during the day, and the costs of building refrigerated and frozen delivery systems are also significant. Inventory management costs and marketing competition burdens are also high.

An industry official said, "The dawn delivery services, which e-commerce companies that could not be excluded from the market introduced one after another due to the growth of the online grocery shopping market accelerated by COVID-19, are being reorganized mainly around major players who will continue to invest," adding, "Intense competition will continue over market dominance and whether to sustain investments in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)